- Page 1 and 2: 3 rd meeting of young researchers a

- Page 3 and 4: Comissão Organizadora / Comité Ci

- Page 5 and 6: Programa Wednesday, February 17 th

- Page 7 and 8: Parallel Oral Sessions I A1 Biologi

- Page 9 and 10: Degradation of anthocyanins and ant

- Page 11 and 12: Bio-guided HPLC-PAD-APCI-MS metabol

- Page 13 and 14: The effect of temperature on total

- Page 15 and 16: Parallel Oral Sessions I A2 Economi

- Page 17 and 18: The third sector social innovation

- Page 19 and 20: Are the ' entrepreneurs students' e

- Page 21 and 22: Convergence of Accounting Practice

- Page 23 and 24: Parallel Oral Sessions I A3 Environ

- Page 25 and 26: Ecological Assessment of Leça rive

- Page 27 and 28: Chlorella vulgaris for Wastewater T

- Page 29 and 30: Decontamination of cork bleaching w

- Page 31 and 32: Degradation of Sirius ® Blue dye b

- Page 33 and 34: Parallel Oral Sessions II A1 Biolog

- Page 35 and 36: ATF-3 expression during inflammator

- Page 37 and 38: Hemodynamic and morphometric charac

- Page 39 and 40: Nicotinic modulation of cholinergic

- Page 41 and 42: Parallel Oral Sessions II A2 Filoso

- Page 43 and 44: Gender Politics and its relation to

- Page 45 and 46: “Inclua-me fora disso” Contrapo

- Page 47 and 48: Parallel Oral Sessions II A3 Numeri

- Page 49 and 50: Central Pattern Generators in Biped

- Page 51: Time-Frequency analysis in Heart Ra

- Page 55 and 56: Parallel Oral Sessions III A1 Biolo

- Page 57 and 58: The homeodomain transcription facto

- Page 59 and 60: Two new aromatase inhibitors: Biolo

- Page 61 and 62: Crossing between PCR and HACCP: a p

- Page 63 and 64: Surface modification of chitosan po

- Page 65 and 66: Parallel Oral Sessions III A2 Histo

- Page 67 and 68: New Digital Methods on Rock Art Rec

- Page 69 and 70: Methodologies for a Contextual Inve

- Page 71 and 72: Treaties and detached decorative pr

- Page 73 and 74: Parallel Oral Sessions III A3 Commu

- Page 75 and 76: A Flu and the Agenda-Setting Theory

- Page 77 and 78: The influence of television on deve

- Page 79 and 80: A look at Machinima: Machine Animat

- Page 81 and 82: Parallel Oral Sessions IV A1 Biolog

- Page 83 and 84: Modulation of angiogenesis and infl

- Page 85 and 86: Biological activity of caffeic acid

- Page 87 and 88: Prediction of intestinal absorption

- Page 89 and 90: The effect of folate status on the

- Page 91 and 92: Parallel Oral Sessions IV A2 Chemis

- Page 93 and 94: Synthesis of Silica Particles for T

- Page 95 and 96: Optimization of a methodology for d

- Page 97 and 98: Structural, interfacial and rheolog

- Page 99 and 100: Parallel Oral Sessions IV A3 Renewa

- Page 101 and 102: Hydrogen generation and storage by

- Page 103 and 104:

Third generation photovoltaic cells

- Page 105 and 106:

Prediction of Raw-Material Characte

- Page 107 and 108:

Parallel Oral Sessions IV A4 Sport

- Page 109 and 110:

Application of critical velocity in

- Page 111 and 112:

Effects of acute endurance exercise

- Page 113 and 114:

Warming-up before sporting activity

- Page 115 and 116:

Parallel Oral Sessions V A1 Biologi

- Page 117 and 118:

Acute Haemodynamic Effects of Tezos

- Page 119 and 120:

Negative inotropic effect of angiot

- Page 121 and 122:

Relaxation of Human Penile Smooth M

- Page 123 and 124:

Parallel Oral Sessions V A2 Agronom

- Page 125 and 126:

Flowering and fruit-set in Vitis vi

- Page 127 and 128:

Evolution of antioxidant activity o

- Page 129 and 130:

