SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RUSSELL CREDIT LIMITED<br />

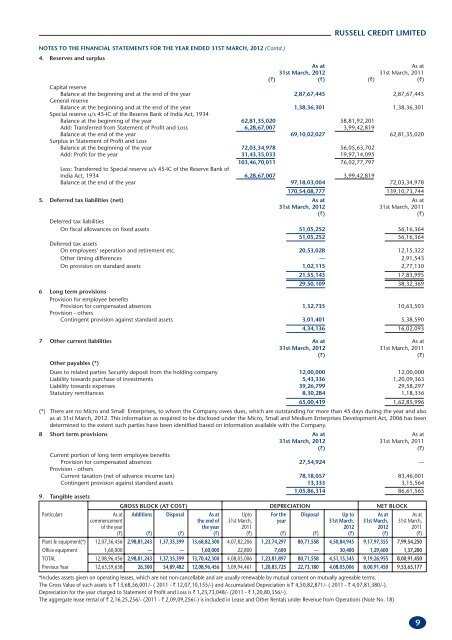

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST MARCH, 2012 (Contd.)<br />

4. Reserves and surplus<br />

As at As at<br />

31st March, 2012 31st March, 2011<br />

(`) (`) (`) (`)<br />

Capital reserve<br />

Balance at the beginning and at the end of the year<br />

General reserve<br />

2,87,67,445 2,87,67,445<br />

Balance at the beginning and at the end of the year<br />

Special reserve u/s 45-IC of the Reserve Bank of India Act, 1934<br />

1,38,36,301 1,38,36,301<br />

Balance at the beginning of the year 62,81,35,020 58,81,92,201<br />

Add: Transferred from Statement of Profit and Loss 6,28,67,007 3,99,42,819<br />

Balance at the end of the year<br />

Surplus in Statement of Profit and Loss<br />

69,10,02,027 62,81,35,020<br />

Balance at the beginning of the year 72,03,34,978 56,05,63,702<br />

Add: Profit for the year 31,43,35,033 19,97,14,095<br />

Less: Transferred to Special reserve u/s 45-IC of the Reserve Bank of<br />

103,46,70,011 76,02,77,797<br />

India Act, 1934 6,28,67,007 3,99,42,819<br />

Balance at the end of the year 97,18,03,004 72,03,34,978<br />

170,54,08,777 139,10,73,744<br />

5. Deferred tax liabilities (net) As at As at<br />

31st March, 2012 31st March, 2011<br />

Deferred tax liabilities<br />

(`) (`)<br />

On fiscal allowances on fixed assets 51,05,252 56,16,364<br />

Deferred tax assets<br />

51,05,252 56,16,364<br />

On employees' seperation and retirement etc. 20,53,028 12,15,322<br />

Other timing differences — 2,91,543<br />

On provision on standard assets 1,02,115 2,77,130<br />

21,55,143 17,83,995<br />

29,50,109 38,32,369<br />

6 Long term provisions<br />

Provision for employee benefits<br />

Provision for compensated absences<br />

Provision - others<br />

1,32,735 10,63,503<br />

Contingent provision against standard assets 3,01,401 5,38,590<br />

4,34,136 16,02,093<br />

7 Other current liabilities As at As at<br />

31st March, 2012 31st March, 2011<br />

Other payables (*)<br />

(`) (`)<br />

Dues to related parties Security deposit from the holding company 12,00,000 12,00,000<br />

Liability towards purchase of investments 5,43,336 1,20,09,363<br />

Liability towards expenses 39,26,799 29,58,297<br />

Statutory remittances 8,30,284 1,18,336<br />

65,00,419 1,62,85,996<br />

(*) There are no Micro and Small Enterprises, to whom the Company owes dues, which are outstanding for more than 45 days during the year and also<br />

as at 31st March, 2012. This information as required to be disclosed under the Micro, Small and Medium Enterprises Development Act, 2006 has been<br />

determined to the extent such parties have been identified based on information available with the Company.<br />

8 Short term provisions As at As at<br />

31st March, 2012 31st March, 2011<br />

Current portion of long term employee benefits<br />

(`) (`)<br />

Provision for compensated absences<br />

Provision - others<br />

27,54,924 —<br />

Current taxation (net of advance income tax) 78,18,057 83,46,001<br />

Contingent provision against standard assets 13,333 3,15,564<br />

9. Tangible assets<br />

1,05,86,314 86,61,565<br />

GROSS BLOCK (AT COST) DEPRECIATION NET BLOCK<br />

Particulars As at Additions Disposal As at Upto For the Disposal Up to As at As at<br />

commencement the end of 31st March, year 31st March, 31st March, 31st March,<br />

of the year the year 2011 2012 2012 2011<br />

(`) (`) (`) (`) (`) (`) (`) (`) (`) (`)<br />

Plant & equipment(*) 12,07,36,456 2,98,81,243 1,37,35,399 13,68,82,300 4,07,82,206 1,23,74,297 80,71,558 4,50,84,945 9,17,97,355 7,99,54,250<br />

Office equipment 1,60,000 — — 1,60,000 22,800 7,600 — 30,400 1,29,600 1,37,200<br />

TOTAL 12,08,96,456 2,98,81,243 1,37,35,399 13,70,42,300 4,08,05,006 1,23,81,897 80,71,558 4,51,15,345 9,19,26,955 8,00,91,450<br />

Previous Year 12,63,59,638 26,300 54,89,482 12,08,96,456 3,09,94,461 1,20,83,725 22,73,180 4,08,05,006 8,00,91,450 9,53,65,177<br />

*Includes assets given on operating leases, which are not non-cancellable and are usually renewable by mutual consent on mutually agreeable terms.<br />

The Gross Value of such assets is ` 13,68,56,001/- ( 2011 - ` 12,07,10,155/-) and Accumulated Depreciation is ` 4,50,82,871/- ( 2011 - ` 4,07,81,380/-).<br />

Depreciation for the year charged to Statement of Profit and Loss is ` 1,23,73,048/- (2011 - ` 1,20,80,356/-).<br />

The aggregate lease rental of ` 2,16,25,256/- (2011 - ` 2,09,09,256/-) is included in Lease and Other Rentals under Revenue from Operations (Note No. 18)<br />

9