Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

114 l <strong>Dialog</strong> Axiata PLC l <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes to the Financial Statements<br />

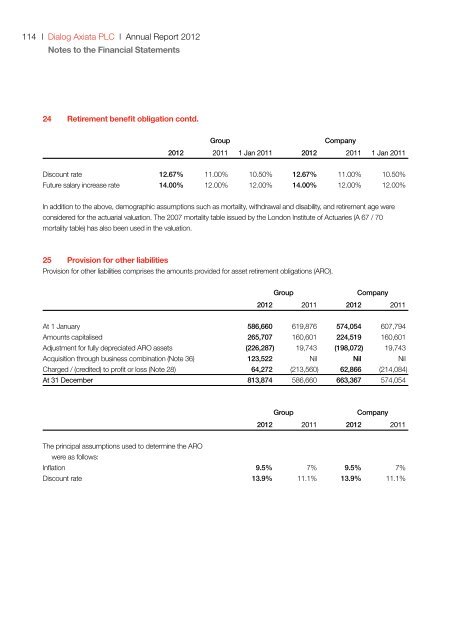

24 Retirement benefit obligation contd.<br />

Group Company<br />

<strong>2012</strong> 2011 1 Jan 2011 <strong>2012</strong> 2011 1 Jan 2011<br />

Discount rate 12.67% 11.00% 10.50% 12.67% 11.00% 10.50%<br />

Future salary increase rate 14.00% 12.00% 12.00% 14.00% 12.00% 12.00%<br />

In addition to the above, demographic assumptions such as mortality, withdrawal and disability, and retirement age were<br />

considered for the actuarial valuation. The 2007 mortality table issued by the London Institute of Actuaries (A 67 / 70<br />

mortality table) has also been used in the valuation.<br />

25 Provision for other liabilities<br />

Provision for other liabilities comprises the amounts provided for asset retirement obligations (ARO).<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

At 1 January 586,660 619,876 574,054 607,794<br />

Amounts capitalised 265,707 160,601 224,519 160,601<br />

Adjustment for fully depreciated ARO assets (226,287) 19,743 (198,072) 19,743<br />

Acquisition through business combination (Note 36) 123,522 Nil Nil Nil<br />

Charged / (credited) to profit or loss (Note 28) 64,272 (213,560) 62,866 (214,084)<br />

At 31 December 813,874 586,660 663,367 574,054<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

The principal assumptions used to determine the ARO<br />

were as follows:<br />

Inflation 9.5% 7% 9.5% 7%<br />

Discount rate 13.9% 11.1% 13.9% 11.1%

![nrypq;Nfh ,d;#ud;;]; nfhk;gdp ypkplw - Dialog](https://img.yumpu.com/15429071/1/190x245/nrypqnfh-dud-nfhkgdp-ypkplw-dialog.jpg?quality=85)