Concentration of cadmium by lettuce

- Page 131 and 132:

Discrimination of Port Wine categor

- Page 133 and 134:

Parallel Oral Sessions V A3 Chemica

- Page 135 and 136:

Evaluation of Different Solvents fo

- Page 137 and 138:

Nanocrystalline Zinc-Substituted Hy

- Page 139 and 140:

Study and optimization of a multi-l

- Page 141 and 142:

Parallel Oral Sessions V A4 Sport S

- Page 143 and 144:

Overweight, Obesity, Physical Activ

- Page 145 and 146:

The built environment and participa

- Page 147 and 148:

The Sport Management in the curricu

- Page 149 and 150:

Parallel Oral Sessions VI A1 Biolog

- Page 151 and 152:

Portuguese primary care evaluation

- Page 153 and 154:

Screening and Assessment of Undernu

- Page 155 and 156:

Genetic characterization of Portugu

- Page 157 and 158:

Mutational screening of AXIN2 gene

- Page 159 and 160:

Parallel Oral Sessions VI A2 Chemis

- Page 161 and 162:

Quinolones as Metalloantibiotics: S

- Page 163 and 164:

Towards an “intelligent” contro

- Page 165 and 166:

Substrate recognition in HIV-1 Prot

- Page 167 and 168:

Parallel Oral Sessions VI A3 Electr

- Page 169 and 170:

Polyphase filter with continuous pa

- Page 171 and 172:

Digital Sigma Delta 1 st Order Modu

- Page 173 and 174:

Network based security for academic

- Page 175 and 176:

High-Birefringent Fibre Loop Mirror

- Page 177 and 178:

Parallel Oral Sessions VI A4 Geogra

- Page 179 and 180:

The creation of the European Citize

- Page 181 and 182:

The central status of the domestic

- Page 183 and 184:

Scenarios of urban sprawl using GIS

- Page 185 and 186:

Parallel Oral Sessions VII A1 Psych

- Page 187 and 188:

Patterns of preschool literacy, num

- Page 189 and 190:

I am a writer: A program for writin

- Page 191 and 192:

Understanding the inner-experience

- Page 193 and 194:

Parallel Oral Sessions VII A2 Liter

- Page 195 and 196:

I know It´s only poetry, but I lik

- Page 197 and 198:

The Mirror: a philosophical and the

- Page 199 and 200:

Parallel Oral Sessions VII A3 Engin

- Page 201 and 202:

AllCall : An Automated Call for Pap

- Page 203 and 204:

TraSMAPI - An Application Programmi

- Page 205 and 206:

Heart Sound Segmentation for Digita

- Page 207 and 208:

Capacitated Vehicle Routing Problem

- Page 209 and 210:

Parallel Oral Sessions VIII A1 Arch

- Page 211 and 212:

The epidermal design: From experien

- Page 213 and 214:

The value of memory in project´s p

- Page 215 and 216:

Nairobi: Upgrading the slums A. Coe

- Page 217 and 218:

Parallel Oral Sessions VIII A2 Civi

- Page 219 and 220:

Thermal Refurbishment of Roofs in O

- Page 221 and 222:

Operational control of cutting tree

- Page 223 and 224:

Influence of Socioeconomic status o

- Page 225 and 226:

Parallel Oral Sessions VIII A3 Arts

- Page 227 and 228:

The ‘art’ of entrepreneurship:

- Page 229 and 230:

Porto through the game: a playful c

- Page 231 and 232:

Retrato gráfico das minhas viagens

- Page 233 and 234:

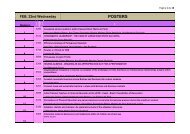

Posters I Wednesday, February 17 th

- Page 235 and 236:

Social Entrepreneurship: An analysi

- Page 237 and 238:

Characterisation of wine management

- Page 239 and 240:

Proximity Analysis among Researcher

- Page 241 and 242:

Awareness and brand equity of “Vi

- Page 243 and 244:

Effect of dimethyldioctadecylammoni

- Page 245 and 246:

Determination of ibuprofen in water

- Page 247 and 248:

Evaluation of the suitability of th

- Page 249 and 250:

Photochemical degradation of trans-

- Page 251 and 252:

