Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

78<br />

Financial Statements<br />

Notes to the accounts continued<br />

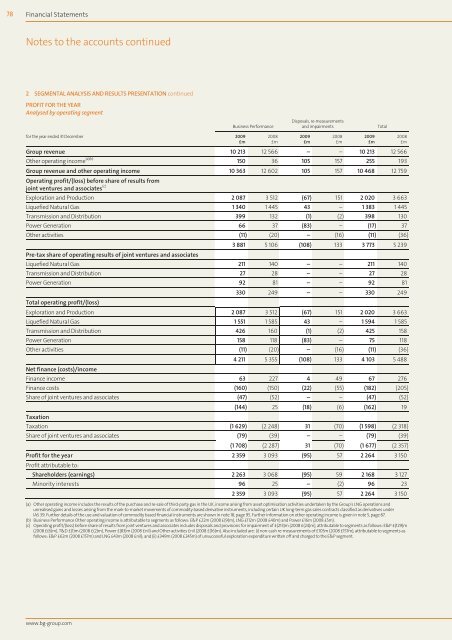

2 SEGMENTAL ANALYSIS AND RESULTS PRESENTATION continued<br />

PROFIT FOR THE YEAR<br />

Analysed by operating segment<br />

for the year ended 31 December <strong>2009</strong><br />

£m<br />

www.bg-group.com<br />

Business Performance<br />

2008<br />

£m<br />

Disposals, re-measurements<br />

<strong>and</strong> impairments Total<br />

<strong>Group</strong> revenue 10 213 12 566 – – 10 213 12 566<br />

Other operating income (a)(b) 150 36 105 157 255 193<br />

<strong>Group</strong> revenue <strong>and</strong> other operating income<br />

Operating profit/(loss) before share of results from<br />

joint ventures <strong>and</strong> associates<br />

10 363 12 602 105 157 10 468 12 759<br />

(c)<br />

Exploration <strong>and</strong> Production 2 087 3 512 (67) 151 2 020 3 663<br />

Liquefied Natural Gas 1 340 1 445 43 – 1 383 1 445<br />

Transmission <strong>and</strong> Distribution 399 132 (1) (2) 398 130<br />

Power Generation 66 37 (83) – (17) 37<br />

Other activities (11) (20) – (16) (11) (36)<br />

Pre-tax share of operating results of joint ventures <strong>and</strong> associates<br />

3 881 5 106 (108) 133 3 773 5 239<br />

Liquefied Natural Gas 211 140 – – 211 140<br />

Transmission <strong>and</strong> Distribution 27 28 – – 27 28<br />

Power Generation 92 81 – – 92 81<br />

Total operating profit/(loss)<br />

330 249 – – 330 249<br />

Exploration <strong>and</strong> Production 2 087 3 512 (67) 151 2 020 3 663<br />

Liquefied Natural Gas 1 551 1 585 43 – 1 594 1 585<br />

Transmission <strong>and</strong> Distribution 426 160 (1) (2) 425 158<br />

Power Generation 158 118 (83) – 75 118<br />

Other activities (11) (20) – (16) (11) (36)<br />

Net finance (costs)/income<br />

4 211 5 355 (108) 133 4 103 5 488<br />

Finance income 63 227 4 49 67 276<br />

Finance costs (160) (150) (22) (55) (182) (205)<br />

Share of joint ventures <strong>and</strong> associates (47) (52) – – (47) (52)<br />

Taxation<br />

(144) 25 (18) (6) (162) 19<br />

Taxation (1 629) (2 248) 31 (70) (1 598) (2 318)<br />

Share of joint ventures <strong>and</strong> associates (79) (39) – – (79) (39)<br />

(1 708) (2 287) 31 (70) (1 677) (2 357)<br />

Profit for the year<br />

Profit attributable to:<br />

2 359 3 093 (95) 57 2 264 3 150<br />

Shareholders (earnings) 2 263 3 068 (95) 59 2 168 3 127<br />

Minority interests 96 25 – (2) 96 23<br />

2 359 3 093 (95) 57 2 264 3 150<br />

(a) Other operating income includes the results of the purchase <strong>and</strong> re-sale of third-party gas in the UK, income arising from asset optimisation activities undertaken by the <strong>Group</strong>’s LNG operations <strong>and</strong><br />

unrealised gains <strong>and</strong> losses arising from the mark-to-market movements of commodity based derivative instruments, including certain UK long-term gas sales contracts classified as derivatives under<br />

IAS 39. Further details of the use <strong>and</strong> valuation of commodity based financial instruments are shown in note 18, page 95. Further information on other operating income is given in note 5, page 87.<br />

(b) Business Performance Other operating income is attributable to segments as follows: E&P £22m (2008 £(9)m), LNG £112m (2008 £40m) <strong>and</strong> Power £16m (2008 £5m).<br />

(c) Operating profit/(loss) before share of results from joint ventures <strong>and</strong> associates includes disposals <strong>and</strong> provisions for impairment of £(213)m (2008 £(24)m), attributable to segments as follows: E&P £(129)m<br />

(2008 £(6)m), T&D £(1)m (2008 £(2)m), Power £(83)m (2008 £nil) <strong>and</strong> Other activities £nil (2008 £(16)m). Also included are: (i) non-cash re-measurements of £105m (2008 £157m), attributable to segments as<br />

follows: E&P £62m (2008 £157m) <strong>and</strong> LNG £43m (2008 £nil); <strong>and</strong> (ii) £349m (2008 £245m) of unsuccessful exploration expenditure written off <strong>and</strong> charged to the E&P segment.<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m