You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

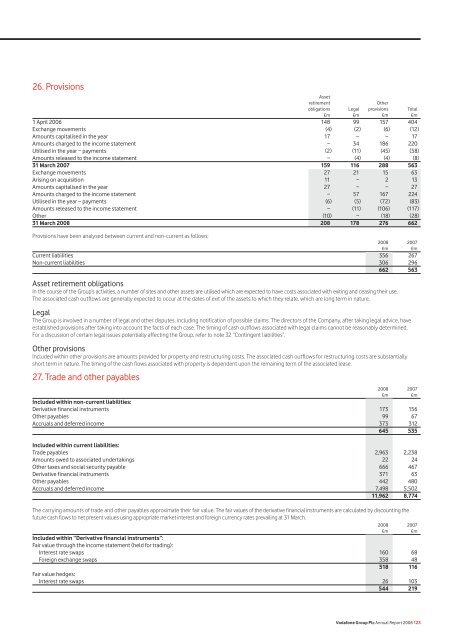

26. Provisions<br />

Asset<br />

retirement O<strong>the</strong>r<br />

obligations Legal provisions Total<br />

£m £m £m £m<br />

1 April 2006 148 99 157 404<br />

Exchange movements (4) (2) (6) (12)<br />

Amounts capitalised in <strong>the</strong> year 17 − − 17<br />

Amounts charged to <strong>the</strong> income statement − 34 186 220<br />

Utilised in <strong>the</strong> year − payments (2) (11) (45) (58)<br />

Amounts released to <strong>the</strong> income statement − (4) (4) (8)<br />

31 March 2007 159 116 288 563<br />

Exchange movements 27 21 15 63<br />

Arising on acquisition 11 − 2 13<br />

Amounts capitalised in <strong>the</strong> year 27 − − 27<br />

Amounts charged to <strong>the</strong> income statement − 57 167 224<br />

Utilised in <strong>the</strong> year − payments (6) (5) (72) (83)<br />

Amounts released to <strong>the</strong> income statement − (11) (106) (117)<br />

O<strong>the</strong>r (10) − (18) (28)<br />

31 March 2008 208 178 276 662<br />

Provisions have been analysed between current and non-current as follows:<br />

2008 2007<br />

£m £m<br />

Current liabilities 356 267<br />

Non-current liabilities 306 296<br />

662 563<br />

Asset retirement obligations<br />

In <strong>the</strong> course of <strong>the</strong> Group’s activities, a number of sites and o<strong>the</strong>r assets are utilised which are expected to have costs associated with exiting and ceasing <strong>the</strong>ir use.<br />

The associated cash outflows are generally expected to occur at <strong>the</strong> dates of exit of <strong>the</strong> assets to which <strong>the</strong>y relate, which are long term in nature.<br />

Legal<br />

The Group is involved in a number of legal and o<strong>the</strong>r disputes, including notification of possible claims. The directors of <strong>the</strong> Company, after taking legal advice, have<br />

established provisions after taking into account <strong>the</strong> facts of each case. The timing of cash outflows associated with legal claims cannot be reasonably determined.<br />

For a discussion of certain legal issues potentially affecting <strong>the</strong> Group, refer to note 32 “Contingent liabilities”.<br />

O<strong>the</strong>r provisions<br />

Included within o<strong>the</strong>r provisions are amounts provided for property and restructuring costs. The associated cash outflows for restructuring costs are substantially<br />

short term in nature. The timing of <strong>the</strong> cash flows associated with property is dependent upon <strong>the</strong> remaining term of <strong>the</strong> associated lease.<br />

27. Trade and o<strong>the</strong>r payables<br />

2008 2007<br />

£m £m<br />

Included within non-current liabilities:<br />

Derivative financial instruments 173 156<br />

O<strong>the</strong>r payables 99 67<br />

Accruals and deferred income 373 312<br />

645 535<br />

Included within current liabilities:<br />

Trade payables 2,963 2,238<br />

Amounts owed to associated undertakings 22 24<br />

O<strong>the</strong>r taxes and social security payable 666 467<br />

Derivative financial instruments 371 63<br />

O<strong>the</strong>r payables 442 480<br />

Accruals and deferred income 7,498 5,502<br />

11,962 8,774<br />

The carrying amounts of trade and o<strong>the</strong>r payables approximate <strong>the</strong>ir fair value. The fair values of <strong>the</strong> derivative financial instruments are calculated by discounting <strong>the</strong><br />

future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at 31 March.<br />

2008 2007<br />

£m £m<br />

Included within “Derivative financial instruments”:<br />

Fair value through <strong>the</strong> income statement (held for trading):<br />

Interest rate swaps 160 68<br />

Foreign exchange swaps 358 48<br />

518 116<br />

Fair value hedges:<br />

Interest rate swaps 26 103<br />

544 219<br />

<strong>Vodafone</strong> Group Plc Annual Report 2008 123