Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

Annual Report 2012 - Dialog

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

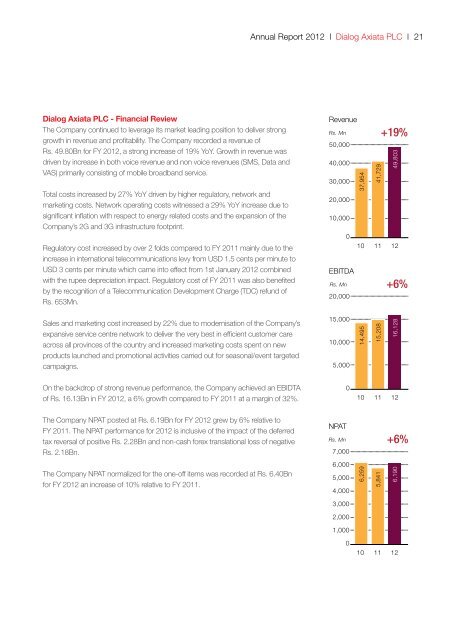

<strong>Dialog</strong> Axiata PLC - Financial Review<br />

The Company continued to leverage its market leading position to deliver strong<br />

growth in revenue and profitability. The Company recorded a revenue of<br />

Rs. 49.80Bn for FY <strong>2012</strong>, a strong increase of 19% YoY. Growth in revenue was<br />

driven by increase in both voice revenue and non voice revenues (SMS, Data and<br />

VAS) primarily consisting of mobile broadband service.<br />

Total costs increased by 27% YoY driven by higher regulatory, network and<br />

marketing costs. Network operating costs witnessed a 29% YoY increase due to<br />

significant inflation with respect to energy related costs and the expansion of the<br />

Company’s 2G and 3G infrastructure footprint.<br />

Regulatory cost increased by over 2 folds compared to FY 2011 mainly due to the<br />

increase in international telecommunications levy from USD 1.5 cents per minute to<br />

USD 3 cents per minute which came into effect from 1st January <strong>2012</strong> combined<br />

with the rupee depreciation impact. Regulatory cost of FY 2011 was also benefited<br />

by the recognition of a Telecommunication Development Charge (TDC) refund of<br />

Rs. 653Mn.<br />

Sales and marketing cost increased by 22% due to modernisation of the Company’s<br />

expansive service centre network to deliver the very best in efficient customer care<br />

across all provinces of the country and increased marketing costs spent on new<br />

products launched and promotional activities carried out for seasonal/event targeted<br />

campaigns.<br />

On the backdrop of strong revenue performance, the Company achieved an EBIDTA<br />

of Rs. 16.13Bn in FY <strong>2012</strong>, a 6% growth compared to FY 2011 at a margin of 32%.<br />

The Company NPAT posted at Rs. 6.19Bn for FY <strong>2012</strong> grew by 6% relative to<br />

FY 2011. The NPAT performance for <strong>2012</strong> is inclusive of the impact of the deferred<br />

tax reversal of positive Rs. 2.28Bn and non-cash forex translational loss of negative<br />

Rs. 2.18Bn.<br />

The Company NPAT normalized for the one-off items was recorded at Rs. 6.40Bn<br />

for FY <strong>2012</strong> an increase of 10% relative to FY 2011.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> l <strong>Dialog</strong> Axiata PLC l 21<br />

Revenue<br />

Rs. Mn +19%<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

EBITDA<br />

37,954<br />

10<br />

41,729<br />

11<br />

49,803<br />

12<br />

Rs. Mn +6%<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

NPAT<br />

0<br />

14,495<br />

10<br />

15,208<br />

11<br />

16,128<br />

12<br />

Rs. Mn +6%<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

6,259<br />

10<br />

5,841<br />

11<br />

6,190<br />

12

![nrypq;Nfh ,d;#ud;;]; nfhk;gdp ypkplw - Dialog](https://img.yumpu.com/15429071/1/190x245/nrypqnfh-dud-nfhkgdp-ypkplw-dialog.jpg?quality=85)