- Page 1 and 2:

PhD Program in Management and Busin

- Page 3 and 4:

List of figures Figure 1. Optimal l

- Page 5 and 6:

„If you want to understand today,

- Page 7 and 8:

Neither the theory nor the empirica

- Page 9 and 10:

Table 1. Installations receiving th

- Page 11 and 12:

oth on national and corporate level

- Page 13 and 14:

1. Climate Change Regulation The fi

- Page 15 and 16:

approaches, activities that are not

- Page 17 and 18:

In Europe the United Kingdom and De

- Page 19 and 20:

(2) Allocating emission rights is d

- Page 21 and 22:

Figure 2. The cap determines the ma

- Page 23 and 24:

Table 5. Tradeable certificates (ba

- Page 25 and 26:

value, sectoral and spatial coverag

- Page 27 and 28:

with their quantified reduction tar

- Page 29 and 30:

* * * Several authors (Hahn and Sta

- Page 31 and 32:

EU ETS Within the context of the UN

- Page 33 and 34:

establishing an international marke

- Page 35 and 36:

(c) Allowances can also be distribu

- Page 37 and 38:

• ETS in New Zealand; • Volunta

- Page 39 and 40:

emissions trading schemes, making i

- Page 41 and 42:

end of the pilot phase. Since Augus

- Page 43 and 44:

Figure 10. Distance to burden-shari

- Page 45 and 46:

Early attitude of companies towards

- Page 47 and 48:

high quality, differentiated produc

- Page 49 and 50:

investments needed in the industry.

- Page 51 and 52:

3.2. Emission Trading in the new EU

- Page 53 and 54:

environmental benefits at a relativ

- Page 55 and 56:

well below their Kyoto target (EEA,

- Page 57 and 58:

lawsuits against the Commission for

- Page 59 and 60:

The most active countries to host J

- Page 61 and 62:

Figure 14. Hot air as supply for AA

- Page 63 and 64:

There have been three proposals on

- Page 65 and 66:

transparency of AAU transfers; redu

- Page 67 and 68:

Figure 18. Tradeable Hungarian AAU

- Page 69 and 70:

“Think Globally, Act Locally” I

- Page 71 and 72:

At the same time, this relatively f

- Page 73 and 74:

processes on the whole act a sink,

- Page 75 and 76:

directly from CO2 emissions are ess

- Page 77 and 78:

1.2. A Review of the Hungarian Lite

- Page 79 and 80:

2. Introducing the EU ETS in Hungar

- Page 81 and 82:

databases containing common data el

- Page 83 and 84:

instances where inconsistent decisi

- Page 85 and 86:

emissions each calendar year Non-tr

- Page 87 and 88:

is found to be in order, they may s

- Page 89 and 90:

economy to a market economy, as is

- Page 91 and 92:

the EU ETS. Many observers believe

- Page 93 and 94:

Emissions allowances to be allocate

- Page 95 and 96:

2005 2006 2007 Installation Alloc.

- Page 97 and 98:

Finance is putting much of the reve

- Page 99 and 100:

