Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TSR performance for the Performance Share Awards is measured over<br />

a three-year performance period commencing on the first day of<br />

the calendar month in which the award is made. There is no retest<br />

provision. The level of Performance Share Awards vesting is related to<br />

the Company’s TSR performance over this period relative to a weighted<br />

index of a selection of industry peers. The constituents of the Index for<br />

the September <strong>2009</strong> awards were:<br />

• Anadarko Petroleum • ENI S.p.A.<br />

• Royal Dutch Shell plc<br />

Corporation<br />

• EOG Resources, Inc. • StatoilHydro ASA<br />

• Apache Corporation<br />

• Exxon Mobil<br />

• Suncor Energy Inc.<br />

• BP plc<br />

Corporation<br />

• Talisman Energy Inc.<br />

• Chevron Corporation • Hess Corporation<br />

• ConocoPhillips<br />

• Devon Energy<br />

Corporation<br />

• Marathon Oil<br />

Corporation<br />

• Repsol YPF S.A.<br />

• Total S.A.<br />

• Woodside<br />

Petroleum Ltd.<br />

Of these companies, nine are headquartered in the USA, one in the UK,<br />

two in Canada, one in Australia <strong>and</strong> five elsewhere in Europe.<br />

The constituents of the Index for the September 2008 awards were<br />

identical to those listed above, except that Suncor Energy Inc. was not<br />

an Index constituent <strong>and</strong> Petro-Canada was included in the Index up<br />

to the date of the completion of its acquisition by Suncor Energy Inc.<br />

in August <strong>2009</strong>.<br />

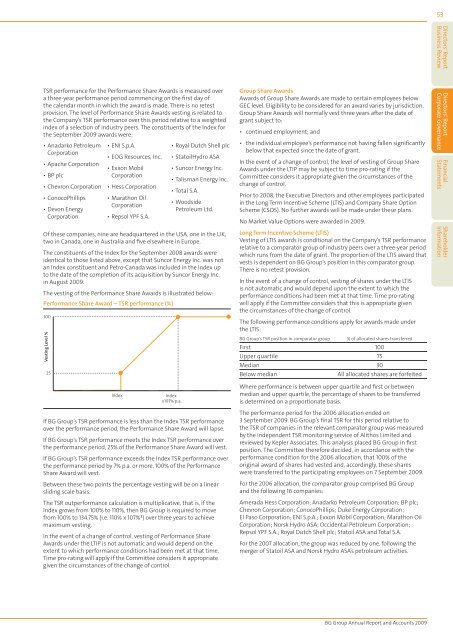

The vesting of the Performance Share Awards is illustrated below:<br />

Performance Share Award – TSR performance (%)<br />

100<br />

Vesting Level %<br />

25<br />

Index<br />

Index<br />

x107% p.a.<br />

If <strong>BG</strong> <strong>Group</strong>’s TSR performance is less than the Index TSR performance<br />

over the performance period, the Performance Share Award will lapse.<br />

If <strong>BG</strong> <strong>Group</strong>’s TSR performance meets the Index TSR performance over<br />

the performance period, 25% of the Performance Share Award will vest.<br />

If <strong>BG</strong> <strong>Group</strong>’s TSR performance exceeds the Index TSR performance over<br />

the performance period by 7% p.a. or more, 100% of the Performance<br />

Share Award will vest.<br />

Between these two points the percentage vesting will be on a linear<br />

sliding scale basis.<br />

The TSR outperformance calculation is multiplicative, that is, if the<br />

Index grows from 100% to 110%, then <strong>BG</strong> <strong>Group</strong> is required to move<br />

from 100% to 134.75% (i.e. 110% x 107% 3 ) over three years to achieve<br />

maximum vesting.<br />

In the event of a change of control, vesting of Performance Share<br />

Awards under the LTIP is not automatic <strong>and</strong> would depend on the<br />

extent to which performance conditions had been met at that time.<br />

Time pro-rating will apply if the Committee considers it appropriate<br />

given the circumstances of the change of control.<br />

<strong>Group</strong> Share Awards<br />

Awards of <strong>Group</strong> Share Awards are made to certain employees below<br />

