6 RUSSELL CREDIT LIMITED BALANCE SHEET AS AT 31ST MARCH, 2012 Note As at As at 31st March, 2012 31st March, 2011 (`) (`) (`) (`) I. Equity and Liability 1. Shareholders' Funds a) Share capital 3 646,47,87,370 646,47,87,370 b) Reserves and surplus 4 170,54,08,777 817,01,96,147 139,10,73,744 785,58,61,114 2. Non-current liabilities a) Deferred tax liabilities (net) 5 29,50,109 38,32,369 b) Long term provisions 6 4,34,136 33,84,245 16,02,093 54,34,462 3. Current liabilities a) Other current liabilities 7 65,00,419 1,62,85,996 b) Short term provisions 8 1,05,86,314 1,70,86,733 86,61,565 2,49,47,561 Total 819,06,67,125 788,62,43,137 II. Assets 1. Non-current assets (a) Fixed assets i) Tangible assets 9 9,19,26,955 8,00,91,450 ii) Capital work-in-progress 5,15,38,885 — 14,34,65,840 8,00,91,450 (b) Non-current investments 10 150,21,02,353 436,92,14,563 (c) Long term loans and advances 11 2,91,00,583 167,46,68,776 13,91,61,977 458,84,67,990 2. Current assets (a) Current portion of long term investment 12 — 55,00,00,000 (b) Inventories 13 542,06,71,521 257,05,24,808 (c) Trade receivables 14 1,05,78,077 2,89,29,010 (d) Cash and cash equivalents 15 107,69,44,146 32,37,843 (e) Short-term loans and advances 16 77,17,428 14,49,73,533 (f) Other current assets 17 87,177 651,59,98,349 1,09,953 329,77,75,147 Total 819,06,67,125 788,62,43,137 The accompanying notes 1 to 24 are an integral part of the financial statements In terms of our report of even date For A. F. Ferguson & Co. Chartered Accountants Shyamak R. Tata Partner Kolkata, 10th May, 2012 On behalf of the Board R. Tandon Director S. Dutta Director S. Jain Manager & Secretary STATEMENT OF PROFIT AND LOSS FOR THE YEAR ENDED 31ST MARCH, 2012 Note For the year ended For the year ended 31st March, 2012 31st March, 2011 (`) (`) I Revenue from operations 18 40,24,70,536 27,09,14,216 II Other income 19 33,79,025 62,82,188 III Total revenue 40,58,49,561 27,71,96,404 IV Expenses Employee benefits expense 20 1,56,58,832 1,56,07,205 Finance cost 21 806 40,41,236 Depreciation expense 9 1,23,81,897 1,20,83,725 Other expenses 22 43,56,166 1,94,83,245 Total expenditure 3,23,97,701 5,12,15,411 V Profit before tax 37,34,51,860 22,59,80,993 VI Tax expense: Current tax 23 5,99,99,087 2,76,31,424 Deferred tax 23 (8,82,260) (13,64,526) VII Profit for the year 31,43,35,033 19,97,14,095 Earnings per share (Face value ` 10/- each) 24(6) 0.49 0.31 (Basic and Diluted) The accompanying notes 1 to 24 are an integral part of the financial statements In terms of our report of even date For A. F. Ferguson & Co. Chartered Accountants Shyamak R. Tata Partner Kolkata, 10th May, 2012 On behalf of the Board R. Tandon Director S. Dutta Director S. Jain Manager & Secretary

