Vision - Alibaba

Vision - Alibaba

Vision - Alibaba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

100 Annual Report 2007<br />

Notes to the Financial Statements<br />

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

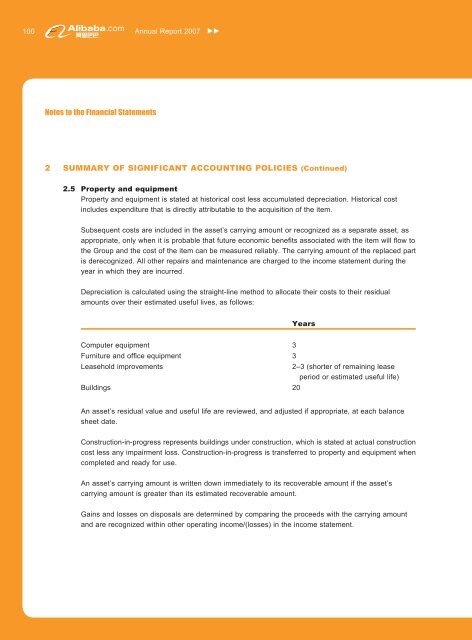

2.5 Property and equipment<br />

Property and equipment is stated at historical cost less accumulated depreciation. Historical cost<br />

includes expenditure that is directly attributable to the acquisition of the item.<br />

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as<br />

appropriate, only when it is probable that future economic benefi ts associated with the item will fl ow to<br />

the Group and the cost of the item can be measured reliably. The carrying amount of the replaced part<br />

is derecognized. All other repairs and maintenance are charged to the income statement during the<br />

year in which they are incurred.<br />

Depreciation is calculated using the straight-line method to allocate their costs to their residual<br />

amounts over their estimated useful lives, as follows:<br />

Years<br />

Computer equipment 3<br />

Furniture and offi ce equipment 3<br />

Leasehold improvements 2–3 (shorter of remaining lease<br />

period or estimated useful life)<br />

Buildings 20<br />

An asset’s residual value and useful life are reviewed, and adjusted if appropriate, at each balance<br />

sheet date.<br />

Construction-in-progress represents buildings under construction, which is stated at actual construction<br />

cost less any impairment loss. Construction-in-progress is transferred to property and equipment when<br />

completed and ready for use.<br />

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s<br />

carrying amount is greater than its estimated recoverable amount.<br />

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount<br />

and are recognized within other operating income/(losses) in the income statement.