Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> l <strong>Dialog</strong> Axiata PLC l 119<br />

31 Dividends<br />

The Directors have recommended a withholding tax free final dividend of Rs. 0.33 (2011 - Rs.0.25) per share amounting to<br />

Rs. 2,687,446,874 (2011 - Rs. 2,035,944,601) for the financial year <strong>2012</strong> subject to the approval of the shareholders at the<br />

<strong>Annual</strong> General Meeting.<br />

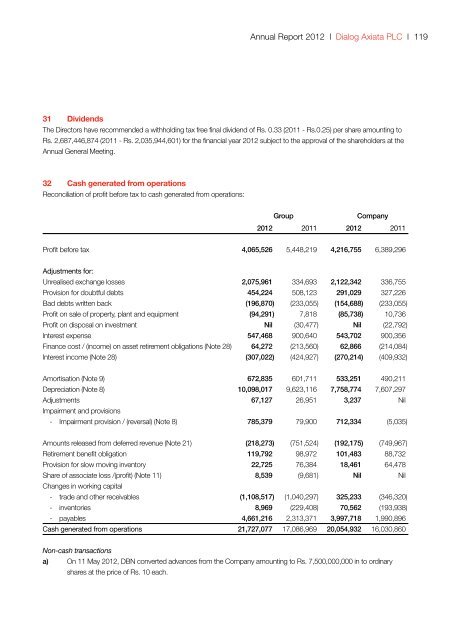

32 Cash generated from operations<br />

Reconciliation of profit before tax to cash generated from operations:<br />

Group Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Profit before tax 4,065,526 5,448,219 4,216,755 6,389,296<br />

Adjustments for:<br />

Unrealised exchange losses 2,075,961 334,693 2,122,342 336,755<br />

Provision for doubtful debts 454,224 508,123 291,029 327,226<br />

Bad debts written back (196,870) (233,055) (154,688) (233,055)<br />

Profit on sale of property, plant and equipment (94,291) 7,818 (85,738) 10,736<br />

Profit on disposal on investment Nil (30,477) Nil (22,792)<br />

Interest expense 547,468 900,640 543,702 900,356<br />

Finance cost / (income) on asset retirement obligations (Note 28) 64,272 (213,560) 62,866 (214,084)<br />

Interest income (Note 28) (307,022) (424,927) (270,214) (409,932)<br />

Amortisation (Note 9) 672,835 601,711 533,251 490,211<br />

Depreciation (Note 8) 10,098,017 9,623,116 7,758,774 7,607,297<br />

Adjustments<br />

Impairment and provisions<br />

67,127 26,951 3,237 Nil<br />

- Impairment provision / (reversal) (Note 8) 785,379 79,900 712,334 (5,035)<br />

Amounts released from deferred revenue (Note 21) (218,273) (751,524) (192,175) (749,967)<br />

Retirement benefit obligation 119,792 98,972 101,483 88,732<br />

Provision for slow moving inventory 22,725 76,384 18,461 64,478<br />

Share of associate loss /(profit) (Note 11)<br />

Changes in working capital<br />

8,539 (9,681) Nil Nil<br />

- trade and other receivables (1,108,517) (1,040,297) 325,233 (346,320)<br />

- inventories 8,969 (229,408) 70,562 (193,938)<br />

- payables 4,661,216 2,313,371 3,997,718 1,990,896<br />

Cash generated from operations 21,727,077 17,086,969 20,054,932 16,030,860<br />

Non-cash transactions<br />

a) On 11 May <strong>2012</strong>, DBN converted advances from the Company amounting to Rs. 7,500,000,000 in to ordinary<br />

shares at the price of Rs. 10 each.

![nrypq;Nfh ,d;#ud;;]; nfhk;gdp ypkplw - Dialog](https://img.yumpu.com/15429071/1/190x245/nrypqnfh-dud-nfhkgdp-ypkplw-dialog.jpg?quality=85)