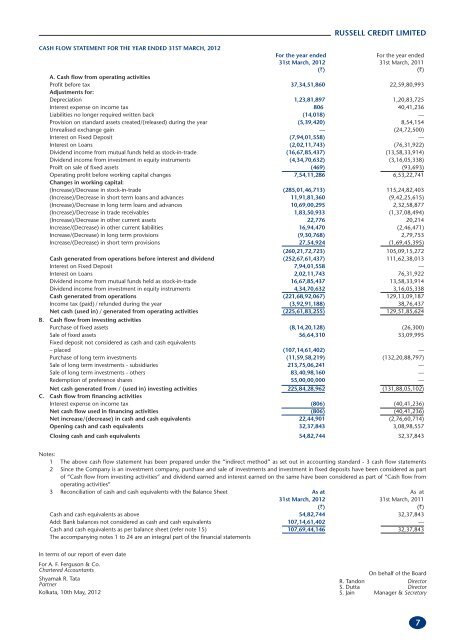

RUSSELL CREDIT LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED 31ST MARCH, 2012 For the year ended For the year ended 31st March, 2012 31st March, 2011 (`) (`) A. Cash flow from operating activities Profit before tax Adjustments for: 37,34,51,860 22,59,80,993 Depreciation 1,23,81,897 1,20,83,725 Interest expense on income tax 806 40,41,236 Liabilities no longer required written back (14,018) — Provision on standard assets created/(released) during the year (5,39,420) 8,54,154 Unrealised exchange gain — (24,72,500) Interest on Fixed Deposit (7,94,01,558) — Interest on Loans (2,02,11,743) (76,31,922) Dividend income from mutual funds held as stock-in-trade (16,67,85,437) (13,58,33,914) Dividend income from investment in equity instruments (4,34,70,632) (3,16,05,338) Proift on sale of fixed assets (469) (93,693) Operating profit before working capital changes Changes in working capital: 7,54,11,286 6,53,22,741 (Increase)/Decrease in stock-in-trade (285,01,46,713) 115,24,82,403 (Increase)/Decrease in short term loans and advances 11,91,81,360 (9,42,25,615) (Increase)/Decrease in long term loans and advances 10,69,00,295 2,32,58,877 (Increase)/Decrease in trade receivables 1,83,50,933 (1,37,08,494) (Increase)/Decrease in other current assets 22,776 20,214 Increase/(Decrease) in other current liabilities 16,94,470 (2,46,471) Increase/(Decrease) in long term provisions (9,30,768) 2,79,753 Increase/(Decrease) in short term provisions 27,54,924 (1,69,45,395) (260,21,72,723) 105,09,15,272 Cash generated from operations before interest and dividend (252,67,61,437) 111,62,38,013 Interest on Fixed Deposit 7,94,01,558 — Interest on Loans 2,02,11,743 76,31,922 Dividend income from mutual funds held as stock-in-trade 16,67,85,437 13,58,33,914 Dividend income from investment in equity instruments 4,34,70,632 3,16,05,338 Cash generated from operations (221,68,92,067) 129,13,09,187 Income tax (paid) / refunded during the year (3,92,91,188) 38,76,437 Net cash (used in) / generated from operating activities (225,61,83,255) 129,51,85,624 B. Cash flow from investing activities Purchase of fixed assets (8,14,20,128) (26,300) Sale of fixed assets Fixed deposit not considered as cash and cash equivalents 56,64,310 33,09,995 – placed (107,14,61,402) — Purchase of long term investments (11,59,58,219) (132,20,88,797) Sale of long term investments - subsidiaries 213,75,06,241 — Sale of long term investments - others 83,40,98,160 — Redemption of preference shares 55,00,00,000 — Net cash generated from / (used in) investing activities 225,84,28,962 (131,88,05,102) C. Cash flow from financing activities Interest expense on income tax (806) (40,41,236) Net cash flow used in financing activities (806) (40,41,236) Net increase/(decrease) in cash and cash equivalents 22,44,901 (2,76,60,714) Opening cash and cash equivalents 32,37,843 3,08,98,557 Closing cash and cash equivalents 54,82,744 32,37,843 Notes: 1 The above cash flow statement has been prepared under the “indirect method” as set out in accounting standard - 3 cash flow statements 2 Since the Company is an investment company, purchase and sale of investments and investment in fixed deposits have been considered as part of “Cash flow from investing activities” and dividend earned and interest earned on the same have been considered as part of “Cash flow from operating activities” 3 Reconciliation of cash and cash equivalents with the Balance Sheet As at As at 31st March, 2012 31st March, 2011 (`) (`) Cash and cash equivalents as above 54,82,744 32,37,843 Add: Bank balances not considered as cash and cash equivalents 107,14,61,402 — Cash and cash equivalents as per balance sheet (refer note 15) 107,69,44,146 32,37,843 The accompanying notes 1 to 24 are an integral part of the financial statements In terms of our report of even date For A. F. Ferguson & Co. Chartered Accountants Shyamak R. Tata Partner Kolkata, 10th May, 2012 On behalf of the Board R. Tandon Director S. Dutta Director S. Jain Manager & Secretary 7

