SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

SUBSIDIARY COMPANIES - ITC Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE ACCOUNTS<br />

30. Related party disclosures<br />

1. Parties exercising control over the Company:<br />

Related Party Relationship<br />

<strong>ITC</strong> Limited Holding company effective September<br />

29, 2011, was the ultimate holding<br />

company in 2010-11<br />

Russell Credit Limited Fellow subsidiary, was the holding<br />

company of Wimco Limited till<br />

September 28, 2011<br />

WIMCO LIMITED<br />

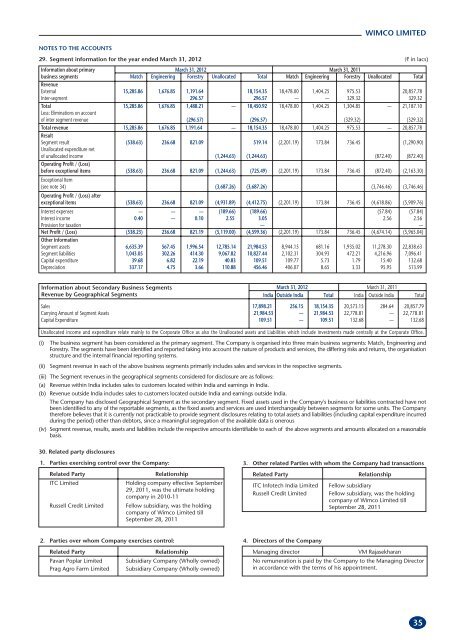

29. Segment information for the year ended March 31, 2012 (` in lacs)<br />

Information about primary March 31, 2012 March 31, 2011<br />

business segments<br />

Revenue<br />

Match Engineering Forestry Unallocated Total Match Engineering Forestry Unallocated Total<br />

External 15,285.86 1,676.85 1,191.64 18,154.35 18,478.00 1,404.25 975.53 20,857.78<br />

Inter-segment 296.57 296.57 — — 329.32 329.32<br />

Total<br />

Less: Eliminations on account<br />

15,285.86 1,676.85 1,488.21 — 18,450.92 18,478.00 1,404.25 1,304.85 — 21,187.10<br />

of inter segment revenue (296.57) (296.57) (329.32) (329.32)<br />

Total revenue<br />

Result<br />

15,285.86 1,676.85 1,191.64 — 18,154.35 18,478.00 1,404.25 975.53 — 20,857.78<br />

Segment result<br />

Unallocated expenditure net<br />

(538.63) 236.68 821.09 519.14 (2,201.19) 173.84 736.45 (1,290.90)<br />

of unallocated income<br />

Operating Profit / (Loss)<br />

(1,244.63) (1,244.63) (872.40) (872.40)<br />

before exceptional items<br />

Exceptional Item<br />

(538.63) 236.68 821.09 (1,244.63) (725.49) (2,201.19) 173.84 736.45 (872.40) (2,163.30)<br />

(see note 34)<br />

Operating Profit / (Loss) after<br />

(3,687.26) (3,687.26) (3,746.46) (3,746.46)<br />

exceptional items (538.63) 236.68 821.09 (4,931.89) (4,412.75) (2,201.19) 173.84 736.45 (4,618.86) (5,909.76)<br />

Interest expenses — — — (189.66) (189.66) (57.84) (57.84)<br />

Interest income 0.40 — 0.10 2.55 3.05 2.56 2.56<br />

Provision for taxation — —<br />

Net Profit / (Loss)<br />

Other Information<br />

(538.23) 236.68 821.19 (5,119.00) (4,599.36) (2,201.19) 173.84 736.45 (4,674.14) (5,965.04)<br />

Segment assets 6,635.39 567.45 1,996.54 12,785.14 21,984.53 8,944.15 681.16 1,935.02 11,278.30 22,838.63<br />

Segment liabilities 1,043.05 302.26 414.30 9,067.82 10,827.44 2,102.31 304.93 472.21 4,216.96 7,096.41<br />

Capital expenditure 39.68 6.82 22.19 40.83 109.51 109.77 5.73 1.79 15.40 132.68<br />

Depreciation 337.17 4.75 3.66 110.88 456.46 406.07 8.65 3.33 95.95 513.99<br />

Information about Secondary Business Segments<br />

Revenue by Geographical Segments<br />

March 31, 2012 March 31, 2011<br />

India Outside India Total India Outside India Total<br />

Sales 17,898.21 256.15 18,154.35 20,573.15 284.64 20,857.79<br />

Carrying Amount of Segment Assets 21,984.53 — 21,984.53 22,778.81 — 22,778.81<br />

Capital Expenditure 109.51 — 109.51 132.68 — 132.68<br />

Unallocated income and expenditure relate mainly to the Corporate Office as also the Unallocated assets and Liabilities which include investments made centrally at the Corporate Office.<br />

(i) The business segment has been considered as the primary segment. The Company is organised into three main business segments: Match, Engineering and<br />

Forestry. The segments have been identified and reported taking into account the nature of products and services, the differing risks and returns, the organisation<br />

structure and the internal financial reporting systems.<br />

(ii) Segment revenue in each of the above business segments primarily includes sales and services in the respective segments.<br />

(iii) The Segment revenues in the geographical segments considered for disclosure are as follows:<br />

(a) Revenue within India includes sales to customers located within India and earnings in India.<br />

(b) Revenue outside India includes sales to customers located outside India and earnings outside India.<br />

The Company has disclosed Geographical Segment as the secondary segment. Fixed assets used in the Company's business or liabilities contracted have not<br />

been identified to any of the reportable segments, as the fixed assets and services are used interchangeably between segments for some units. The Company<br />

therefore believes that it is currently not practicable to provide segment disclosures relating to total assets and liabilities (including capital expenditure incurred<br />

during the period) other than debtors, since a meaningful segregation of the available data is onerous<br />

(iv) Segment revenue, results, assets and liabilities include the respective amounts identifiable to each of the above segments and amounts allocated on a reasonable<br />

basis.<br />

2. Parties over whom Company exercises control:<br />

Related Party Relationship<br />

Pavan Poplar Limited Subsidiary Company (Wholly owned)<br />

Prag Agro Farm Limited Subsidiary Company (Wholly owned)<br />

3. Other related Parties with whom the Company had transactions<br />

Related Party Relationship<br />

<strong>ITC</strong> Infotech India Limited Fellow subsidiary<br />

Russell Credit Limited Fellow subsidiary, was the holding<br />

company of Wimco Limited till<br />

September 28, 2011<br />

4. Directors of the Company<br />

Managing director VM Rajasekharan<br />

No remuneration is paid by the Company to the Managing Director<br />

in accordance with the terms of his appointment.<br />

35