Reseña de Valores 2012 - Bolsa de Santiago

Reseña de Valores 2012 - Bolsa de Santiago

Reseña de Valores 2012 - Bolsa de Santiago

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

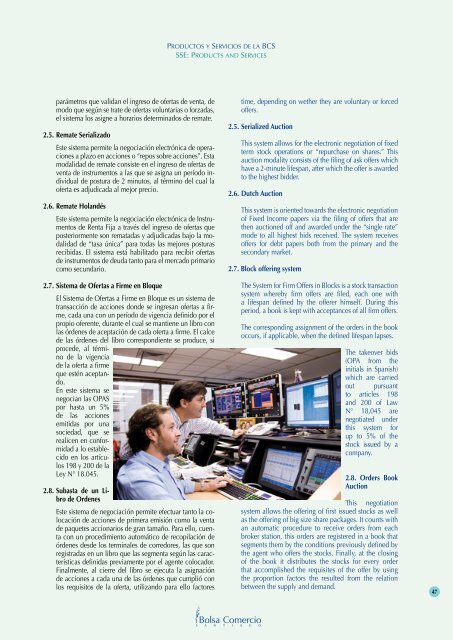

Productos y Servicios <strong>de</strong> la BCSSSE: Products and Servicesparámetros que validan el ingreso <strong>de</strong> ofertas <strong>de</strong> venta, <strong>de</strong>modo que según se trate <strong>de</strong> ofertas voluntarias o forzadas,el sistema los asigne a horarios <strong>de</strong>terminados <strong>de</strong> remate.2.5. Remate SerializadoEste sistema permite la negociación electrónica <strong>de</strong> operacionesa plazo en acciones o “repos sobre acciones”. Estamodalidad <strong>de</strong> remate consiste en el ingreso <strong>de</strong> ofertas <strong>de</strong>venta <strong>de</strong> instrumentos a las que se asigna un período individual<strong>de</strong> postura <strong>de</strong> 2 minutos, al término <strong>de</strong>l cual laoferta es adjudicada al mejor precio.2.6. Remate HolandésEste sistema permite la negociación electrónica <strong>de</strong> Instrumentos<strong>de</strong> Renta Fija a través <strong>de</strong>l ingreso <strong>de</strong> ofertas queposteriormente son rematadas y adjudicadas bajo la modalidad<strong>de</strong> “tasa única” para todas las mejores posturasrecibidas. El sistema está habilitado para recibir ofertas<strong>de</strong> instrumentos <strong>de</strong> <strong>de</strong>uda tanto para el mercado primariocomo secundario.2.7. Sistema <strong>de</strong> Ofertas a Firme en BloqueEl Sistema <strong>de</strong> Ofertas a Firme en Bloque es un sistema <strong>de</strong>transacción <strong>de</strong> acciones don<strong>de</strong> se ingresan ofertas a firme,cada una con un período <strong>de</strong> vigencia <strong>de</strong>finido por elpropio oferente, durante el cual se mantiene un libro conlas ór<strong>de</strong>nes <strong>de</strong> aceptación <strong>de</strong> cada oferta a firme. El calce<strong>de</strong> las ór<strong>de</strong>nes <strong>de</strong>l libro correspondiente se produce, siproce<strong>de</strong>, al término<strong>de</strong> la vigencia<strong>de</strong> la oferta a firmeque estén aceptando.En este sistema senegocian las OPASpor hasta un 5%<strong>de</strong> las accionesemitidas por unasociedad, que serealicen en conformidada lo establecidoen los artículos198 y 200 <strong>de</strong> laLey N° 18.045.2.8. Subasta <strong>de</strong> un Libro<strong>de</strong> Or<strong>de</strong>nesEste sistema <strong>de</strong> negociación permite efectuar tanto la colocación<strong>de</strong> acciones <strong>de</strong> primera emisión como la venta<strong>de</strong> paquetes accionarios <strong>de</strong> gran tamaño. Para ello, cuentacon un procedimiento automático <strong>de</strong> recopilación <strong>de</strong>ór<strong>de</strong>nes <strong>de</strong>s<strong>de</strong> los terminales <strong>de</strong> corredores, las que sonregistradas en un libro que las segmenta según las características<strong>de</strong>finidas previamente por el agente colocador.Finalmente, al cierre <strong>de</strong>l libro se ejecuta la asignación<strong>de</strong> acciones a cada una <strong>de</strong> las ór<strong>de</strong>nes que cumplió conlos requisitos <strong>de</strong> la oferta, utilizando para ello factorestime, <strong>de</strong>pending on wether they are voluntary or forcedoffers.2.5. Serialized AuctionThis system allows for the electronic negotiation of fixedterm stock operations or “repurchase on shares.” Thisauction modality consists of the filing of ask offers whichhave a 2-minute lifespan, after which the offer is awar<strong>de</strong>dto the highest bid<strong>de</strong>r.2.6. Dutch AuctionThis system is oriented towards the electronic negotiationof Fixed Income papers via the filing of offers that arethen auctioned off and awar<strong>de</strong>d un<strong>de</strong>r the “single rate”mo<strong>de</strong> to all highest bids received. The system receivesoffers for <strong>de</strong>bt papers both from the primary and thesecondary market.2.7. Block offering systemThe System for Firm Offers in Blocks is a stock transactionsystem whereby firm offers are filed, each one witha lifespan <strong>de</strong>fined by the offerer himself. During thisperiod, a book is kept with acceptances of all firm offers.The corresponding assignment of the or<strong>de</strong>rs in the bookoccurs, if applicable, when the <strong>de</strong>fined lifespan lapses.The takeover bids(OPA from theinitials in Spanish)which are carriedout pursuantto articles 198and 200 of LawN° 18,045 arenegotiated un<strong>de</strong>rthis system forup to 5% of thestock issued by acompany.2.8. Or<strong>de</strong>rs BookAuctionThis negotiationsystem allows the offering of first issued stocks as wellas the offering of big size share packages. It counts withan automatic procedure to receive or<strong>de</strong>rs from eachbroker station, this or<strong>de</strong>rs are registered in a book thatsegments them by the conditions previously <strong>de</strong>fined bythe agent who offers the stocks. Finally, at the closingof the book it distributes the stocks for every or<strong>de</strong>rthat accomplished the requisites of the offer by usingthe proportion factors the resulted from the relationbetween the supply and <strong>de</strong>mand.47