You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

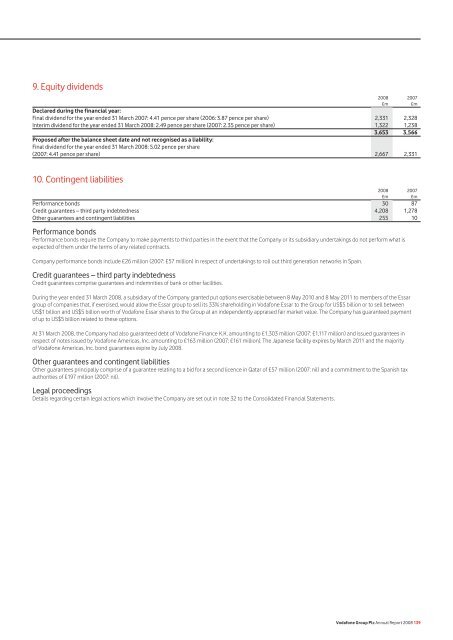

9. Equity dividends<br />

2008 2007<br />

£m £m<br />

Declared during <strong>the</strong> financial year:<br />

Final dividend for <strong>the</strong> year ended 31 March 2007: 4.41 pence per share (2006: 3.87 pence per share) 2,331 2,328<br />

Interim dividend for <strong>the</strong> year ended 31 March 2008: 2.49 pence per share (2007: 2.35 pence per share) 1,322 1,238<br />

Proposed after <strong>the</strong> balance sheet date and not recognised as a liability:<br />

Final dividend for <strong>the</strong> year ended 31 March 2008: 5.02 pence per share<br />

3,653 3,566<br />

(2007: 4.41 pence per share) 2,667 2,331<br />

10. Contingent liabilities<br />

2008 2007<br />

£m £m<br />

Performance bonds 30 87<br />

Credit guarantees – third party indebtedness 4,208 1,278<br />

O<strong>the</strong>r guarantees and contingent liabilities 255 10<br />

Performance bonds<br />

Performance bonds require <strong>the</strong> Company to make payments to third parties in <strong>the</strong> event that <strong>the</strong> Company or its subsidiary undertakings do not perform what is<br />

expected of <strong>the</strong>m under <strong>the</strong> terms of any related contracts.<br />

Company performance bonds include £26 million (2007: £57 million) in respect of undertakings to roll out third generation networks in Spain.<br />

Credit guarantees – third party indebtedness<br />

Credit guarantees comprise guarantees and indemnities of bank or o<strong>the</strong>r facilities.<br />

During <strong>the</strong> year ended 31 March 2008, a subsidiary of <strong>the</strong> Company granted put options exercisable between 8 May 2010 and 8 May 2011 to members of <strong>the</strong> Essar<br />

group of companies that, if exercised, would allow <strong>the</strong> Essar group to sell its 33% shareholding in <strong>Vodafone</strong> Essar to <strong>the</strong> Group for US$5 billion or to sell between<br />

US$1 billion and US$5 billion worth of <strong>Vodafone</strong> Essar shares to <strong>the</strong> Group at an independently appraised fair market value. The Company has guaranteed payment<br />

of up to US$5 billion related to <strong>the</strong>se options.<br />

At 31 March 2008, <strong>the</strong> Company had also guaranteed debt of <strong>Vodafone</strong> Finance K.K. amounting to £1,303 million (2007: £1,117 million) and issued guarantees in<br />

respect of notes issued by <strong>Vodafone</strong> Americas, Inc. amounting to £163 million (2007: £161 million). The Japanese facility expires by March 2011 and <strong>the</strong> majority<br />

of <strong>Vodafone</strong> Americas, Inc. bond guarantees expire by July 2008.<br />

O<strong>the</strong>r guarantees and contingent liabilities<br />

O<strong>the</strong>r guarantees principally comprise of a guarantee relating to a bid for a second licence in Qatar of £57 million (2007: nil) and a commitment to <strong>the</strong> Spanish tax<br />

authorities of £197 million (2007: nil).<br />

Legal proceedings<br />

Details regarding certain legal actions which involve <strong>the</strong> Company are set out in note 32 to <strong>the</strong> Consolidated Financial Statements.<br />

<strong>Vodafone</strong> Group Plc Annual Report 2008 139