CUSTOMER AGREED REMUNERATION - CRA International

CUSTOMER AGREED REMUNERATION - CRA International

CUSTOMER AGREED REMUNERATION - CRA International

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.0<br />

3.1<br />

IMPACT ON SUPPLY<br />

<strong>CUSTOMER</strong> <strong>AGREED</strong> <strong>REMUNERATION</strong><br />

The previous chapter highlighted that, from the consumers’ perspective, CAR would<br />

increase the demand for advice. In this chapter we consider whether CAR would mean<br />

that it is economic for advisers and providers to serve this market by examining the<br />

implications of CAR for the supply of advice. We start by considering existing intermediary<br />

remuneration and how this has been changing.<br />

Current intermediary remuneration<br />

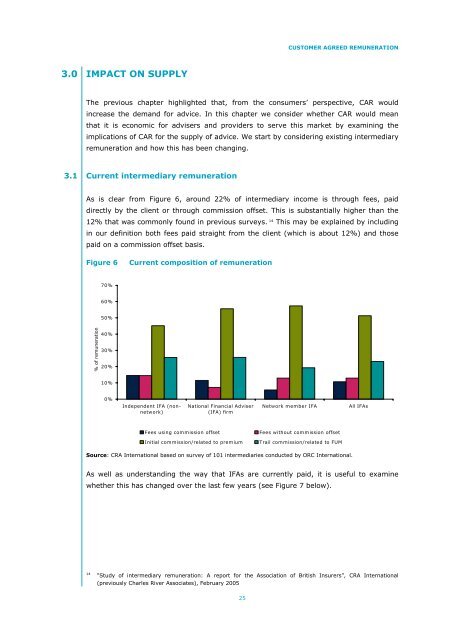

As is clear from Figure 6, around 22% of intermediary income is through fees, paid<br />

directly by the client or through commission offset. This is substantially higher than the<br />

12% that was commonly found in previous surveys. 14 This may be explained by including<br />

in our definition both fees paid straight from the client (which is about 12%) and those<br />

paid on a commission offset basis.<br />

Figure 6 Current composition of remuneration<br />

% of remuneration<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

Independent IFA (nonnetwork)<br />

National Financial Adviser<br />

(IFA) firm<br />

Network member IFA All IFAs<br />

Fees using commission offset Fees without commission offset<br />

Initial commission/related to premium Trail commission/related to FUM<br />

Source: <strong>CRA</strong> <strong>International</strong> based on survey of 101 intermediaries conducted by ORC <strong>International</strong>.<br />

As well as understanding the way that IFAs are currently paid, it is useful to examine<br />

whether this has changed over the last few years (see Figure 7 below).<br />

14 “Study of intermediary remuneration: A report for the Association of British Insurers”, <strong>CRA</strong> <strong>International</strong><br />

(previously Charles River Associates), February 2005<br />

25