Vision - Alibaba

Vision - Alibaba

Vision - Alibaba

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32 Annual Report 2007<br />

Income tax charges increased by 154.2% from<br />

RMB71.5 million in 2006 to RMB181.6 million in 2007.<br />

This increase was primarily due to the increase in<br />

taxable profi t from our operations in China. In 2006 and<br />

2007, our effective tax rates were 24.5% and 15.8%,<br />

respectively. Share-based compensation expense<br />

arising from equity-based awards is not deductible for<br />

tax purposes. If we exclude the effects of such equitybased<br />

awards, our effective tax rates would have been<br />

14.0% and 17.6% in 2007 and 2006, respectively.<br />

On March 16, 2007, the National People’s Congress<br />

approved the new Enterprise Income Tax Law (the “New<br />

EIT Law”). The New EIT Law, which became effective<br />

from January 1, 2008, unifi es the corporate income<br />

tax rate for domestic enterprises and foreign invested<br />

enterprises to 25%. In addition, among others, the<br />

New EIT Law provides for a preferential tax rate of 15%<br />

for enterprises qualifi ed as high and new technology<br />

enterprises (“HNTE”). However, the detailed rules on<br />

the applicable requirements and procedures to apply<br />

for preferential tax treatment as HNTE have not yet<br />

been announced. In December 2007, <strong>Alibaba</strong> China<br />

obtained a certifi cate issued by the Science and<br />

Technology Department of Zhejiang Province confi rming<br />

<strong>Alibaba</strong> China’s status as a high and new technology<br />

enterprise. This certifi cate is valid for a period of two<br />

years from the date of issuance. In addition, our<br />

management has conducted research and consulted<br />

relevant third parties as well as performed certain due<br />

diligence procedures to confi rm the view of our board<br />

of directors that <strong>Alibaba</strong> China will obtain its formal<br />

HNTE designation in 2008 under the New EIT Law<br />

upon the completion of certain administrative approval<br />

procedures. Consequently, <strong>Alibaba</strong> China used 15% in<br />

the computation of deferred taxes as of December 31,<br />

2007. If <strong>Alibaba</strong> China does not obtain the formal HNTE<br />

designation in 2008, its applicable enterprise income<br />

tax rate will become 25% in 2008, which would have a<br />

negative effect on our future results.<br />

Depreciation of property and equipment<br />

Our depreciation expenses increased by 9.2% from<br />

RMB54.0 million in 2006 to RMB59.0 million in 2007,<br />

mainly due to the addition of property and equipment<br />

during the year.<br />

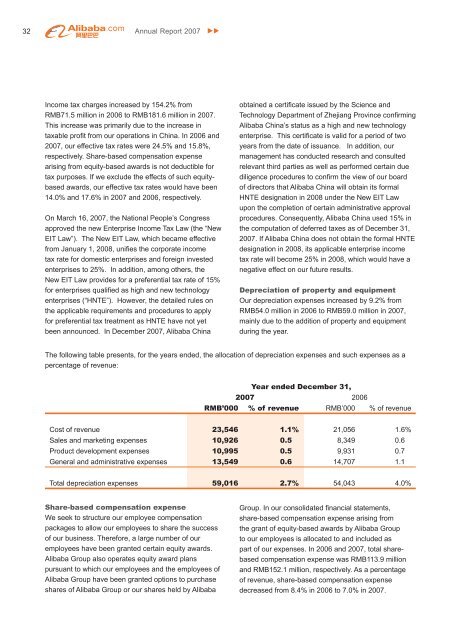

The following table presents, for the years ended, the allocation of depreciation expenses and such expenses as a<br />

percentage of revenue:<br />

Year ended December 31,<br />

2007 2006<br />

RMB’000 % of revenue RMB’000 % of revenue<br />

Cost of revenue 23,546 1.1% 21,056 1.6%<br />

Sales and marketing expenses 10,926 0.5 8,349 0.6<br />

Product development expenses 10,995 0.5 9,931 0.7<br />

General and administrative expenses 13,549 0.6 14,707 1.1<br />

Total depreciation expenses 59,016 2.7% 54,043 4.0%<br />

Share-based compensation expense<br />

We seek to structure our employee compensation<br />

packages to allow our employees to share the success<br />

of our business. Therefore, a large number of our<br />

employees have been granted certain equity awards.<br />

<strong>Alibaba</strong> Group also operates equity award plans<br />

pursuant to which our employees and the employees of<br />

<strong>Alibaba</strong> Group have been granted options to purchase<br />

shares of <strong>Alibaba</strong> Group or our shares held by <strong>Alibaba</strong><br />

Group. In our consolidated fi nancial statements,<br />

share-based compensation expense arising from<br />

the grant of equity-based awards by <strong>Alibaba</strong> Group<br />

to our employees is allocated to and included as<br />

part of our expenses. In 2006 and 2007, total sharebased<br />

compensation expense was RMB113.9 million<br />

and RMB152.1 million, respectively. As a percentage<br />

of revenue, share-based compensation expense<br />

decreased from 8.4% in 2006 to 7.0% in 2007.