Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

25 PENSIONS AND POST-RETIREMENT BENEFITS<br />

The majority of the <strong>Group</strong>’s UK employees participate in the <strong>BG</strong> Pension Scheme (the “Scheme”). The Scheme is of the defined benefit type. It is a<br />

registered pension scheme established under trust. The Trustee is <strong>BG</strong> <strong>Group</strong> Pension Trustees Limited. The Scheme is funded to cover future pension<br />

liabilities in respect of service up to the balance sheet date. It is subject to an independent valuation at least every three years, on the basis of which<br />

the independent qualified actuary certifies the rate of employers’ contributions that, together with the specified contributions payable by the employees<br />

<strong>and</strong> proceeds from the Scheme’s assets, are expected to be sufficient to fund the benefits payable under the Scheme.<br />

Participating employers’ contributions are certified by the Scheme’s independent qualified actuary. For the year ended 31 December <strong>2009</strong>, the employers’<br />

contribution rate in respect of most Scheme members was effectively 26.9% of pensionable pay up to 31 July <strong>2009</strong> (including Scheme expenses) <strong>and</strong> 35.2%<br />

of pensionable pay thereafter (excluding Scheme expenses which are now met directly by the Company). In addition, 3% of pensionable pay was<br />

contributed by most members either directly or by their employer via a salary sacrifice arrangement.<br />

A full independent actuarial valuation of the Scheme for funding purposes was completed as at 31 March 2008. This showed that the aggregate market<br />

value of the Scheme’s assets at 31 March 2008 was £577m, representing some 83% of the accrued liabilities. The <strong>Group</strong> made one payment of £27m in<br />

<strong>2009</strong> <strong>and</strong> intends to make five further payments of £27m in the years to 2014 in order to reduce the Scheme’s deficit. Aggregate Company contributions<br />

for the year ending 31 December 2010 are expected to be £71m.<br />

The <strong>BG</strong> Supplementary Benefits Scheme is available to provide benefits in excess of the ‘lifetime allowance’. This scheme is an unfunded, unregistered<br />

arrangement.<br />

With effect from 2 April 2007, new UK employees have been offered membership of a defined contribution stakeholder pension plan, the <strong>BG</strong> <strong>Group</strong><br />

Retirement Benefits Plan (the “Plan”). Life assurance <strong>and</strong> income protection benefits are also provided under separate plans; these benefits are fully<br />

insured. Members may choose the rate at which they contribute to the Plan, either directly or via salary sacrifice, <strong>and</strong> the additional employer’s<br />

contribution is determined by the rate that the member selects. A wide range of funds is available from which members may choose how the<br />

contributions will be invested. The cost of the Plan has been included in the amounts recognised in the consolidated income statement in the table below.<br />

There is an unfunded post-retirement employee benefit plan for healthcare in respect of employees of Comgás. Provision has been made in respect<br />

of this plan.<br />

The <strong>Group</strong> also has a number of defined contribution schemes <strong>and</strong> smaller defined benefit schemes. These are not material in <strong>Group</strong> terms.<br />

The following information in respect of the Scheme, the <strong>BG</strong> Supplementary Benefits Scheme <strong>and</strong> the Comgás post-retirement healthcare plan<br />

(described hereafter as the “plans”) has been provided in accordance with IAS 19.<br />

Valuations of all of the plans’ assets <strong>and</strong> expected liabilities as at 31 December <strong>2009</strong> were carried out by independent actuaries in accordance with the<br />

requirements of IAS 19. In calculating the charge to the income statement including any recognised actuarial gains <strong>and</strong> losses, a 10% corridor was applied.<br />

This means that a portion of actuarial gains <strong>and</strong> losses is recognised as income or expense only if it exceeds the greater of:<br />

a) 10% of the present value of the defined benefit obligation at that date (before deducting plan assets); <strong>and</strong><br />

b) 10% of the fair value of any plan assets at that date.<br />

These limits are calculated <strong>and</strong> applied separately for each defined benefit plan at each balance sheet date <strong>and</strong> the portion of actuarial gains <strong>and</strong> losses<br />

to be recognised in future years for each plan is the excess of actuarial gains <strong>and</strong> losses over <strong>and</strong> above the 10% limits divided by the expected average<br />

remaining working lives of the employees participating in that plan.<br />

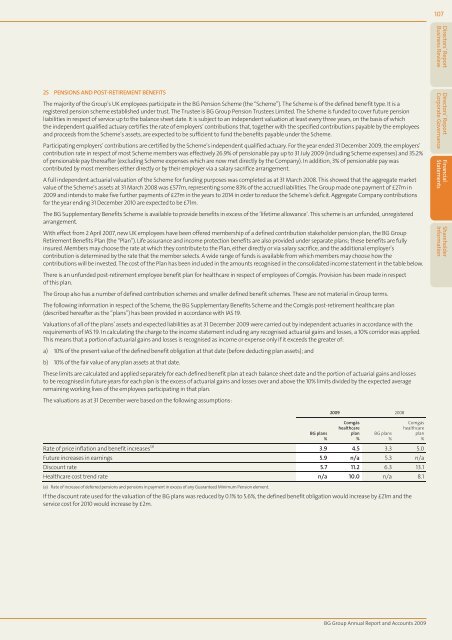

The valuations as at 31 December were based on the following assumptions:<br />

<strong>BG</strong> plans<br />

%<br />

<strong>2009</strong> 2008<br />

Comgás<br />

healthcare<br />

plan<br />

%<br />

<strong>BG</strong> plans<br />

%<br />

Comgás<br />

healthcare<br />

plan<br />

%<br />

Rate of price inflation <strong>and</strong> benefit increases (a) 3.9 4.5 3.3 5.0<br />

Future increases in earnings 5.9 n/a 5.3 n/a<br />

Discount rate 5.7 11.2 6.3 13.1<br />

Healthcare cost trend rate n/a 10.0 n/a 8.1<br />

(a) Rate of increase of deferred pensions <strong>and</strong> pensions in payment in excess of any Guaranteed Minimum Pension element.<br />

If the discount rate used for the valuation of the <strong>BG</strong> plans was reduced by 0.1% to 5.6%, the defined benefit obligation would increase by £21m <strong>and</strong> the<br />

service cost for 2010 would increase by £2m.<br />

<strong>BG</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2009</strong><br />

107<br />

Directors’ <strong>Report</strong><br />

Business Review<br />

Directors’ <strong>Report</strong><br />

Corporate Governance<br />

Financial<br />

Statements<br />

Shareholder<br />

Information