Vision - Alibaba

Vision - Alibaba

Vision - Alibaba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

146 Annual Report 2007<br />

Notes to the Financial Statements<br />

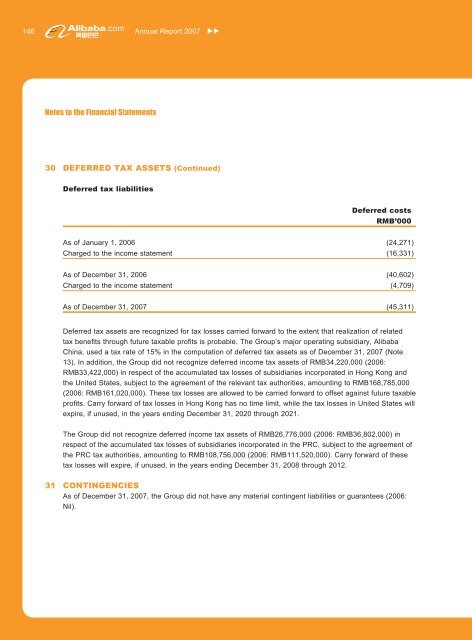

30 DEFERRED TAX ASSETS (Continued)<br />

Deferred tax liabilities<br />

Deferred costs<br />

RMB’000<br />

As of January 1, 2006 (24,271)<br />

Charged to the income statement (16,331)<br />

As of December 31, 2006 (40,602)<br />

Charged to the income statement (4,709)<br />

As of December 31, 2007 (45,311)<br />

Deferred tax assets are recognized for tax losses carried forward to the extent that realization of related<br />

tax benefi ts through future taxable profi ts is probable. The Group’s major operating subsidiary, <strong>Alibaba</strong><br />

China, used a tax rate of 15% in the computation of deferred tax assets as of December 31, 2007 (Note<br />

13). In addition, the Group did not recognize deferred income tax assets of RMB34,220,000 (2006:<br />

RMB33,422,000) in respect of the accumulated tax losses of subsidiaries incorporated in Hong Kong and<br />

the United States, subject to the agreement of the relevant tax authorities, amounting to RMB168,785,000<br />

(2006: RMB161,020,000). These tax losses are allowed to be carried forward to offset against future taxable<br />

profi ts. Carry forward of tax losses in Hong Kong has no time limit, while the tax losses in United States will<br />

expire, if unused, in the years ending December 31, 2020 through 2021.<br />

The Group did not recognize deferred income tax assets of RMB26,776,000 (2006: RMB36,802,000) in<br />

respect of the accumulated tax losses of subsidiaries incorporated in the PRC, subject to the agreement of<br />

the PRC tax authorities, amounting to RMB108,756,000 (2006: RMB111,520,000). Carry forward of these<br />

tax losses will expire, if unused, in the years ending December 31, 2008 through 2012.<br />

31 CONTINGENCIES<br />

As of December 31, 2007, the Group did not have any material contingent liabilities or guarantees (2006:<br />

Nil).