conclusion. It is safe to conclude

- Page 101 and 102: allowance surplus, and then increas

- Page 103 and 104: agent. 23 Denmark sold 2,762 thousa

- Page 105 and 106: and Water prepared its proposal on

- Page 107 and 108: What was the reason for this anomal

- Page 109 and 110: considered a “transfer.” Apart

- Page 111 and 112: When allowances are recognized as g

- Page 113 and 114: provision is to be formed against t

- Page 115 and 116: the model shall be supplemented wit

- Page 117 and 118: Participants of the Hungarian EU ET

- Page 119 and 120: program, full sets of emissions dat

- Page 121 and 122: Figure 27. The Concentration of the

- Page 123 and 124: Figure 30. The Hungarian EU ETS mar

- Page 125 and 126: Figure 32. Positions of Hungarian E

- Page 127 and 128: Figure 40 below shows the allocatio

- Page 129 and 130: 3.2. The Impact of the EU ETS on Hu

- Page 131 and 132: interviews, that companies looked u

- Page 133 and 134: neither emissions-reduction targets

- Page 135 and 136: was considered, since they all obta

- Page 137 and 138: spillover effect; this, however, co

- Page 139 and 140: During the pilot period, Hungarian

- Page 141 and 142: to comply shall have their names pu

- Page 143 and 144: eact efficiently to regulations. Th

- Page 145 and 146: ensuring great enough profit, it sw

- Page 147 and 148: combined with an internal price tha

- Page 149 and 150: Were Emissions Actually Reduced? Co

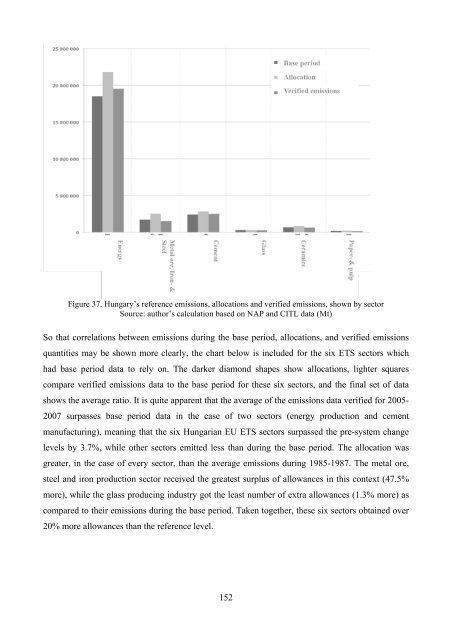

- Page 151: column) and the verified emissions

- Page 155 and 156: * * * The effects of the EU ETS on

- Page 157 and 158: (2) Transfer account of allowances,

- Page 159 and 160: In an EU-context, Hungary held its

- Page 161 and 162: installations the author spoke to w

- Page 163 and 164: Companies, which were certain of th

- Page 165 and 166: Figure 42. Hungarian transactions d

- Page 167 and 168: phase. CITL Data The transaction da

- Page 169 and 170: International Transfers The author

- Page 171 and 172: Based on these numbers, it may be c

- Page 173 and 174: The two right-hand side columns in

- Page 175 and 176: sales, and how much was accounted f

- Page 177 and 178: the CITL only contains data on wher

- Page 179 and 180: approximately two-fifths of the vol

- Page 181 and 182: (3) Installations that had shut dow

- Page 183 and 184: production, one-fifth represented t

- Page 185 and 186: IV. EXPERIENCES OF THE EU ETS PILOT

- Page 187 and 188: starting in 2012, the European Unio

- Page 189 and 190: originally allocated. Based on thes

- Page 191 and 192: economic development rather than as

- Page 193 and 194: Hungary has still to learn to opera

- Page 195 and 196: Appendix I. - Questionnaire 3.c. Cl

- Page 197 and 198: Had surplus but did not sell EUAs ,

- Page 199 and 200: Appendix III. - Accounting Aspects

- Page 201 and 202: Appendix V. - Overview and main fea

- Page 203 and 204:

Appendix VII. - Foreign emission al

- Page 205 and 206:

Hungária Cementipari Rt. 2006 HU 5

- Page 207 and 208:

Reductions Clean Development Mechan

- Page 209 and 210:

Linking Directive from project acti

- Page 211 and 212:

VII. REFERENCES Ahman, M. - Burtraw

- Page 213 and 214:

Burtraw, D. - Palmer, K. - Bharvirk

- Page 215 and 216:

EEA (2006): Greenhouse gas emission

- Page 217 and 218:

Hahn, R. - Stavins, R. (1999): What

- Page 219 and 220:

Kaderják, P. (1997): Economics for

- Page 221 and 222:

Montero, J. P. (1997): Marketable P

- Page 223 and 224:

Philibert, C. (2006): Certainty ver

- Page 225 and 226:

Tietenberg, T. (1992): Relevant Exp

- Page 227 and 228:

Woerdmann, E. (2003): Developing ca

- Page 229 and 230:

Hungarian law - Hungarian governmen

- Page 231 and 232:

Oxford University Press, USA http:/

- Page 233:

Author’s Publications related to