SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNEXURE TO THE AUDITORS’ REPORT<br />

[Referred to in paragraph 3 thereof]<br />

In our opinion and according to the information and explanations given to<br />

us, the nature of the Company’s business/activities during the year are such<br />

that clauses 4(ii), (iii), (v), (vi), (viii), (x), (xi), (xii), (xiii), (xv), (xvi), (xviii),<br />

(xix) and (xx) of Companies (Auditor’s Report) Order 2003, are not applicable<br />

to the Company. In respect of the other clauses, we report as under:<br />

(i) In respect of its fixed assets:<br />

(a) The Company has maintained proper records showing full particulars,<br />

including quantitative details and situation of the fixed assets.<br />

(b) The fixed assets were physically verified during the year by the<br />

Management in accordance with a regular programme of<br />

verification, which, in our opinion, provides for physical verification<br />

of all the fixed assets at reasonable intervals. According to the<br />

information and explanations given to us, no material discrepancies<br />

were noticed on such verification.<br />

(c) During the year, in our opinion, a substantial part of fixed assets<br />

has not been disposed off by the Company.<br />

(ii) In our opinion and according to the information and explanations<br />

given to us, there are adequate internal control systems commensurate<br />

with the size of the Company and the nature of its business for the<br />

purchase of fixed assets and for the sale of services. Further, on the<br />

basis of our examination and according to the information and<br />

explanations given to us, we have neither come across nor have we<br />

been informed of any instance of major weaknesses in the aforesaid<br />

internal control systems.<br />

(iii) In our opinion, the Company has an internal audit system commensurate<br />

with the size of the Company and the nature of its business.<br />

(iv) (a) According to the information and explanations given to us and<br />

according to the books and records as produced and examined<br />

by us, in our opinion, the Company is regular in depositing<br />

undisputed statutory dues including provident fund, income-tax,<br />

sales tax, service tax, cess and other material statutory dues as<br />

applicable with the appropriate authorities.<br />

(b) As at 31st March, 2012, according to the records of the Company<br />

and the information and explanations given to us, there were no<br />

dues on account of income-tax, service tax and cess which have<br />

not been deposited on account of any dispute. The particulars of<br />

RUSSELL CREDIT LIMITED<br />

dues relating to sales tax that have not been deposited on account<br />

of any dispute are given below:<br />

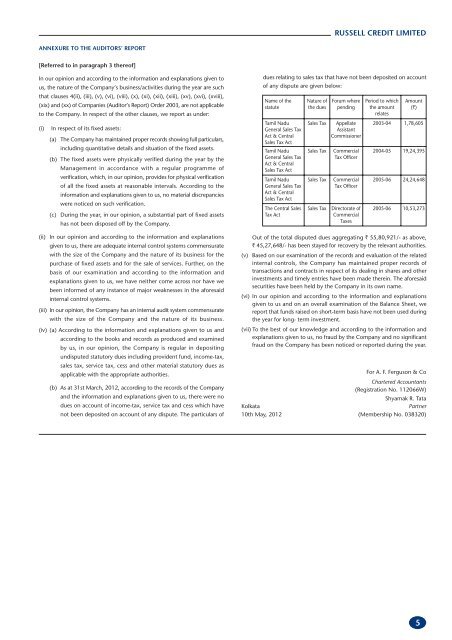

Name of the Nature of Forum where Period to which Amount<br />

statute the dues pending the amount<br />

relates<br />

(`)<br />

Tamil Nadu Sales Tax Appellate 2003-04 1,78,605<br />

General Sales Tax Assistant<br />

Act & Central<br />

Sales Tax Act<br />

Commissioner<br />

Tamil Nadu Sales Tax Commercial 2004-05 19,24,395<br />

General Sales Tax<br />

Act & Central<br />

Sales Tax Act<br />

Tax Officer<br />

Tamil Nadu Sales Tax Commercial 2005-06 24,24,648<br />

General Sales Tax<br />

Act & Central<br />

Sales Tax Act<br />

Tax Officer<br />

The Central Sales Sales Tax Directorate of 2005-06 10,53,273<br />

Tax Act Commercial<br />

Taxes<br />

Out of the total disputed dues aggregating ` 55,80,921/- as above,<br />

` 45,27,648/- has been stayed for recovery by the relevant authorities.<br />

(v) Based on our examination of the records and evaluation of the related<br />

internal controls, the Company has maintained proper records of<br />

transactions and contracts in respect of its dealing in shares and other<br />

investments and timely entries have been made therein. The aforesaid<br />

securities have been held by the Company in its own name.<br />

(vi) In our opinion and according to the information and explanations<br />

given to us and on an overall examination of the Balance Sheet, we<br />

report that funds raised on short-term basis have not been used during<br />

the year for long- term investment.<br />

(vii) To the best of our knowledge and according to the information and<br />

explanations given to us, no fraud by the Company and no significant<br />

fraud on the Company has been noticed or reported during the year.<br />

For A. F. Ferguson & Co<br />

Chartered Accountants<br />

(Registration No. 112066W)<br />

Shyamak R. Tata<br />

Kolkata Partner<br />

10th May, 2012 (Membership No. 038320)<br />

5