Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94 l <strong>Dialog</strong> Axiata PLC l <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes to the Financial Statements<br />

9 Intangible assets contd.<br />

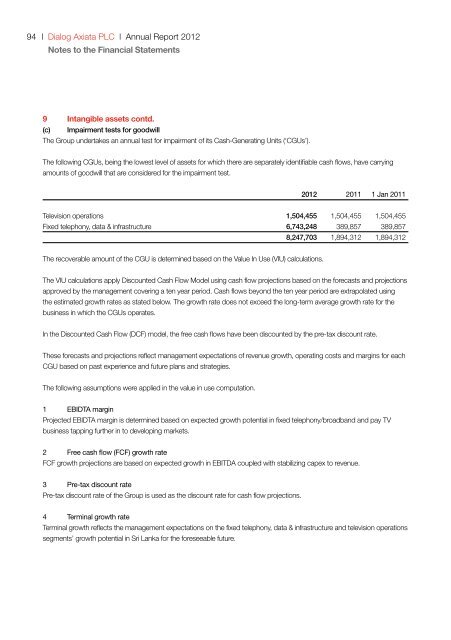

(c) Impairment tests for goodwill<br />

The Group undertakes an annual test for impairment of its Cash-Generating Units (‘CGUs’).<br />

The following CGUs, being the lowest level of assets for which there are separately identifiable cash flows, have carrying<br />

amounts of goodwill that are considered for the impairment test.<br />

<strong>2012</strong> 2011 1 Jan 2011<br />

Television operations 1,504,455 1,504,455 1,504,455<br />

Fixed telephony, data & infrastructure 6,743,248 389,857 389,857<br />

8,247,703 1,894,312 1,894,312<br />

The recoverable amount of the CGU is determined based on the Value In Use (VIU) calculations.<br />

The VIU calculations apply Discounted Cash Flow Model using cash flow projections based on the forecasts and projections<br />

approved by the management covering a ten year period. Cash flows beyond the ten year period are extrapolated using<br />

the estimated growth rates as stated below. The growth rate does not exceed the long-term average growth rate for the<br />

business in which the CGUs operates.<br />

In the Discounted Cash Flow (DCF) model, the free cash flows have been discounted by the pre-tax discount rate.<br />

These forecasts and projections reflect management expectations of revenue growth, operating costs and margins for each<br />

CGU based on past experience and future plans and strategies.<br />

The following assumptions were applied in the value in use computation.<br />

1 EBIDTA margin<br />

Projected EBIDTA margin is determined based on expected growth potential in fixed telephony/broadband and pay TV<br />

business tapping further in to developing markets.<br />

2 Free cash flow (FCF) growth rate<br />

FCF growth projections are based on expected growth in EBITDA coupled with stabilizing capex to revenue.<br />

3 Pre-tax discount rate<br />

Pre-tax discount rate of the Group is used as the discount rate for cash flow projections.<br />

4 Terminal growth rate<br />

Terminal growth reflects the management expectations on the fixed telephony, data & infrastructure and television operations<br />

segments’ growth potential in Sri Lanka for the foreseeable future.

![nrypq;Nfh ,d;#ud;;]; nfhk;gdp ypkplw - Dialog](https://img.yumpu.com/15429071/1/190x245/nrypqnfh-dud-nfhkgdp-ypkplw-dialog.jpg?quality=85)