Download 2007 Annual Report in PDF (4.8Mb - VimpelCom

Download 2007 Annual Report in PDF (4.8Mb - VimpelCom

Download 2007 Annual Report in PDF (4.8Mb - VimpelCom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

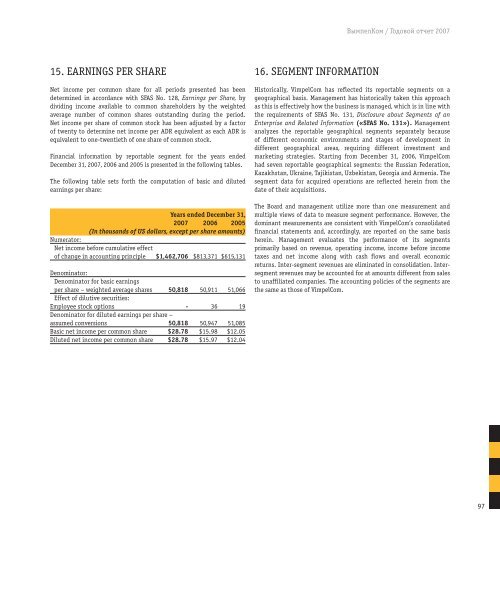

15. EARNINGS PER SHARE<br />

Net <strong>in</strong>come per common share for all periods presented has been<br />

determ<strong>in</strong>ed <strong>in</strong> accordance with SFAS No. 128, Earn<strong>in</strong>gs per Share, by<br />

divid<strong>in</strong>g <strong>in</strong>come available to common shareholders by the weighted<br />

average number of common shares outstand<strong>in</strong>g dur<strong>in</strong>g the period.<br />

Net <strong>in</strong>come per share of common stock has been adjusted by a factor<br />

of twenty to determ<strong>in</strong>e net <strong>in</strong>come per ADR equivalent as each ADR is<br />

equivalent to one-twentieth of one share of common stock.<br />

F<strong>in</strong>ancial <strong>in</strong>formation by reportable segment for the years ended<br />

December 31, <strong>2007</strong>, 2006 and 2005 is presented <strong>in</strong> the follow<strong>in</strong>g tables.<br />

The follow<strong>in</strong>g table sets forth the computation of basic and diluted<br />

earn<strong>in</strong>gs per share:<br />

Years ended December 31,<br />

<strong>2007</strong> 2006 2005<br />

(In thousands of US dollars, except per share amounts)<br />

Numerator:<br />

Net <strong>in</strong>come before cumulative effect<br />

of change <strong>in</strong> account<strong>in</strong>g pr<strong>in</strong>ciple $1,462,706 $813,371 $615,131<br />

Denom<strong>in</strong>ator:<br />

Denom<strong>in</strong>ator for basic earn<strong>in</strong>gs<br />

per share – weighted average shares 50,818 50,911 51,066<br />

Effect of dilutive securities:<br />

Employee stock options - 36 19<br />

Denom<strong>in</strong>ator for diluted earn<strong>in</strong>gs per share –<br />

assumed conversions 50,818 50,947 51,085<br />

Basic net <strong>in</strong>come per common share $28.78 $15.98 $12.05<br />

Diluted net <strong>in</strong>come per common share $28.78 $15.97 $12.04<br />

16. SEGMENT INFORMATION<br />

ВымпелКом / Годовой отчет <strong>2007</strong><br />

Historically, <strong>VimpelCom</strong> has reflected its reportable segments on a<br />

geographical basis. Management has historically taken this approach<br />

as this is effectively how the bus<strong>in</strong>ess is managed, which is <strong>in</strong> l<strong>in</strong>e with<br />

the requirements of SFAS No. 131, Disclosure about Segments of an<br />

Enterprise and Related Information («SFAS No. 131»). Management<br />

analyzes the reportable geographical segments separately because<br />

of different economic environments and stages of development <strong>in</strong><br />

different geographical areas, requir<strong>in</strong>g different <strong>in</strong>vestment and<br />

market<strong>in</strong>g strategies. Start<strong>in</strong>g from December 31, 2006, <strong>VimpelCom</strong><br />

had seven reportable geographical segments: the Russian Federation,<br />

Kazakhstan, Ukra<strong>in</strong>e, Tajikistan, Uzbekistan, Georgia and Armenia. The<br />

segment data for acquired operations are reflected here<strong>in</strong> from the<br />

date of their acquisitions.<br />

The Board and management utilize more than one measurement and<br />

multiple views of data to measure segment performance. However, the<br />

dom<strong>in</strong>ant measurements are consistent with <strong>VimpelCom</strong>’s consolidated<br />

f<strong>in</strong>ancial statements and, accord<strong>in</strong>gly, are reported on the same basis<br />

here<strong>in</strong>. Management evaluates the performance of its segments<br />

primarily based on revenue, operat<strong>in</strong>g <strong>in</strong>come, <strong>in</strong>come before <strong>in</strong>come<br />

taxes and net <strong>in</strong>come along with cash flows and overall economic<br />

returns. Inter-segment revenues are elim<strong>in</strong>ated <strong>in</strong> consolidation. Intersegment<br />

revenues may be accounted for at amounts different from sales<br />

to unaffiliated companies. The account<strong>in</strong>g policies of the segments are<br />

the same as those of <strong>VimpelCom</strong>.<br />

97