- Page 1: SUBSIDIARY COMPANIES Russell Credit

- Page 4 and 5: ANNEXURE TO THE REPORT OF THE DIREC

- Page 8 and 9: NOTES TO THE FINANCIAL STATEMENTS F

- Page 10 and 11: NOTES TO THE FINANCIAL STATEMENTS F

- Page 12 and 13: NOTES TO THE FINANCIAL STATEMENTS F

- Page 14 and 15: NOTES TO THE FINANCIAL STATEMENTS F

- Page 16 and 17: ANNEXURE TO THE AUDITORS’ REPORT

- Page 18 and 19: NOTES TO THE FINANCIAL STATEMENTS F

- Page 20 and 21: NOTES TO THE FINANCIAL STATEMENTS F

- Page 22 and 23: DIRECTORS’ REPORT TO THE MEMBERS

- Page 24 and 25: to its bankers. The Company did not

- Page 26 and 27: CASH FLOW STATEMENT FOR THE YEAR EN

- Page 28 and 29: NOTES TO THE ACCOUNTS As at As at M

- Page 30 and 31: NOTES TO THE ACCOUNTS 11. Fixed ass

- Page 32 and 33: NOTES TO THE ACCOUNTS Year Ended Ye

- Page 34 and 35: NOTES TO THE ACCOUNTS 26. Finance c

- Page 36 and 37: NOTES TO THE ACCOUNTS 5. Transactio

- Page 38 and 39: NOTES TO THE ACCOUNTS 43 - Signific

- Page 40 and 41: DIRECTORS’ REPORT TO THE MEMBERS

- Page 42 and 43: (vii) In our opinion, the Company h

- Page 44 and 45: NOTES TO THE ACCOUNTS 1. Share capi

- Page 46 and 47: 23. Significant accounting policies

- Page 48 and 49: of services. We have not observed a

- Page 50 and 51: NOTES TO THE ACCOUNTS As at As at M

- Page 52 and 53: NOTES TO THE ACCOUNTS 21. Segment i

- Page 54 and 55: DIRECTORS’ REPORT FOR THE YEAR EN

- Page 56 and 57:

56 TECHNICO PTY LIMITED BALANCE SHE

- Page 58 and 59:

(c) Foreign currency translation Th

- Page 60 and 61:

60 TECHNICO PTY LIMITED NOTES TO AN

- Page 62 and 63:

NOTES TO AND FORMING PART OF FINANC

- Page 64 and 65:

NOTES TO AND FORMING PART OF FINANC

- Page 66 and 67:

BALANCE SHEET AS AT MARCH 31, 2012

- Page 68 and 69:

5. Liquidity Risk Liquidity risk is

- Page 70 and 71:

ANNEXURE TO THE REPORT OF DIRECTORS

- Page 72 and 73:

CASH FLOW STATEMENT FOR THE YEAR EN

- Page 74 and 75:

74 TECHNICO AGRI SCIENCES LIMITED N

- Page 76 and 77:

Notes to financial statements for t

- Page 78 and 79:

NOTES TO FINANCIAL STATEMENTS FOR T

- Page 80 and 81:

Notes to financial statements for t

- Page 82 and 83:

DIRECTORS’ REPORT FOR THE YEAR EN

- Page 84 and 85:

84 TECHNICO ASIA HOLDINGS PTY LIMIT

- Page 86 and 87:

Note 4: Trade and other payables 20

- Page 88 and 89:

BALANCE SHEET AS ON 31st DECEMBER 2

- Page 90 and 91:

INCOME AND PROFIT DISTRIBUTION STAT

- Page 92 and 93:

