Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Annual Report and Accounts 2009 - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

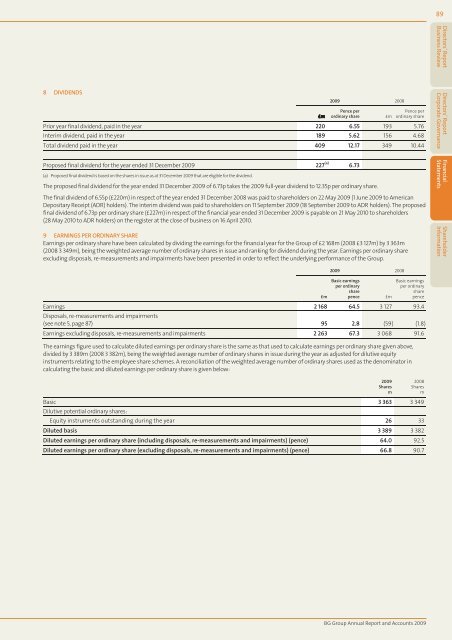

8 DIVIDENDS<br />

£m<br />

<strong>2009</strong> 2008<br />

Pence per<br />

ordinary share £m<br />

Pence per<br />

ordinary share<br />

Prior year final dividend, paid in the year 220 6.55 193 5.76<br />

Interim dividend, paid in the year 189 5.62 156 4.68<br />

Total dividend paid in the year 409 12.17 349 10.44<br />

Proposed final dividend for the year ended 31 December <strong>2009</strong> 227 (a) 6.73<br />

(a) Proposed final dividend is based on the shares in issue as at 31 December <strong>2009</strong> that are eligible for the dividend.<br />

The proposed final dividend for the year ended 31 December <strong>2009</strong> of 6.73p takes the <strong>2009</strong> full-year dividend to 12.35p per ordinary share.<br />

The final dividend of 6.55p (£220m) in respect of the year ended 31 December 2008 was paid to shareholders on 22 May <strong>2009</strong> (1 June <strong>2009</strong> to American<br />

Depositary Receipt (ADR) holders). The interim dividend was paid to shareholders on 11 September <strong>2009</strong> (18 September <strong>2009</strong> to ADR holders). The proposed<br />

final dividend of 6.73p per ordinary share (£227m) in respect of the financial year ended 31 December <strong>2009</strong> is payable on 21 May 2010 to shareholders<br />

(28 May 2010 to ADR holders) on the register at the close of business on 16 April 2010.<br />

9 EARNINGS PER ORDINARY SHARE<br />

Earnings per ordinary share have been calculated by dividing the earnings for the financial year for the <strong>Group</strong> of £2 168m (2008 £3 127m) by 3 363m<br />

(2008 3 349m), being the weighted average number of ordinary shares in issue <strong>and</strong> ranking for dividend during the year. Earnings per ordinary share<br />

excluding disposals, re-measurements <strong>and</strong> impairments have been presented in order to reflect the underlying performance of the <strong>Group</strong>.<br />

<strong>2009</strong> 2008<br />

Basic earnings<br />

Basic earnings<br />

per ordinary<br />

per ordinary<br />

share<br />

share<br />

£m<br />

pence £m<br />

pence<br />

Earnings<br />

Disposals, re-measurements <strong>and</strong> impairments<br />

2 168 64.5 3 127 93.4<br />

(see note 5, page 87) 95 2.8 (59) (1.8)<br />

Earnings excluding disposals, re-measurements <strong>and</strong> impairments 2 263 67.3 3 068 91.6<br />

The earnings figure used to calculate diluted earnings per ordinary share is the same as that used to calculate earnings per ordinary share given above,<br />

divided by 3 389m (2008 3 382m), being the weighted average number of ordinary shares in issue during the year as adjusted for dilutive equity<br />

instruments relating to the employee share schemes. A reconciliation of the weighted average number of ordinary shares used as the denominator in<br />

calculating the basic <strong>and</strong> diluted earnings per ordinary share is given below:<br />

Basic<br />

Dilutive potential ordinary shares:<br />

3 363 3 349<br />

Equity instruments outst<strong>and</strong>ing during the year 26 33<br />

Diluted basis 3 389 3 382<br />

Diluted earnings per ordinary share (including disposals, re-measurements <strong>and</strong> impairments) (pence) 64.0 92.5<br />

Diluted earnings per ordinary share (excluding disposals, re-measurements <strong>and</strong> impairments) (pence) 66.8 90.7<br />

<strong>2009</strong><br />

Shares<br />

m<br />

2008<br />

Shares<br />

m<br />

<strong>BG</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2009</strong><br />

89<br />

Directors’ <strong>Report</strong><br />

Business Review<br />

Directors’ <strong>Report</strong><br />

Corporate Governance<br />

Financial<br />

Statements<br />

Shareholder<br />

Information