Dóra Fazekas Carbon Market Implications for new EU - UniCredit ...

Dóra Fazekas Carbon Market Implications for new EU - UniCredit ...

Dóra Fazekas Carbon Market Implications for new EU - UniCredit ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

interesting to examine what percent of Hungarian participants entered the market prior to the April<br />

2006 deadline. Was the last month of the first year of the pilot phase sufficient <strong>for</strong> obligated<br />

companies to sell their surpluses on the market?<br />

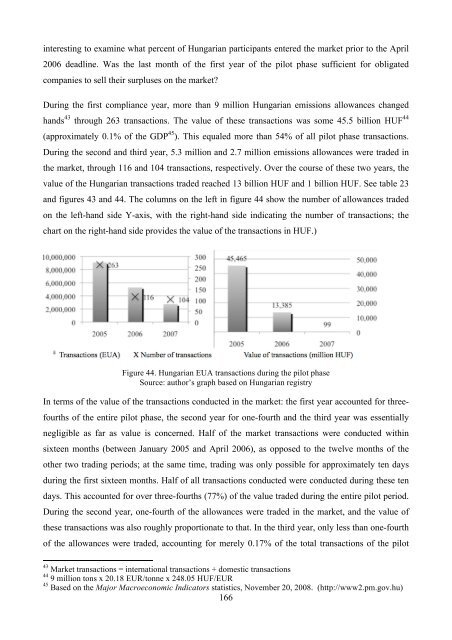

During the first compliance year, more than 9 million Hungarian emissions allowances changed<br />

hands 43 through 263 transactions. The value of these transactions was some 45.5 billion HUF 44<br />

(approximately 0.1% of the GDP 45 ). This equaled more than 54% of all pilot phase transactions.<br />

During the second and third year, 5.3 million and 2.7 million emissions allowances were traded in<br />

the market, through 116 and 104 transactions, respectively. Over the course of these two years, the<br />

value of the Hungarian transactions traded reached 13 billion HUF and 1 billion HUF. See table 23<br />

and figures 43 and 44. The columns on the left in figure 44 show the number of allowances traded<br />

on the left-hand side Y-axis, with the right-hand side indicating the number of transactions; the<br />

chart on the right-hand side provides the value of the transactions in HUF.)<br />

Figure 44. Hungarian <strong>EU</strong>A transactions during the pilot phase<br />

Source: author’s graph based on Hungarian registry<br />

In terms of the value of the transactions conducted in the market: the first year accounted <strong>for</strong> three-<br />

fourths of the entire pilot phase, the second year <strong>for</strong> one-fourth and the third year was essentially<br />

negligible as far as value is concerned. Half of the market transactions were conducted within<br />

sixteen months (between January 2005 and April 2006), as opposed to the twelve months of the<br />

other two trading periods; at the same time, trading was only possible <strong>for</strong> approximately ten days<br />

during the first sixteen months. Half of all transactions conducted were conducted during these ten<br />

days. This accounted <strong>for</strong> over three-fourths (77%) of the value traded during the entire pilot period.<br />

During the second year, one-fourth of the allowances were traded in the market, and the value of<br />

these transactions was also roughly proportionate to that. In the third year, only less than one-fourth<br />

of the allowances were traded, accounting <strong>for</strong> merely 0.17% of the total transactions of the pilot<br />

43<br />

<strong>Market</strong> transactions = international transactions + domestic transactions<br />

44<br />

9 million tons x 20.18 <strong>EU</strong>R/tonne x 248.05 HUF/<strong>EU</strong>R<br />

45<br />

Based on the Major Macroeconomic Indicators statistics, November 20, 2008. (http://www2.pm.gov.hu)<br />

166