2009 Annual Report - CRH

2009 Annual Report - CRH

2009 Annual Report - CRH

- TAGS

- annual

- www.crh.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

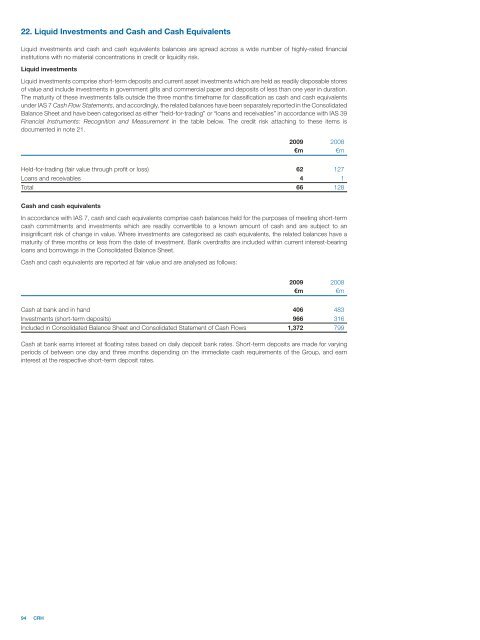

22. Liquid Investments and Cash and Cash Equivalents<br />

Liquid investments and cash and cash equivalents balances are spread across a wide number of highly-rated financial<br />

institutions with no material concentrations in credit or liquidity risk.<br />

Liquid investments<br />

Liquid investments comprise short-term deposits and current asset investments which are held as readily disposable stores<br />

of value and include investments in government gilts and commercial paper and deposits of less than one year in duration.<br />

The maturity of these investments falls outside the three months timeframe for classification as cash and cash equivalents<br />

under IAS 7 Cash Flow Statements, and accordingly, the related balances have been separately reported in the Consolidated<br />

Balance Sheet and have been categorised as either “held-for-trading” or “loans and receivables” in accordance with IAS 39<br />

Financial Instruments: Recognition and Measurement in the table below. The credit risk attaching to these items is<br />

documented in note 21.<br />

94 <strong>CRH</strong><br />

<strong>2009</strong> 2008<br />

€m €m<br />

Held-for-trading (fair value through profit or loss) 62 127<br />

Loans and receivables 4 1<br />

Total 66 128<br />

Cash and cash equivalents<br />

In accordance with IAS 7, cash and cash equivalents comprise cash balances held for the purposes of meeting short-term<br />

cash commitments and investments which are readily convertible to a known amount of cash and are subject to an<br />

insignificant risk of change in value. Where investments are categorised as cash equivalents, the related balances have a<br />

maturity of three months or less from the date of investment. Bank overdrafts are included within current interest-bearing<br />

loans and borrowings in the Consolidated Balance Sheet.<br />

Cash and cash equivalents are reported at fair value and are analysed as follows:<br />

<strong>2009</strong> 2008<br />

€m €m<br />

Cash at bank and in hand 406 483<br />

Investments (short-term deposits) 966 316<br />

Included in Consolidated Balance Sheet and Consolidated Statement of Cash Flows 1,372 799<br />

Cash at bank earns interest at floating rates based on daily deposit bank rates. Short-term deposits are made for varying<br />

periods of between one day and three months depending on the immediate cash requirements of the Group, and earn<br />

interest at the respective short-term deposit rates.