SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

SSG No 10 - Shipgaz

- TAGS

- shipgaz

- shipgaz.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OlYMPIC SHIPPING<br />

SHIPPING AND SHIP MANAGEMENT<br />

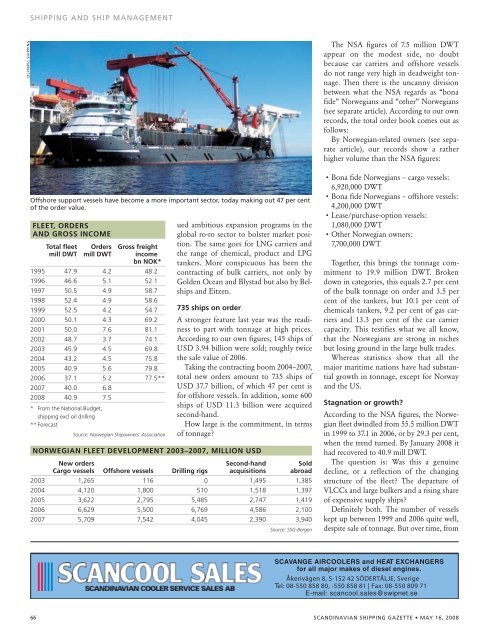

Offshore support vessels have become a more important sector, today making out 47 per cent<br />

of the order value.<br />

FleeT, orDerS<br />

AND groSS INCome<br />

Total fleet orders gross freight<br />

mill DWT mill DWT income<br />

bn <strong>No</strong>K*<br />

1995 47.9 4.2 48.2<br />

1996 46.6 5.1 52.1<br />

1997 50.5 4.9 58.7<br />

1998 52.4 4.9 58.6<br />

1999 52.5 4.2 54.7<br />

2000 50.1 4.3 69.2<br />

2001 50.0 7.6 81.1<br />

2002 48.7 3.7 74.1<br />

2003 45.9 4.5 69.8<br />

2004 43.2 4.5 75.8<br />

2005 40.9 5.6 79.8<br />

2006 37.1 5.2 77.5**<br />

2007 40.0 6.8<br />

2008 40.9 7.5<br />

* From the National Budget,<br />

shipping excl oil drilling<br />

** Forecast<br />

Source: <strong>No</strong>rwegian Shipowners’ Association<br />

ued ambitious expansion programs in the<br />

global ro-ro sector to bolster market position.<br />

The same goes for LNG carriers and<br />

the range of chemical, product and LPG<br />

tankers. More conspicuous has been the<br />

contracting of bulk carriers, not only by<br />

Golden Ocean and Blystad but also by Belships<br />

and Eitzen.<br />

735 ships on order<br />

A stronger feature last year was the readiness<br />

to part with tonnage at high prices.<br />

According to our own figures, 145 ships of<br />

USD 3.94 billion were sold; roughly twice<br />

the sale value of 2006.<br />

Taking the contracting boom 2004–2007,<br />

total new orders amount to 735 ships of<br />

USD 37.7 billion, of which 47 per cent is<br />

for offshore vessels. In addition, some 600<br />

ships of USD 11.3 billion were acquired<br />

second-hand.<br />

How large is the commitment, in terms<br />

of tonnage?<br />

<strong>No</strong>rWegIAN FleeT DevelopmeNT 2003–2007, mIllIoN uSD<br />

New orders Second-hand Sold<br />

Cargo vessels offshore vessels Drilling rigs acquisitions abroad<br />

2003 1,265 116 0 1,495 1,385<br />

2004 4,120 1,800 5<strong>10</strong> 1,518 1,397<br />

2005 3,622 2,795 5,485 2,747 1,419<br />

2006 6,629 5,500 6,769 4,586 2,<strong>10</strong>0<br />

2007 5,709 7,542 4,045 2,390 3,940<br />

Source: <strong>SSG</strong>-Bergen<br />

The NSA figures of 7.5 million DWT<br />

appear on the modest side, no doubt<br />

because car carriers and offshore vessels<br />

do not range very high in deadweight tonnage.<br />

Then there is the uncanny division<br />

between what the NSA regards as “bona<br />

fide” <strong>No</strong>rwegians and “other” <strong>No</strong>rwegians<br />

(see separate article). According to our own<br />

records, the total order book comes out as<br />

follows:<br />

By <strong>No</strong>rwegian-related owners (see separate<br />

article), our records show a rather<br />

higher volume than the NSA figures:<br />

• Bona fide <strong>No</strong>rwegians – cargo vessels:<br />

6,920,000 DWT<br />

• Bona fide <strong>No</strong>rwegians – offshore vessels:<br />

4,200,000 DWT<br />

• Lease/purchase-option vessels:<br />

1,080,000 DWT<br />

• Other <strong>No</strong>rwegian owners:<br />

7,700,000 DWT<br />

Together, this brings the tonnage commitment<br />

to 19.9 million DWT. Broken<br />

down in categories, this equals 2.7 per cent<br />

of the bulk tonnage on order and 3.5 per<br />

cent of the tankers, but <strong>10</strong>.1 per cent of<br />

chemicals tankers, 9.2 per cent of gas carriers<br />

and 13.3 per cent of the car carrier<br />

capacity. This testifies what we all know,<br />

that the <strong>No</strong>rwegians are strong in niches<br />

but losing ground in the large bulk trades.<br />

Whereas statistics show that all the<br />

major maritime nations have had substantial<br />

growth in tonnage, except for <strong>No</strong>rway<br />

and the US.<br />

Stagnation or growth?<br />

According to the NSA figures, the <strong>No</strong>rwegian<br />

fleet dwindled from 55.5 million DWT<br />

in 1999 to 37.1 in 2006, or by 29.3 per cent,<br />

when the trend turned. By January 2008 it<br />

had recovered to 40.9 mill DWT.<br />

The question is: Was this a genuine<br />

decline, or a reflection of the changing<br />

structure of the fleet? The departure of<br />

VLCCs and large bulkers and a rising share<br />

of expensive supply ships?<br />

Definitely both. The number of vessels<br />

kept up between 1999 and 2006 quite well,<br />

despite sale of tonnage. But over time, from<br />

SCAVANGE AIRCOOLERS and HEAT EXCHANGERS<br />

for all major makes of diesel engines.<br />

Åkerivägen 8, S-152 42 SÖDERTÄLJE, Sverige<br />

Tel: 08-550 858 80, -550 858 81 | Fax: 08-550 809 71<br />

E-mail: scancool.sales@swipnet.se<br />

66 SCANDINAVIAN SHIPPING GAZETTE • MAY 16, 2008