Degradation of Metalaxyl by Chemica

- Page 253 and 254:

Characterization of the actual stat

- Page 255 and 256:

Contribution of the Microbial Commu

- Page 257 and 258:

Bioremediation with soils contamina

- Page 259 and 260:

Relevance of Temporal and Spatial V

- Page 261 and 262:

Extended-spectrum beta-lactamase pr

- Page 263 and 264:

Can Solanum nigrum L. be use to phy

- Page 265 and 266:

Study on the changes of soil chemic

- Page 267 and 268:

Toxicity of the pharmaceutical Simv

- Page 269 and 270:

Does macroalgae extracts support Pl

- Page 271 and 272:

Assessment of genetic diversity wit

- Page 273 and 274:

Safety of minimally processed garli

- Page 275 and 276:

Search for selective modulators of

- Page 277 and 278:

Evaluation of the paracrinic mechan

- Page 279 and 280:

Nickel analysis of coffee substitut

- Page 281 and 282:

Tomato (Lycopersicon esculentum) se

- Page 283 and 284:

5 % (Compounds area) Ficus carica l

- Page 285 and 286:

Chemical profile and antioxidant ac

- Page 287 and 288:

Exploiting sea cucumber Holothuria

- Page 289 and 290:

Cytotoxicity effect of a 35% H2O2 b

- Page 291 and 292:

Hydroxyxanthones: Recent Progress i

- Page 293 and 294:

The role of drug-membrane interacti

- Page 295 and 296:

Synthesis of a pyranoxanthone: opti

- Page 297 and 298:

Synthesis, physico-chemical propert

- Page 299 and 300:

Expression and activity evaluation

- Page 301 and 302:

Mutation screening in routine lung

- Page 303 and 304:

Fungal secondary metabolites as pot

- Page 305 and 306:

Thermal and textural analysis of hu

- Page 307 and 308:

Woman in the Politic: An Analyse of

- Page 309 and 310:

Introduction to MAXIMA Software B.

- Page 311 and 312:

Study of ionospheric anomalies usin

- Page 313 and 314:

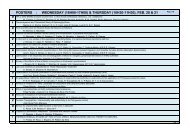

Posters II Thursday, February 18 th

- Page 315 and 316:

Hydration knowledge and behaviour a

- Page 317 and 318:

Bone mineral density and bone miner

- Page 319 and 320:

Behavioural Plasticity in Goalball

- Page 321 and 322:

The contribute of walking to preser

- Page 323 and 324:

Anodic stripping voltammetric analy

- Page 325 and 326:

Synthesis and enzymatic characteriz

- Page 327 and 328:

Utilization of a chromogenic substr

- Page 329 and 330:

Scavenging activities of sulfasalaz

- Page 331 and 332:

Automatic flow methodology for quin

- Page 333 and 334:

Chiral Xanthones with Potencial Ant

- Page 335 and 336:

F lu o rescent In tensity(a.u .)x10

- Page 337 and 338:

Interaction of resveratrol with mod

- Page 339 and 340:

In vitro assessment of meloxicam ef

- Page 341 and 342:

Flow injection amperometric determi

- Page 343 and 344:

Quantification of Chimassorb 944 in

- Page 345 and 346:

Determination of diltiazem by strip

- Page 347 and 348:

Fat uptake by fried foods A. Costa

- Page 349 and 350:

Spinel-Type Ferrite Nanoparticles:

- Page 351 and 352:

Near infrared spectroscopy: a tool

- Page 353 and 354:

Tropical Disease Research: New Time

- Page 355 and 356:

Activity and inhibition of bee veno

- Page 357 and 358:

Catalytic synthesis of indigo and i

- Page 359 and 360:

Energetic study of fluorene Sónia

- Page 361 and 362:

Polyoxometalates: Electrochemical S

- Page 363 and 364:

Inhibition of cyclooxygenases by ne

- Page 365 and 366:

Computational Parameterization of C

- Page 367 and 368:

Gas-diffusion extraction module (GD

- Page 369 and 370:

Systematic Development of Molecular

- Page 371 and 372:

Chromatographic determination of ri

- Page 373 and 374:

Development of a multicommutated fl

- Page 375 and 376:

Theoretical and computational studi

- Page 377 and 378:

