Building Design Construction

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

news<br />

MEDICAL OFFICES ARE BEST BET FOR<br />

HEALTH REALTY INVESTORS: CBRE<br />

Investors in healthcare buildings view multitenant<br />

medical offi ces as their best bet for<br />

return on investments whose fi nancing, to<br />

an increasing degree, leans toward cash<br />

rather than debt.<br />

Those are some of the fi ndings in a 15-page<br />

<strong>Design</strong>ing with CMU?<br />

NO WORRIES<br />

BlockFlash ® , the patented single-wythe CMU<br />

flashing system, is cleverly simple—collect<br />

all the water in the cells, then get rid of it.<br />

It’s simple to install too. Totally reliable by<br />

design, it simply works every time—spec<br />

BlockFlash and have no worries.<br />

report that CBRE’s U.S. Healthcare Capital<br />

Markets Group has released, based on input<br />

from 80 healthcare real estate investors.<br />

Nearly one-third (32%) of all respondents<br />

say they target transactions that fall between<br />

$20 million and $50 million. Another 31%<br />

say that their preferred transaction range is<br />

$10 million to $20 million. Nearly all of the<br />

respondents—96%—are most interested in<br />

medical offi ce buildings as the type of building<br />

that meets their acquisition criteria. The next<br />

preferred building type is ambulatory surgery<br />

centers (63%), wellness centers (41%), and<br />

assisted living facilities (39%).<br />

The total amount of equity that fi rms allocated<br />

for healthcare real estate investment<br />

this year, nearly $14.5 billion, was about 7%<br />

less than the $15.5 billion estimate from the<br />

2015 survey. But the 2016 number is still considerably<br />

higher than estimates in the years<br />

2011 through 2014, and is actually 132%<br />

of the total market transaction volume that<br />

traded in the healthcare sector in 2015.<br />

More at: www.BDCnetwork.com/HCoutlook16<br />

NASCENT WIRELESS<br />

SENSOR MARKET IS<br />

POISED TO ASCEND<br />

IN NEXT DECADE<br />

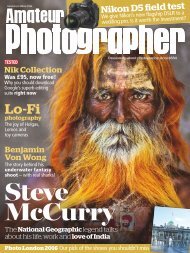

Over the next decade, revenue from wireless<br />

sensor sales worldwide for installation and<br />

use in commercial structures is expected<br />

to increase at a compound annual rate of<br />

16.5%, a projection that refl ects the growing<br />

demand for products that provide intelligent<br />

Call or email for samples: 800.664.6638 x509 •samples@mortarnet.com<br />

mortarnet.com<br />

($ Millions)<br />

$800<br />

$700<br />

$600<br />

$500<br />

$400<br />

$300<br />

$200<br />

$100<br />

0<br />

North America<br />

Europe<br />

Asia Pacific<br />

Latin America<br />

Middle East & Africa<br />

2016 2017 2018 2019 2020 2021 2022 2023 2024 2025<br />

A new report from Navigant Research foresees<br />

a steady climb in commercial demand for<br />

wireless sensors, as developers and their AEC<br />

partners seek better ways to make their buildings<br />

smarter and more interconnected.<br />

SOURCE: NAVIGANT RESEARCH<br />

Circle 757<br />

12 MAY 2016 BUILDING DESIGN+CONSTRUCTION www.BDCnetwork.com