SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

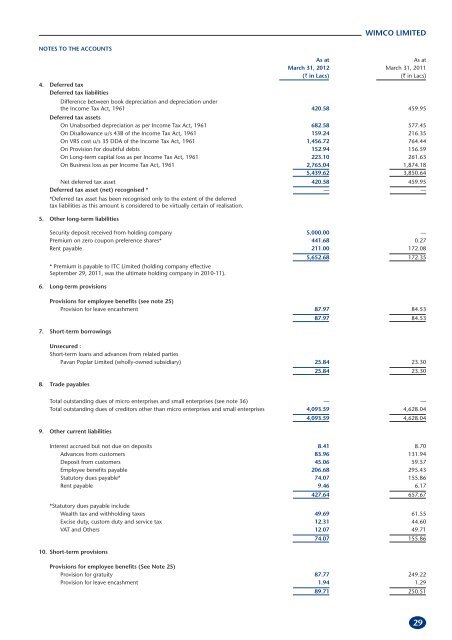

NOTES TO THE ACCOUNTS<br />

As at As at<br />

March 31, 2012 March 31, 2011<br />

(` in Lacs) (` in Lacs)<br />

4. Deferred tax<br />

Deferred tax liabilities<br />

Difference between book depreciation and depreciation under<br />

the Income Tax Act, 1961<br />

Deferred tax assets<br />

420.58 459.95<br />

On Unabsorbed depreciation as per Income Tax Act, 1961 682.58 577.45<br />

On Disallowance u/s 43B of the Income Tax Act, 1961 159.24 216.35<br />

On VRS cost u/s 35 DDA of the Income Tax Act, 1961 1,456.72 764.44<br />

On Provision for doubtful debts 152.94 156.59<br />

On Long-term capital loss as per Income Tax Act, 1961 223.10 261.63<br />

On Business loss as per Income Tax Act, 1961 2,765.04 1,874.18<br />

5,439.62 3,850.64<br />

Net deferred tax asset 420.58 459.95<br />

Deferred tax asset (net) recognised *<br />

*Deferred tax asset has been recognised only to the extent of the deferred<br />

tax liabilities as this amount is considered to be virtually certain of realisation.<br />

— —<br />

5. Other long-term liabilities<br />

Security deposit received from holding company 5,000.00 —<br />

Premium on zero coupon preference shares* 441.68 0.27<br />

Rent payable 211.00 172.08<br />

* Premium is payable to <strong>ITC</strong> Limited (holding company effective<br />

September 29, 2011, was the ultimate holding company in 2010-11).<br />

5,652.68 172.35<br />

6. Long-term provisions<br />

Provisions for employee benefits (see note 25)<br />

Provision for leave encashment 87.97 84.53<br />

87.97 84.53<br />

7. Short-term borrowings<br />

Unsecured :<br />

Short-term loans and advances from related parties<br />

Pavan Poplar Limited (wholly-owned subsidiary) 25.84 23.30<br />

25.84 23.30<br />

8. Trade payables<br />

Total outstanding dues of micro enterprises and small enterprises (see note 36) — —<br />

Total outstanding dues of creditors other than micro enterprises and small enterprises 4,093.59 4,628.04<br />

9. Other current liabilities<br />

4,093.59 4,628.04<br />

Interest accrued but not due on deposits 8.41 8.70<br />

Advances from customers 83.96 131.94<br />

Deposit from customers 45.06 59.57<br />

Employee benefits payable 206.68 295.43<br />

Statutory dues payable* 74.07 155.86<br />

Rent payable 9.46 6.17<br />

*Statutory dues payable include<br />

427.64 657.67<br />

Wealth tax and withholding taxes 49.69 61.55<br />

Excise duty, custom duty and service tax 12.31 44.60<br />

VAT and Others 12.07 49.71<br />

74.07 155.86<br />

10. Short-term provisions<br />

WIMCO LIMITED<br />

Provisions for employee benefits (See Note 25)<br />

Provision for gratuity 87.77 249.22<br />

Provision for leave encashment 1.94 1.29<br />

89.71 250.51<br />

29