Aza-Diels-Alder reaction between im

- Page 379 and 380:

Solvothermal preparation of Ce-base

- Page 381 and 382:

Self-assembly of anionic lysine-bas

- Page 383 and 384:

Thermotropic liquid crystals from d

- Page 385 and 386:

Antioxidant Capacity of Commercial

- Page 387 and 388:

Chemical and structural characteriz

- Page 389 and 390:

Literary Archetypes in Eduardo Gale

- Page 391 and 392:

GIS and Detection of Areas with Arc

- Page 393 and 394:

The Spatial Distribution and Travel

- Page 395 and 396:

Posters III Friday, February 19 th

- Page 397 and 398:

The potential of Austrian Architect

- Page 399 and 400:

Topology and Complex Geometries in

- Page 401 and 402:

Researching Rapid Prototyping in Ar

- Page 403 and 404:

Recycled Spaces Inês Alves Departm

- Page 405 and 406:

The use of photography in the educa

- Page 407 and 408:

Hydraulic characterisation of nonwo

- Page 409 and 410:

Incorporation of nanocomposites mat

- Page 411 and 412:

Structural evaluation and character

- Page 413 and 414:

Development of a biomimetic coating

- Page 415 and 416:

VORSat - Measuring a CubeSat Attitu

- Page 417 and 418:

Assessing viscous fingering effects

- Page 419 and 420:

Integration of Generation onto the

- Page 421 and 422:

Resistance of the geosynthetics aga

- Page 423 and 424:

Traditional dry cured sausages in M

- Page 425 and 426:

Isoflavones composition of Arabica

- Page 427 and 428:

Evaluation of DNA extraction protoc

- Page 429 and 430:

Host-tailored sensors for Dopamine

- Page 431 and 432:

Pesticide residues in grapes for wi

- Page 433 and 434:

FIA spectrophotometric system for t

- Page 435 and 436:

Gunshot residues analysis on the ha

- Page 437 and 438:

Comparison of Etest with the CLSI r

- Page 439 and 440:

Structure-activity profiling of coc

- Page 441 and 442:

Differences on adenosine modulation

- Page 443 and 444:

Conjugated linoleic acid (CLA) cont

- Page 445 and 446:

Grids of Hygiene and Sanitary Condi

- Page 447 and 448:

New approaches for estimating the p

- Page 449 and 450:

Erythrocyte aging/damage in chronic

- Page 451 and 452:

Effect of colchicine on p-glycoprot

- Page 453 and 454:

Project - “Colorful world of food

- Page 455 and 456:

Projects Fine Arts 3 rd meeting of

- Page 457 and 458:

Drawing and the Colonial War: a rep

- Page 459 and 460:

Gyotaku; its origins and relationsh

- Page 461 and 462:

The contemporary. Drawing as an inv

- Page 463 and 464:

ATELIER_PROJECTO Eugénia Pequito 1

- Page 465 and 466:

Identidades Metamorfoseadas J. Paul

- Page 467 and 468:

Instruções de Reportagem M. Guede

- Page 469 and 470:

Assembling new relations at canvas

- Page 471 and 472:

Case Studies IJUP 3 rd meeting of y

- Page 473 and 474:

3: IJUP’s 2010 Third Meeting of Y

- Page 475 and 476:

Criação da identidade do IJUP 201

- Page 477 and 478:

IDENTIDADE IJUP 2010 Marta Nestor P

- Page 479 and 480:

Identidade IJUP’10 Lúcia Rocha L

- Page 481 and 482:

IJUP’10 Diana Vila Pouca Faculdad

- Page 483 and 484:

IJUP 2010 - proposta de carta Maria

- Page 485 and 486:

Identidade IJUP’10 Pedro Reis Fac

- Page 487 and 488:

Identidade IJUP’10 Bruno Almeida

- Page 489 and 490:

Proposta de Poster para o evento IJ

- Page 491 and 492:

Post-it Filipa Martins Departamento

- Page 493 and 494:

IJUP 10 poster: “This is not just

- Page 495 and 496:

Chemical profile and antioxidant ac

- Page 497 and 498:

Incorporation of nanocomposites mat

- Page 499:

Technical and morphological study o