Risk Management and Governance for PFI Project ... - Title Page - MIT

Risk Management and Governance for PFI Project ... - Title Page - MIT

Risk Management and Governance for PFI Project ... - Title Page - MIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

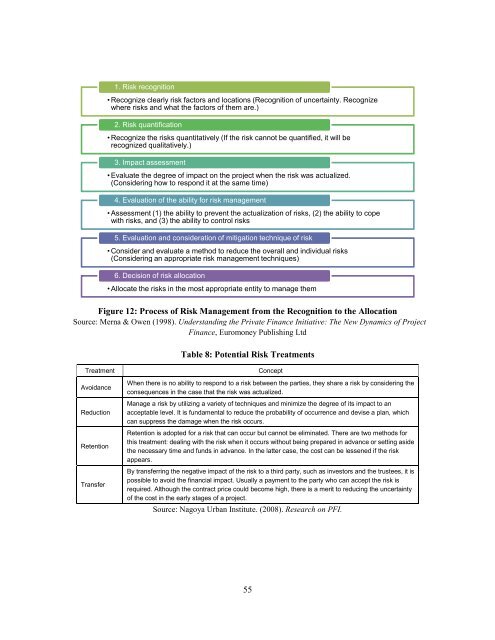

Figure 12: Process of <strong>Risk</strong> <strong>Management</strong> from the Recognition to the Allocation llocation<br />

Source: Merna & Owen (1998). Underst<strong>and</strong>ing the Private Finance Initiative Initiative: The �ew �ew Dynamics of <strong>Project</strong><br />

Finance, Euromoney Publishing Ltd<br />

Treatment<br />

Avoidance<br />

Reduction<br />

Retention<br />

Transfer<br />

1. <strong>Risk</strong> recognition<br />

• Recognize clearly risk factors <strong>and</strong> locations (Recognition of uncertainty. Recognize<br />

where risks <strong>and</strong> what the factors of them are.)<br />

2. <strong>Risk</strong> quantification<br />

• Recognize the risks quantitatively (If the risk cannot be quantified, it will be<br />

recognized qualitatively.)<br />

3. Impact assessment<br />

• Evaluate the degree of impact on the project when the risk was actualized.<br />

(Considering how to respond it at the same time)<br />

4. Evaluation of the ability <strong>for</strong> risk management<br />

• Assessment (1) the ability to prevent the actualization of risks, (2) the ability to cope<br />

with risks, <strong>and</strong> (3) the ability to control risks<br />

5. Evaluation <strong>and</strong> consideration of mitigation technique of risk<br />

• Consider <strong>and</strong> evaluate a method to reduce the overall <strong>and</strong> individual risks<br />

(Considering an appropriate risk management techniques)<br />

6. Decision of risk allocation<br />

• Allocate the risks in the most appropriate entity to manage them<br />

Table 8: Potential <strong>Risk</strong> Treatments<br />

When there is no ability to respond to a risk between the parties, they share a risk by considering the<br />

consequences in the case that the risk was actualized.<br />

Manage a risk by utilizing a variety of techniques <strong>and</strong> minimize the degree of its impact to an<br />

acceptable level. It is fundamental to reduce the probability of occurrence <strong>and</strong> devise a plan, which<br />

can suppress the damage when the risk occurs.<br />

Retention is adopted <strong>for</strong> a risk that can occur but cannot be eliminated. There are two methods <strong>for</strong><br />

this treatment: dealing with the risk when it occurs without being prepared in advance or setting aside<br />

the necessary time <strong>and</strong> funds in advance. In the latter case, the cost can be lessened if the risk<br />

appears.<br />

By transferring the negative impact of the risk to a third party, such as investors <strong>and</strong> the trustees, it is<br />

possible to avoid the financial impact. Usually a payment to the party who can accept the risk is<br />

required. Although the contract price could become high, there is a merit to reducing the uncertainty<br />

of the cost in the early stages of a project.<br />

Source: Nagoya Urban Institute. (2008). Research on <strong>PFI</strong>.<br />

55<br />

Concept