Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

Residential Foreclosures in the City of Buffalo, 1990-2000 - Federal ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

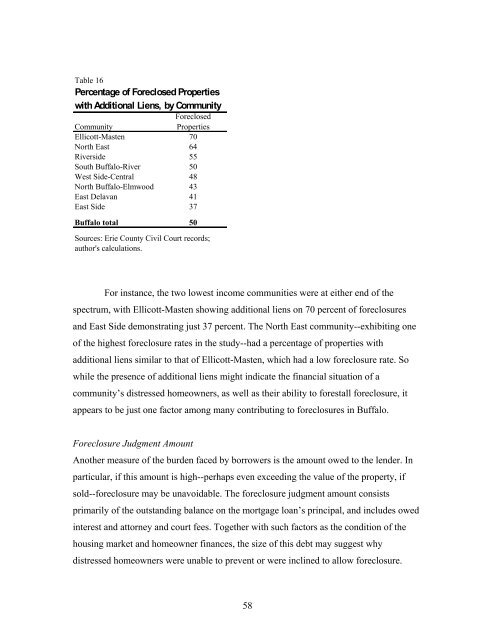

Table 16<br />

Percentage <strong>of</strong> Foreclosed Properties<br />

with Additional Liens, by Community<br />

Community<br />

Foreclosed<br />

Properties<br />

Ellicott-Masten 70<br />

North East 64<br />

Riverside 55<br />

South <strong>Buffalo</strong>-River 50<br />

West Side-Central 48<br />

North <strong>Buffalo</strong>-Elmwood 43<br />

East Delavan 41<br />

East Side 37<br />

<strong>Buffalo</strong> total 50<br />

Sources: Erie County Civil Court records;<br />

author's calculations.<br />

For <strong>in</strong>stance, <strong>the</strong> two lowest <strong>in</strong>come communities were at ei<strong>the</strong>r end <strong>of</strong> <strong>the</strong><br />

spectrum, with Ellicott-Masten show<strong>in</strong>g additional liens on 70 percent <strong>of</strong> foreclosures<br />

and East Side demonstrat<strong>in</strong>g just 37 percent. The North East community--exhibit<strong>in</strong>g one<br />

<strong>of</strong> <strong>the</strong> highest foreclosure rates <strong>in</strong> <strong>the</strong> study--had a percentage <strong>of</strong> properties with<br />

additional liens similar to that <strong>of</strong> Ellicott-Masten, which had a low foreclosure rate. So<br />

while <strong>the</strong> presence <strong>of</strong> additional liens might <strong>in</strong>dicate <strong>the</strong> f<strong>in</strong>ancial situation <strong>of</strong> a<br />

community’s distressed homeowners, as well as <strong>the</strong>ir ability to forestall foreclosure, it<br />

appears to be just one factor among many contribut<strong>in</strong>g to foreclosures <strong>in</strong> <strong>Buffalo</strong>.<br />

Foreclosure Judgment Amount<br />

Ano<strong>the</strong>r measure <strong>of</strong> <strong>the</strong> burden faced by borrowers is <strong>the</strong> amount owed to <strong>the</strong> lender. In<br />

particular, if this amount is high--perhaps even exceed<strong>in</strong>g <strong>the</strong> value <strong>of</strong> <strong>the</strong> property, if<br />

sold--foreclosure may be unavoidable. The foreclosure judgment amount consists<br />

primarily <strong>of</strong> <strong>the</strong> outstand<strong>in</strong>g balance on <strong>the</strong> mortgage loan’s pr<strong>in</strong>cipal, and <strong>in</strong>cludes owed<br />

<strong>in</strong>terest and attorney and court fees. Toge<strong>the</strong>r with such factors as <strong>the</strong> condition <strong>of</strong> <strong>the</strong><br />

hous<strong>in</strong>g market and homeowner f<strong>in</strong>ances, <strong>the</strong> size <strong>of</strong> this debt may suggest why<br />

distressed homeowners were unable to prevent or were <strong>in</strong>cl<strong>in</strong>ed to allow foreclosure.<br />

58