Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

94<br />

Financial Statements<br />

Notes to the accounts continued<br />

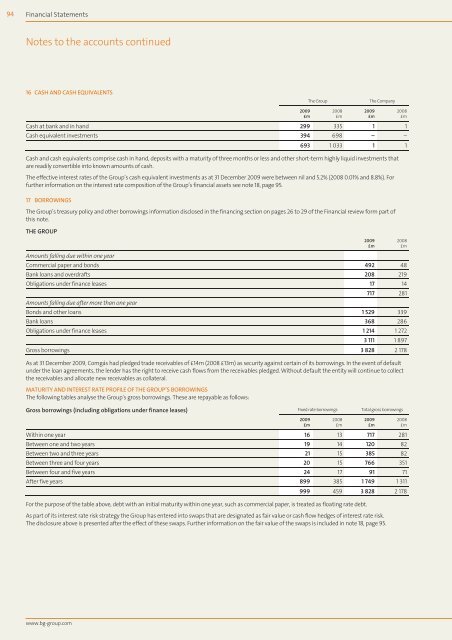

16 CASH AND CASH EQUIVALENTS<br />

www.bg-group.com<br />

<strong>2009</strong><br />

£m<br />

The <strong>Group</strong> The Company<br />

Cash at bank <strong>and</strong> in h<strong>and</strong> 299 335 1 1<br />

Cash equivalent investments 394 698 – –<br />

2008<br />

£m<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

693 1 033 1 1<br />

Cash <strong>and</strong> cash equivalents comprise cash in h<strong>and</strong>, deposits with a maturity of three months or less <strong>and</strong> other short-term highly liquid investments that<br />

are readily convertible into known amounts of cash.<br />

The effective interest rates of the <strong>Group</strong>’s cash equivalent investments as at 31 December <strong>2009</strong> were between nil <strong>and</strong> 5.2% (2008 0.01% <strong>and</strong> 8.8%). For<br />

further information on the interest rate composition of the <strong>Group</strong>’s financial assets see note 18, page 95.<br />

17 BORROWINGS<br />

The <strong>Group</strong>’s treasury policy <strong>and</strong> other borrowings information disclosed in the financing section on pages 26 to 29 of the Financial review form part of<br />

this note.<br />

THE GROUP<br />

Amounts falling due within one year<br />

Commercial paper <strong>and</strong> bonds 492 48<br />

Bank loans <strong>and</strong> overdrafts 208 219<br />

Obligations under finance leases 17 14<br />

Amounts falling due after more than one year<br />

717 281<br />

Bonds <strong>and</strong> other loans 1 529 339<br />

Bank loans 368 286<br />

Obligations under finance leases 1 214 1 272<br />

3 111 1 897<br />

Gross borrowings 3 828 2 178<br />

As at 31 December <strong>2009</strong>, Comgás had pledged trade receivables of £14m (2008 £13m) as security against certain of its borrowings. In the event of default<br />

under the loan agreements, the lender has the right to receive cash flows from the receivables pledged. Without default the entity will continue to collect<br />

the receivables <strong>and</strong> allocate new receivables as collateral.<br />

MATURITY AND INTEREST RATE PROFILE OF THE GROUP’S BORROWINGS<br />

The following tables analyse the <strong>Group</strong>’s gross borrowings. These are repayable as follows:<br />

Gross borrowings (including obligations under finance leases) Fixed rate borrowings Total gross borrowings<br />

Within one year 16 13 717 281<br />

Between one <strong>and</strong> two years 19 14 120 82<br />

Between two <strong>and</strong> three years 21 15 385 82<br />

Between three <strong>and</strong> four years 20 15 766 351<br />

Between four <strong>and</strong> five years 24 17 91 71<br />

After five years 899 385 1 749 1 311<br />

999 459 3 828 2 178<br />

For the purpose of the table above, debt with an initial maturity within one year, such as commercial paper, is treated as floating rate debt.<br />

As part of its interest rate risk strategy the <strong>Group</strong> has entered into swaps that are designated as fair value or cash flow hedges of interest rate risk.<br />

The disclosure above is presented after the effect of these swaps. Further information on the fair value of the swaps is included in note 18, page 95.<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

<strong>2009</strong><br />

£m<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

2008<br />

£m