You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>In</strong>itial period: 1 year<br />

Extension: 1 additional year<br />

b) For “non-serialized” production goods (Annex 1 - Decree 1439/96. Examples:<br />

custom made boats, industrial machines, bridges, etc.)<br />

<strong>In</strong>itial period: 2 years<br />

Extension Period: 1 additional year.<br />

c) Prolonging the extension period (due to natural or manmade disasters that<br />

make re-export impossible): 1 additional year.<br />

Entry bonds<br />

A- The bond equivalent for the amount of import duties, domestic taxes, statistics fees<br />

plus an additional 24% bond must be paid upon entry of the goods into customs. If<br />

the goods admitted under TAR are re-exported unaltered, the entirety of the bond will<br />

be returned. Otherwise, this bond will be returned upon export of the goods that the<br />

TAR goods formed part of. If the goods that are imported are subject to antidumping<br />

duties, a corresponding bond will also be required upon entry. This bond will also be<br />

returned upon re-export of the goods.<br />

B- The bond may be paid in cash, by bank guarantee, or through an insurance bond.<br />

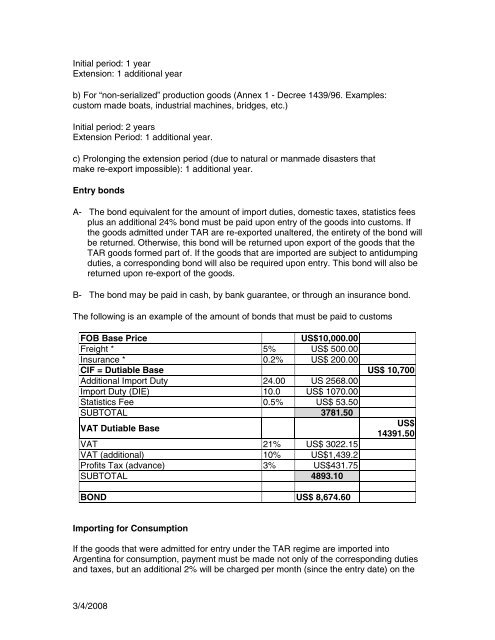

The following is an example of the amount of bonds that must be paid to customs<br />

FOB Base Price US$10,000.00<br />

Freight * 5% US$ 500.00<br />

<strong>In</strong>surance * 0.2% US$ 200.00<br />

CIF = Dutiable Base US$ 10,700<br />

Additional Import Duty 24.00 US 2568.00<br />

Import Duty (DIE) 10.0 US$ 1070.00<br />

Statistics Fee 0.5% US$ 53.50<br />

SUBTOTAL<br />

VAT Dutiable Base<br />

3781.50<br />

VAT 21% US$ 3022.15<br />

VAT (additional) 10% US$1,439.2<br />

Profits Tax (advance) 3% US$431.75<br />

SUBTOTAL 4893.10<br />

BOND US$ 8,674.60<br />

Importing for Consumption<br />

3/4/2008<br />

US$<br />

14391.50<br />

If the goods that were admitted for entry under the TAR regime are imported into<br />

<strong>Argentina</strong> for consumption, payment must be made not only of the corresponding duties<br />

and taxes, but an additional 2% will be charged per month (since the entry date) on the