Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

88<br />

Financial Statements<br />

Notes to the accounts continued<br />

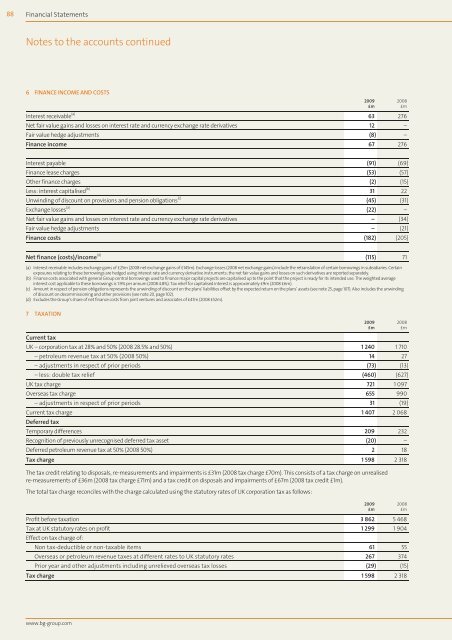

6 FINANCE INCOME AND COSTS<br />

Interest receivable (a)<br />

www.bg-group.com<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

63 276<br />

Net fair value gains <strong>and</strong> losses on interest rate <strong>and</strong> currency exchange rate derivatives 12 –<br />

Fair value hedge adjustments (8) –<br />

Finance income 67 276<br />

Interest payable (91) (69)<br />

Finance lease charges (53) (57)<br />

Other finance charges (2) (15)<br />

Less: interest capitalised (b) 31 22<br />

Unwinding of discount on provisions <strong>and</strong> pension obligations (c) (45) (31)<br />

Exchange losses (a)<br />

(22) –<br />

Net fair value gains <strong>and</strong> losses on interest rate <strong>and</strong> currency exchange rate derivatives – (34)<br />

Fair value hedge adjustments – (21)<br />

Finance costs (182) (205)<br />

Net finance (costs)/income (d) (115) 71<br />

(a) Interest receivable includes exchange gains of £25m (2008 net exchange gains of £145m). Exchange losses (2008 net exchange gains) include the retranslation of certain borrowings in subsidiaries. Certain<br />

exposures relating to these borrowings are hedged using interest rate <strong>and</strong> currency derivative instruments; the net fair value gains <strong>and</strong> losses on such derivatives are reported separately.<br />

(b) Finance costs associated with general <strong>Group</strong> central borrowings used to finance major capital projects are capitalised up to the point that the project is ready for its intended use. The weighted average<br />

interest cost applicable to these borrowings is 1.9% per annum (2008 4.8%). Tax relief for capitalised interest is approximately £9m (2008 £6m).<br />

(c) Amount in respect of pension obligations represents the unwinding of discount on the plans’ liabilities offset by the expected return on the plans’ assets (see note 25, page 107). Also includes the unwinding<br />

of discount on decommissioning <strong>and</strong> other provisions (see note 20, page 102).<br />

(d) Excludes the <strong>Group</strong>’s share of net finance costs from joint ventures <strong>and</strong> associates of £47m (2008 £52m).<br />

7 TAXATION<br />

Current tax<br />

UK – corporation tax at 28% <strong>and</strong> 50% (2008 28.5% <strong>and</strong> 50%) 1 240 1 710<br />

– petroleum revenue tax at 50% (2008 50%) 14 27<br />

– adjustments in respect of prior periods (73) (13)<br />

– less: double tax relief (460) (627)<br />

UK tax charge 721 1 097<br />

Overseas tax charge 655 990<br />

– adjustments in respect of prior periods 31 (19)<br />

Current tax charge 1 407 2 068<br />

Deferred tax<br />

Temporary differences 209 232<br />

Recognition of previously unrecognised deferred tax asset (20) –<br />

Deferred petroleum revenue tax at 50% (2008 50%) 2 18<br />

Tax charge 1 598 2 318<br />

The tax credit relating to disposals, re-measurements <strong>and</strong> impairments is £31m (2008 tax charge £70m). This consists of a tax charge on unrealised<br />

re-measurements of £36m (2008 tax charge £71m) <strong>and</strong> a tax credit on disposals <strong>and</strong> impairments of £67m (2008 tax credit £1m).<br />

The total tax charge reconciles with the charge calculated using the statutory rates of UK corporation tax as follows:<br />

Profit before taxation 3 862 5 468<br />

Tax at UK statutory rates on profit<br />

Effect on tax charge of:<br />

1 299 1 904<br />

Non tax-deductible or non-taxable items 61 55<br />

Overseas or petroleum revenue taxes at different rates to UK statutory rates 267 374<br />

Prior year <strong>and</strong> other adjustments including unrelieved overseas tax losses (29) (15)<br />

Tax charge 1 598 2 318<br />

<strong>2009</strong><br />

£m<br />

<strong>2009</strong><br />

£m<br />

2008<br />

£m<br />

2008<br />

£m