NOTES TO FINANCIAL STATEMENTS 1. Br

- Page 94 and 95:

NOTES TO FINANCIAL STATEMENTS (Cont

- Page 96 and 97:

ANNEXURE TO AUDITORS’ REPORT (con

- Page 98 and 99:

NOTES TO THE FINANCIAL STATEMENTS 1

- Page 100 and 101:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 102 and 103:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 104 and 105:

14. The Board of Directors of the C

- Page 106 and 107:

BALANCE SHEET As at March 31, 2012

- Page 108 and 109:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 110 and 111:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 112 and 113:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 114 and 115:

22. There were no transactions nece

- Page 116 and 117:

STATEMENT OF PROFIT AND LOSS FOR TH

- Page 118 and 119:

NOTES TO THE ACCOUNTS (Contd.) For

- Page 120 and 121:

adequate accounting records in acco

- Page 122 and 123:

given to us, the Company has not gi

- Page 124 and 125:

NOTES TO THE FINANCIAL STATEMENTS N

- Page 126 and 127:

14 CASH AND BANK BALANCES Cash and

- Page 128 and 129:

128 ITC INFOTECH INDIA LIMITED IX.

- Page 130 and 131:

REPORT OF THE DIRECTORS Your Direct

- Page 132 and 133:

132 ITC INFOTECH LIMITED CASH FLOW

- Page 134 and 135:

Unaudited Unaudited 2012 2012 2011

- Page 136 and 137:

17. Reconciliation of movements in

- Page 138 and 139:

138 ITC INFOTECH (USA), INC. BALANC

- Page 140 and 141:

NOTES TO THE FINANCIAL STATEMENTS M

- Page 142 and 143:

NOTE F - INTANGIBLE ASSETS The Comp

- Page 144 and 145:

144 PYXIS SOLUTIONS, LLC. USA STATE

- Page 146 and 147:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 148 and 149:

ANNEXURE TO THE AUDITORS' REPORT TO

- Page 150 and 151:

NOTES TO THE FINANCIAL STATEMENTS N

- Page 152 and 153:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 154 and 155:

REPORT OF THE DIRECTORS FOR THE FIN

- Page 156 and 157:

156 GOLD FLAKE CORPORATION LIMITED

- Page 158 and 159:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 160 and 161:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 162 and 163:

162 together with the notes thereon

- Page 164 and 165:

CASH FLOW STATEMENT FOR THE YEAR EN

- Page 166 and 167:

NOTES TO THE ACCOUNTS (Contd.) As a

- Page 168 and 169:

NOTES TO THE ACCOUNTS (Contd.) As a

- Page 170 and 171:

NOTES TO THE ACCOUNTS (Contd.) Esti

- Page 172 and 173:

NOTES TO THE ACCOUNTS (Contd.) 172

- Page 174 and 175:

REPORT OF THE DIRECTORS FOR THE FIN

- Page 176 and 177:

BALANCE SHEET (All amounts in `, un

- Page 178 and 179:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 180 and 181:

NOTES TO THE FINANCIAL STATEMENTS (

- Page 182 and 183:

REPORT OF THE DIRECTORS FOR THE FIN

- Page 184 and 185:

184 MRR TRADING & INVESTMENT COMPAN

- Page 186 and 187:

REPORT OF THE DIRECTORS FOR THE FIN

- Page 188 and 189:

Annexure I Sl. No. Name of Director

- Page 190 and 191:

PROFIT AND LOSS ACCOUNT FOR THE YEA

- Page 192 and 193:

STATEMENT OF CHANGE IN EQUITY FOR T

- Page 194 and 195:

194 SURYA NEPAL PRIVATE LIMITED SCH

- Page 196 and 197:

196 SURYA NEPAL PRIVATE LIMITED SCH

- Page 198 and 199:

SCHEDULES TO THE ACCOUNTS (Contd.)

- Page 200 and 201:

STATEMENTS OF CASH FLOWS YEAR ENDED

- Page 202:

NOTE 12 - INCOME TAXES Income taxes