2009 Annual Report - CRH

2009 Annual Report - CRH

2009 Annual Report - CRH

- TAGS

- annual

- www.crh.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

10. Income Tax Expense continued<br />

Factors that may affect future tax charges and other disclosure requirements<br />

Excess of capital allowances over depreciation<br />

Based on current capital investment plans, the Group expects to continue to be in a position to claim capital allowances in excess of depreciation in future years.<br />

Investments in subsidiaries and associates and interests in joint ventures<br />

No provision has been made for temporary differences applicable to investments in subsidiaries and interests in joint ventures as the Group is in a position to control<br />

the timing of reversal of the temporary differences and it is probable that the temporary differences will not reverse in the foreseeable future. Due to the absence of<br />

control in the context of associates (significant influence only), deferred tax liabilities are recognised where appropriate in respect of <strong>CRH</strong>’s investments in these entities<br />

on the basis that the exercise of significant influence would not necessarily prevent earnings being remitted by other shareholders in the undertaking. Given that<br />

participation exemptions and tax credits would be available in the context of the Group’s investments in subsidiaries and joint ventures in the majority of the jurisdictions<br />

in which the Group operates, the aggregate amount of temporary differences in respect of which deferred tax liabilities have not been recognised would be immaterial<br />

(with materiality defined in the context of the year-end <strong>2009</strong> financial statements).<br />

Other considerations<br />

The total tax charge in future periods will be affected by any changes to the corporation tax rates in force in the countries in which the Group operates. The current<br />

tax charge will also be impacted by changes in the excess of tax depreciation (capital allowances) over accounting depreciation and the use of tax credits.<br />

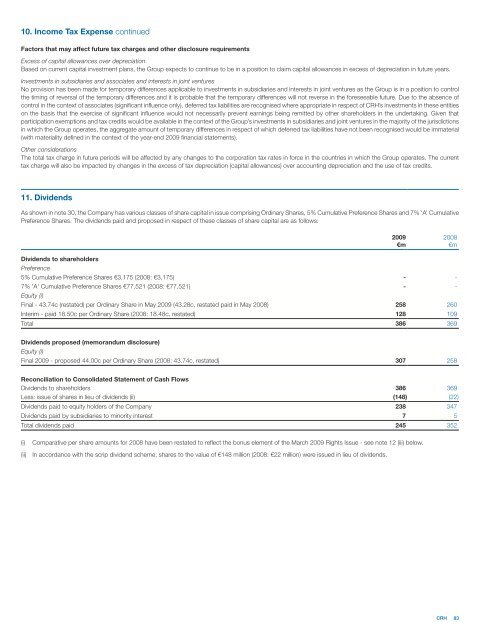

11. Dividends<br />

As shown in note 30, the Company has various classes of share capital in issue comprising Ordinary Shares, 5% Cumulative Preference Shares and 7% ‘A’ Cumulative<br />

Preference Shares. The dividends paid and proposed in respect of these classes of share capital are as follows:<br />

<strong>2009</strong> 2008<br />

€m €m<br />

Dividends to shareholders<br />

Preference<br />

5% Cumulative Preference Shares €3,175 (2008: €3,175) - -<br />

7% 'A' Cumulative Preference Shares €77,521 (2008: €77,521)<br />

Equity (i)<br />

- -<br />

Final - 43.74c (restated) per Ordinary Share in May <strong>2009</strong> (43.28c, restated paid in May 2008) 258 260<br />

Interim - paid 18.50c per Ordinary Share (2008: 18.48c, restated) 128 109<br />

Total 386 369<br />

Dividends proposed (memorandum disclosure)<br />

Equity (i)<br />

Final <strong>2009</strong> - proposed 44.00c per Ordinary Share (2008: 43.74c, restated) 307 258<br />

Reconciliation to Consolidated Statement of Cash Flows<br />

Dividends to shareholders 386 369<br />

Less: issue of shares in lieu of dividends (ii) (148) (22)<br />

Dividends paid to equity holders of the Company 238 347<br />

Dividends paid by subsidiaries to minority interest 7 5<br />

Total dividends paid 245 352<br />

(i) Comparative per share amounts for 2008 have been restated to reflect the bonus element of the March <strong>2009</strong> Rights Issue - see note 12 (iii) below.<br />

(ii) In accordance with the scrip dividend scheme, shares to the value of €148 million (2008: €22 million) were issued in lieu of dividends.<br />

<strong>CRH</strong> 83