Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

to arrange solutions to <strong>the</strong>ir f<strong>in</strong>ancial problems. Homeowners with substantial debt <strong>in</strong><br />

addition to <strong>the</strong>ir mortgage loan see <strong>the</strong>ir options severely restricted, and are more likely<br />

to be unable to stop <strong>the</strong> foreclosure process once it is under way.<br />

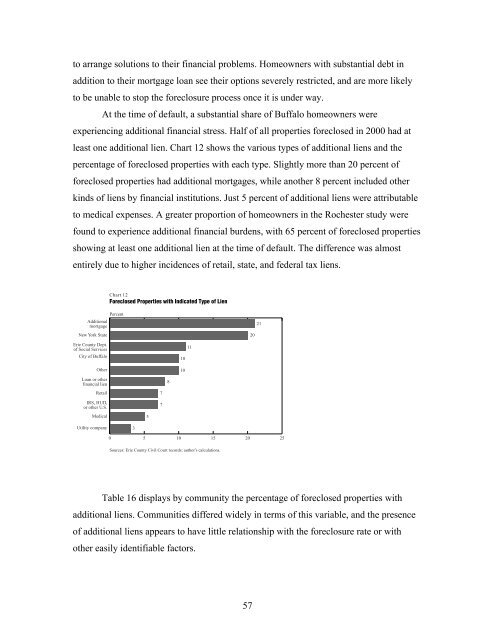

At <strong>the</strong> time <strong>of</strong> default, a substantial share <strong>of</strong> <strong>Buffalo</strong> homeowners were<br />

experienc<strong>in</strong>g additional f<strong>in</strong>ancial stress. Half <strong>of</strong> all properties foreclosed <strong>in</strong> <strong>2000</strong> had at<br />

least one additional lien. Chart 12 shows <strong>the</strong> various types <strong>of</strong> additional liens and <strong>the</strong><br />

percentage <strong>of</strong> foreclosed properties with each type. Slightly more than 20 percent <strong>of</strong><br />

foreclosed properties had additional mortgages, while ano<strong>the</strong>r 8 percent <strong>in</strong>cluded o<strong>the</strong>r<br />

k<strong>in</strong>ds <strong>of</strong> liens by f<strong>in</strong>ancial <strong>in</strong>stitutions. Just 5 percent <strong>of</strong> additional liens were attributable<br />

to medical expenses. A greater proportion <strong>of</strong> homeowners <strong>in</strong> <strong>the</strong> Rochester study were<br />

found to experience additional f<strong>in</strong>ancial burdens, with 65 percent <strong>of</strong> foreclosed properties<br />

show<strong>in</strong>g at least one additional lien at <strong>the</strong> time <strong>of</strong> default. The difference was almost<br />

entirely due to higher <strong>in</strong>cidences <strong>of</strong> retail, state, and federal tax liens.<br />

Additional<br />

mortgage<br />

New York State<br />

Erie County Dept.<br />

<strong>of</strong> Social Services<br />

<strong>City</strong> <strong>of</strong> <strong>Buffalo</strong><br />

O<strong>the</strong>r<br />

Loan or o<strong>the</strong>r<br />

f<strong>in</strong>ancial lien<br />

Retail<br />

IRS, HUD,<br />

or o<strong>the</strong>r U.S.<br />

Medical<br />

Chart 12<br />

Foreclosed Properties with Indicated Type <strong>of</strong> Lien<br />

Percent<br />

5<br />

7<br />

7<br />

Sources: Erie County Civil Court records; author’s calculations.<br />

8<br />

10<br />

10<br />

Utility company<br />

3<br />

0 5 10 15 20 25<br />

11<br />

Table 16 displays by community <strong>the</strong> percentage <strong>of</strong> foreclosed properties with<br />

additional liens. Communities differed widely <strong>in</strong> terms <strong>of</strong> this variable, and <strong>the</strong> presence<br />

<strong>of</strong> additional liens appears to have little relationship with <strong>the</strong> foreclosure rate or with<br />

o<strong>the</strong>r easily identifiable factors.<br />

20<br />

57<br />

21