Vision - Alibaba

Vision - Alibaba

Vision - Alibaba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

144 Annual Report 2007<br />

Notes to the Financial Statements<br />

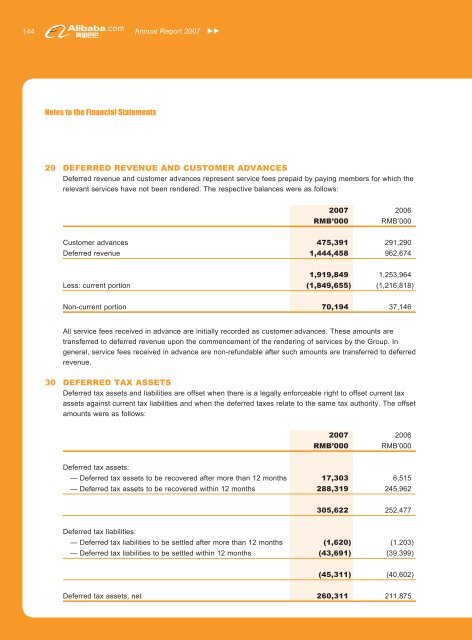

29 DEFERRED REVENUE AND CUSTOMER ADVANCES<br />

Deferred revenue and customer advances represent service fees prepaid by paying members for which the<br />

relevant services have not been rendered. The respective balances were as follows:<br />

2007 2006<br />

RMB’000 RMB’000<br />

Customer advances 475,391 291,290<br />

Deferred revenue 1,444,458 962,674<br />

1,919,849 1,253,964<br />

Less: current portion (1,849,655) (1,216,818)<br />

Non-current portion 70,194 37,146<br />

All service fees received in advance are initially recorded as customer advances. These amounts are<br />

transferred to deferred revenue upon the commencement of the rendering of services by the Group. In<br />

general, service fees received in advance are non-refundable after such amounts are transferred to deferred<br />

revenue.<br />

30 DEFERRED TAX ASSETS<br />

Deferred tax assets and liabilities are offset when there is a legally enforceable right to offset current tax<br />

assets against current tax liabilities and when the deferred taxes relate to the same tax authority. The offset<br />

amounts were as follows:<br />

2007 2006<br />

RMB’000 RMB’000<br />

Deferred tax assets:<br />

— Deferred tax assets to be recovered after more than 12 months 17,303 6,515<br />

— Deferred tax assets to be recovered within 12 months 288,319 245,962<br />

305,622 252,477<br />

Deferred tax liabilities:<br />

— Deferred tax liabilities to be settled after more than 12 months (1,620) (1,203)<br />

— Deferred tax liabilities to be settled within 12 months (43,691) (39,399)<br />

(45,311) (40,602)<br />

Deferred tax assets, net 260,311 211,875