2009 Annual Report - CRH

2009 Annual Report - CRH

2009 Annual Report - CRH

- TAGS

- annual

- www.crh.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28. Retirement Benefit Obligations continued<br />

Actuarial valuations - funding requirements<br />

The funding requirements in relation to the Group’s defined benefit schemes are assessed in accordance with the advice of independent and qualified actuaries and<br />

valuations are prepared in this regard either annually, where local requirements mandate that this be done, or at triennial intervals at a maximum in all other cases. In<br />

Ireland and Britain, either the attained age or projected unit credit methods are used in the valuations. In the Netherlands and Switzerland, the actuarial valuations<br />

reflect the current unit method, while the valuations are performed in accordance with the projected unit credit methodology in Portugal and Germany. In the United<br />

States, valuations are performed using a variety of actuarial cost methodologies - current unit, projected unit and aggregate cost. The actuarial valuations range<br />

from April 2006 to December <strong>2009</strong>.<br />

The assumptions which have the most significant effect on the results of the actuarial valuations are those relating to the rate of return on investments and the rates<br />

of increase in remuneration and pensions. In the course of preparing the funding valuations, it was assumed that the rate of return on investments would, on average,<br />

exceed annual remuneration increases by 2% and pension increases by 3% per annum. In general, actuarial valuations are not available for public inspection; however,<br />

the results of valuations are advised to the members of the various schemes.<br />

Financial assumptions<br />

The financial assumptions employed in the valuation of the defined benefit liabilities arising on pension schemes, post-retirement healthcare obligations and<br />

long-term service commitments applying the projected unit credit methodology are as follows:<br />

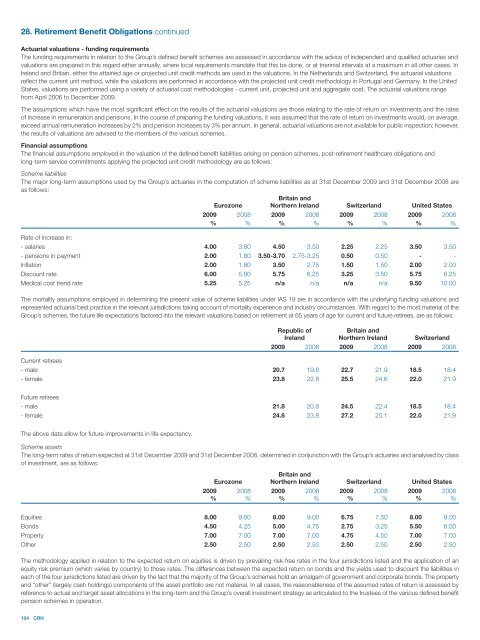

Scheme liabilities<br />

The major long-term assumptions used by the Group’s actuaries in the computation of scheme liabilities as at 31st December <strong>2009</strong> and 31st December 2008 are<br />

as follows:<br />

Britain and<br />

Eurozone Northern Ireland Switzerland United States<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

% % % % % % % %<br />

Rate of increase in:<br />

- salaries 4.00 3.80 4.50 3.50 2.25 2.25 3.50 3.50<br />

- pensions in payment 2.00 1.80 3.50-3.70 2.75-3.25 0.50 0.50 - -<br />

Inflation 2.00 1.80 3.50 2.75 1.50 1.50 2.00 2.00<br />

Discount rate 6.00 5.80 5.75 6.25 3.25 3.50 5.75 6.25<br />

Medical cost trend rate 5.25 5.25 n/a n/a n/a n/a 9.50 10.00<br />

The mortality assumptions employed in determining the present value of scheme liabilities under IAS 19 are in accordance with the underlying funding valuations and<br />

represented actuarial best practice in the relevant jurisdictions taking account of mortality experience and industry circumstances. With regard to the most material of the<br />

Group’s schemes, the future life expectations factored into the relevant valuations based on retirement at 65 years of age for current and future retirees, are as follows:<br />

104 <strong>CRH</strong><br />

Republic of<br />

Ireland<br />

Britain and<br />

Northern Ireland Switzerland<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Current retirees<br />

- male 20.7 19.8 22.7 21.9 18.5 18.4<br />

- female 23.8 22.8 25.5 24.6 22.0 21.9<br />

Future retirees<br />

- male 21.8 20.8 24.5 22.4 18.5 18.4<br />

- female 24.8 23.8 27.2 25.1 22.0 21.9<br />

The above data allow for future improvements in life expectancy.<br />

Scheme assets<br />

The long-term rates of return expected at 31st December <strong>2009</strong> and 31st December 2008, determined in conjunction with the Group’s actuaries and analysed by class<br />

of investment, are as follows:<br />

Eurozone<br />

Britain and<br />

Northern Ireland Switzerland United States<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

% % % % % % % %<br />

Equities 8.00 9.00 8.00 9.00 6.75 7.50 8.00 9.00<br />

Bonds 4.50 4.25 5.00 4.75 2.75 3.25 5.50 6.00<br />

Property 7.00 7.00 7.00 7.00 4.75 4.50 7.00 7.00<br />

Other 2.50 2.50 2.50 2.50 2.50 2.50 2.50 2.50<br />

The methodology applied in relation to the expected return on equities is driven by prevailing risk-free rates in the four jurisdictions listed and the application of an<br />

equity risk premium (which varies by country) to those rates. The differences between the expected return on bonds and the yields used to discount the liabilities in<br />

each of the four jurisdictions listed are driven by the fact that the majority of the Group’s schemes hold an amalgam of government and corporate bonds. The property<br />

and “other” (largely cash holdings) components of the asset portfolio are not material. In all cases, the reasonableness of the assumed rates of return is assessed by<br />

reference to actual and target asset allocations in the long-term and the Group’s overall investment strategy as articulated to the trustees of the various defined benefit<br />

pension schemes in operation.