GEC level. Eligibility to be considered for an award varies by jurisdiction.<br />

<strong>Group</strong> Share Awards will normally vest three years after the date of<br />

grant subject to:<br />

• continued employment; <strong>and</strong><br />

• the individual employee’s performance not having fallen significantly<br />

below that expected since the date of grant.<br />

In the event of a change of control, the level of vesting of <strong>Group</strong> Share<br />

Awards under the LTIP may be subject to time pro-rating if the<br />

Committee considers it appropriate given the circumstances of the<br />

change of control.<br />

Prior to 2008, the Executive Directors <strong>and</strong> other employees participated<br />

in the Long Term Incentive Scheme (LTIS) <strong>and</strong> Company Share Option<br />

Scheme (CSOS). No further awards will be made under these plans.<br />

No Market Value Options were awarded in <strong>2009</strong>.<br />

Long Term Incentive Scheme (LTIS)<br />

Vesting of LTIS awards is conditional on the Company’s TSR performance<br />

relative to a comparator group of industry peers over a three-year period<br />

which runs from the date of grant. The proportion of the LTIS award that<br />

vests is dependent on <strong>BG</strong> <strong>Group</strong>’s position in this comparator group.<br />

There is no retest provision.<br />

In the event of a change of control, vesting of shares under the LTIS<br />

is not automatic <strong>and</strong> would depend upon the extent to which the<br />

performance conditions had been met at that time. Time pro-rating<br />

will apply if the Committee considers that this is appropriate given<br />

the circumstances of the change of control.<br />

The following performance conditions apply for awards made under<br />

the LTIS:<br />

<strong>BG</strong> <strong>Group</strong>’s TSR position in comparator group % of allocated shares transferred<br />

First 100<br />

Upper quartile 75<br />

Median 30<br />

Below median All allocated shares are forfeited<br />

Where performance is between upper quartile <strong>and</strong> first or between<br />

median <strong>and</strong> upper quartile, the percentage of shares to be transferred<br />

is determined on a proportionate basis.<br />

The performance period for the 2006 allocation ended on<br />

3 September <strong>2009</strong>. <strong>BG</strong> <strong>Group</strong>’s final TSR for this period relative to<br />

the TSR of companies in the relevant comparator group was measured<br />

by the independent TSR monitoring service of Alithos Limited <strong>and</strong><br />

reviewed by Kepler Associates. This analysis placed <strong>BG</strong> <strong>Group</strong> in first<br />

position. The Committee therefore decided, in accordance with the<br />

performance condition for the 2006 allocation, that 100% of the<br />

original award of shares had vested <strong>and</strong>, accordingly, these shares<br />

were transferred to the participating employees on 7 September <strong>2009</strong>.<br />

For the 2006 allocation, the comparator group comprised <strong>BG</strong> <strong>Group</strong><br />

<strong>and</strong> the following 16 companies:<br />

Amerada Hess Corporation; Anadarko Petroleum Corporation; BP plc;<br />

Chevron Corporation; ConocoPhillips; Duke Energy Corporation;<br />

El Paso Corporation; ENI S.p.A.; Exxon Mobil Corporation; Marathon Oil<br />

Corporation; Norsk Hydro ASA; Occidental Petroleum Corporation;<br />

Repsol YPF S.A.; Royal Dutch Shell plc; Statoil ASA <strong>and</strong> Total S.A.<br />

For the 2007 allocation, the group was reduced by one, following the<br />

merger of Statoil ASA <strong>and</strong> Norsk Hydro ASA’s petroleum activities.<br />

<strong>BG</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2009</strong><br />

53<br />

Directors’ <strong>Report</strong><br />

Business Review<br />

Directors’ <strong>Report</strong><br />

Corporate Governance<br />

Financial<br />

Statements<br />

Shareholder<br />

Information