Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3/4/2008<br />

Certain imported goods for animal or vegetable reproduction, which pay a zero<br />

percent CET.<br />

Certain imported mineral products that pay zero percent CET.<br />

Imported books, brochures, and newsprints.<br />

New imported capital and information and telecommunications-related goods.<br />

Goods imported under the temporary import regime<br />

Import Duties on Capital and Consumer Products<br />

The Government of <strong>Argentina</strong> (GOA) has reduced the import duty for a broad range of<br />

new capital goods to zero percent. Products classified under approximately 700<br />

harmonized system numbers were affected by this reduction. Most of these goods fall<br />

under chapters 84, 85, 86, 87, 89, 90 and 94. This reduction applies only to imports of<br />

new equipment.<br />

<strong>In</strong> March 2002, the Argentine Government (GOA) lowered import duties on many<br />

consumer products. The new duties range from 12 to 22 percent. The approximately<br />

1,500 harmonized system codes affected include meat, milk, edible oils, canned<br />

tomatoes, canned meat, canned fish, juices, fruits, alcoholic drinks, tobacco, wood<br />

products, apparel, textiles and footwear, as well as household appliances such as<br />

vacuum cleaners, freezers, shavers, stereos, and telephones. Consumer goods<br />

represented 11 percent of all products imported by <strong>Argentina</strong> during 2007.<br />

For a complete list of products affected by these regulations contact the U.S.<br />

Commercial Service in Buenos Aires at Buenos.Aires.Office.Box@mail.doc.gov.<br />

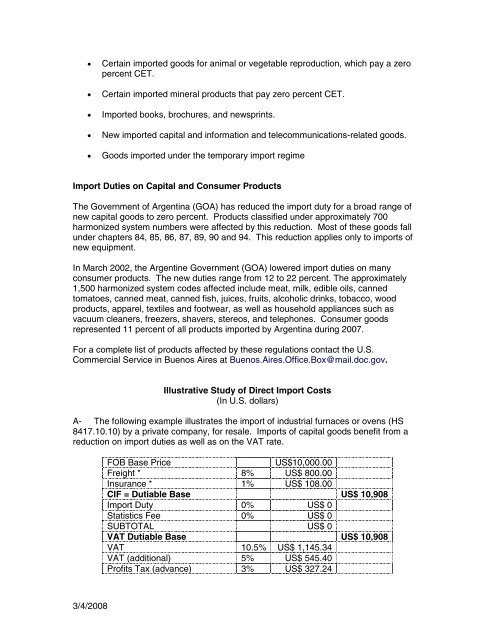

Illustrative Study of Direct Import Costs<br />

(<strong>In</strong> U.S. dollars)<br />

A- The following example illustrates the import of industrial furnaces or ovens (HS<br />

8417.10.10) by a private company, for resale. Imports of capital goods benefit from a<br />

reduction on import duties as well as on the VAT rate.<br />

FOB Base Price US$10,000.00<br />

Freight * 8% US$ 800.00<br />

<strong>In</strong>surance * 1% US$ 108.00<br />

CIF = Dutiable Base US$ 10,908<br />

Import Duty 0% US$ 0<br />

Statistics Fee 0% US$ 0<br />

SUBTOTAL US$ 0<br />

VAT Dutiable Base US$ 10,908<br />

VAT 10.5% US$ 1,145.34<br />

VAT (additional) 5% US$ 545.40<br />

Profits Tax (advance) 3% US$ 327.24