SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

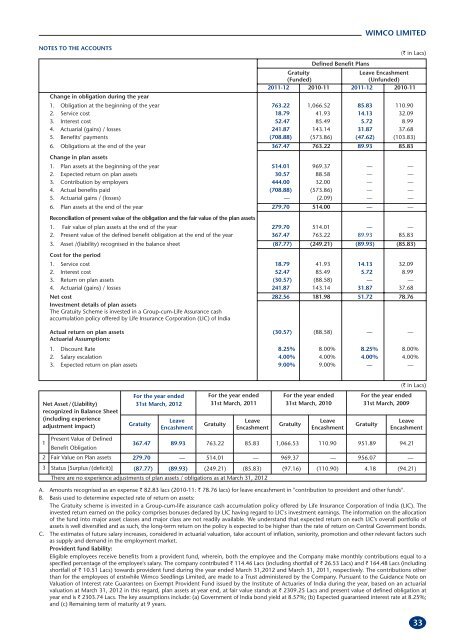

NOTES TO THE ACCOUNTS<br />

Net Asset/(Liability)<br />

recognized in Balance Sheet<br />

(including experience<br />

adjustment impact)<br />

1<br />

2<br />

3<br />

For the year ended<br />

31st March, 2012<br />

Gratuity<br />

Leave<br />

Encashment<br />

For the year ended<br />

31st March, 2011<br />

Gratuity<br />

Leave<br />

Encashment<br />

For the year ended<br />

31st March, 2010<br />

Gratuity<br />

Leave<br />

Encashment<br />

WIMCO LIMITED<br />

For the year ended<br />

31st March, 2009<br />

Gratuity<br />

Leave<br />

Encashment<br />

Present Value of Defined<br />

Benefit Obligation<br />

367.47 89.93 763.22 85.83 1,066.53 110.90 951.89 94.21<br />

Fair Value on Plan assets 279.70 — 514.01 — 969.37 — 956.07 —<br />

Status [Surplus/(deficit)] (87.77) (89.93) (249.21) (85.83) (97.16) (110.90) 4.18 (94.21)<br />

There are no experience adjustments of plan assets / obligations as at March 31, 2012<br />

(` in Lacs)<br />

Gratuity<br />

Defined Benefit Plans<br />

Leave Encashment<br />

(Funded) (Unfunded)<br />

2011-12 2010-11 2011-12 2010-11<br />

Change in obligation during the year<br />

1. Obligation at the beginning of the year 763.22 1,066.52 85.83 110.90<br />

2. Service cost 18.79 41.93 14.13 32.09<br />

3. Interest cost 52.47 85.49 5.72 8.99<br />

4. Actuarial (gains) / losses 241.87 143.14 31.87 37.68<br />

5. Benefits’ payments (708.88) (573.86) (47.62) (103.83)<br />

6. Obligations at the end of the year<br />

Change in plan assets<br />

367.47 763.22 89.93 85.83<br />

1. Plan assets at the beginning of the year 514.01 969.37 — —<br />

2. Expected return on plan assets 30.57 88.58 — —<br />

3. Contribution by employers 444.00 32.00 — —<br />

4. Actual benefits paid (708.88) (573.86) — —<br />

5. Actuarial gains / (losses) — (2.09) — —<br />

6. Plan assets at the end of the year<br />

Reconciliation of present value of the obligation and the fair value of the plan assets<br />

279.70 514.00 — —<br />

1. Fair value of plan assets at the end of the year 279.70 514.01 — —<br />

2. Present value of the defined benefit obligation at the end of the year 367.47 763.22 89.93 85.83<br />

3. Asset /(liability) recognised in the balance sheet<br />

Cost for the period<br />

(87.77) (249.21) (89.93) (85.83)<br />

1. Service cost 18.79 41.93 14.13 32.09<br />

2. Interest cost 52.47 85.49 5.72 8.99<br />

3. Return on plan assets (30.57) (88.58) — —<br />

4. Actuarial (gains) / losses 241.87 143.14 31.87 37.68<br />

Net cost<br />

Investment details of plan assets<br />

The Gratuity Scheme is invested in a Group-cum-Life Assurance cash<br />

accumulation policy offered by Life Insurance Corporation (LIC) of India<br />

282.56 181.98 51.72 78.76<br />

Actual return on plan assets<br />

Actuarial Assumptions:<br />

(30.57) (88.58) — —<br />

1. Discount Rate 8.25% 8.00% 8.25% 8.00%<br />

2. Salary escalation 4.00% 4.00% 4.00% 4.00%<br />

3. Expected return on plan assets 9.00% 9.00% — —<br />

(` in Lacs)<br />

A. Amounts recognised as an expense ` 82.83 lacs (2010-11: ` 78.76 lacs) for leave encashment in "contribution to provident and other funds".<br />

B. Basis used to determine expected rate of return on assets:<br />

The Gratuity scheme is invested in a Group-cum-life assurance cash accumulation policy offered by Life Insurance Corporation of India (LIC). The<br />

invested return earned on the policy comprises bonuses declared by LIC having regard to LIC's investment earnings. The information on the allocation<br />

of the fund into major asset classes and major class are not readily available. We understand that expected return on each LIC's overall portfolio of<br />

assets is well diversified and as such, the long-term return on the policy is expected to be higher than the rate of return on Central Government bonds.<br />

C. The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other relevant factors such<br />

as supply and demand in the employment market.<br />

Provident fund liability:<br />

Eligible employees receive benefits from a provident fund, wherein, both the employee and the Company make monthly contributions equal to a<br />

specified percentage of the employee's salary. The company contributed ` 114.46 Lacs (including shortfall of ` 26.53 Lacs) and ` 164.48 Lacs (including<br />

shortfall of ` 10.51 Lacs) towards provident fund during the year ended March 31,2012 and March 31, 2011, respectively. The contributions other<br />

than for the employees of erstwhile Wimco Seedlings Limited, are made to a Trust administered by the Company. Pursuant to the Guidance Note on<br />

Valuation of Interest rate Guarantees on Exempt Provident Fund issued by the Institute of Actuaries of India during the year, based on an actuarial<br />

valuation at March 31, 2012 in this regard, plan assets at year end, at fair value stands at ` 2309.25 Lacs and present value of defined obligation at<br />

year end is ` 2303.74 Lacs. The key assumptions include: (a) Government of India bond yield at 8.57%; (b) Expected guaranteed interest rate at 8.25%;<br />

and (c) Remaining term of maturity at 9 years.<br />

33