TCS Corporate Sustainability Report 2010-11 - Tata Consultancy ...

TCS Corporate Sustainability Report 2010-11 - Tata Consultancy ...

TCS Corporate Sustainability Report 2010-11 - Tata Consultancy ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Company believes that it has sufficient cash from operations to meet its working capital<br />

requirements. In addition it has short term working capital facilities with various commercial banks.<br />

The available lines of credit with banks were $ 307 Mn as at March 31, 20<strong>11</strong>.<br />

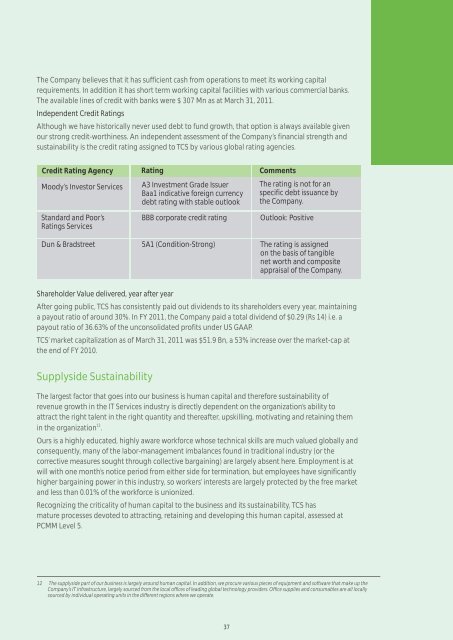

Independent Credit Ratings<br />

Although we have historically never used debt to fund growth, that option is always available given<br />

our strong credit-worthiness. An independent assessment of the Company’s financial strength and<br />

sustainability is the credit rating assigned to <strong>TCS</strong> by various global rating agencies.<br />

Credit Rating Agency Rating Comments<br />

Moody’s Investor Services<br />

Standard and Poor’s<br />

Ratings Services<br />

A3 Investment Grade Issuer<br />

Baa1 indicative foreign currency<br />

debt rating with stable outlook<br />

The rating is not for an<br />

specific debt issuance by<br />

the Company.<br />

BBB corporate credit rating Outlook: Positive<br />

Dun & Bradstreet 5A1 (Condition-Strong) The rating is assigned<br />

on the basis of tangible<br />

net worth and composite<br />

appraisal of the Company.<br />

Shareholder Value delivered, year after year<br />

After going public, <strong>TCS</strong> has consistently paid out dividends to its shareholders every year, maintaining<br />

a payout ratio of around 30%. In FY 20<strong>11</strong>, the Company paid a total dividend of $0.29 (Rs 14) i.e. a<br />

payout ratio of 36.63% of the unconsolidated profits under US GAAP.<br />

<strong>TCS</strong>’ market capitalization as of March 31, 20<strong>11</strong> was $51.9 Bn, a 53% increase over the market-cap at<br />

the end of FY <strong>2010</strong>.<br />

Supplyside <strong>Sustainability</strong><br />

The largest factor that goes into our business is human capital and therefore sustainability of<br />

revenue growth in the IT Services industry is directly dependent on the organization’s ability to<br />

attract the right talent in the right quantity and thereafter, upskilling, motivating and retaining them<br />

12<br />

in the organization .<br />

Ours is a highly educated, highly aware workforce whose technical skills are much valued globally and<br />

consequently, many of the labor-management imbalances found in traditional industry (or the<br />

corrective measures sought through collective bargaining) are largely absent here. Employment is at<br />

will with one month’s notice period from either side for termination, but employees have significantly<br />

higher bargaining power in this industry, so workers’ interests are largely protected by the free market<br />

and less than 0.01% of the workforce is unionized.<br />

Recognizing the criticality of human capital to the business and its sustainability, <strong>TCS</strong> has<br />

mature processes devoted to attracting, retaining and developing this human capital, assessed at<br />

PCMM Level 5.<br />

12 The supplyside part of our business is largely around human capital. In addition, we procure various pieces of equipment and software that make up the<br />

Company’s IT infrastructure, largely sourced from the local offices of leading global technology providers. Office supplies and consumables are all locally<br />

sourced by individual operating units in the different regions where we operate.<br />

37