THE FIAT GROUP IN

THE FIAT GROUP IN

THE FIAT GROUP IN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In Western Europe, Fiat Auto sold 1,456,000 automobiles<br />

and light commercial vehicles, down 13.7% from 2000.<br />

This decrease was partially attributable to the cutbacks in<br />

dealer network car inventory and the natural contraction in<br />

volumes due to phase-out of Bravo and Brava models in<br />

anticipation of the gradual introduction of the Stilo during<br />

the last quarter of the year.<br />

The ongoing crisis on local markets caused sharp sales<br />

decreases in Poland (-42.9%) and Argentina (-61%). On the<br />

other hand, Fiat Auto sales improved significantly in Brazil<br />

(+14.9%).<br />

❚ CNH Global revenues in 2001 totaled 10,777 million euros,<br />

in line with previous year results. Expressed in dollars,<br />

the functional currency of this sector, CNH revenues were<br />

down by approximately 3%, stemming largely from lower<br />

sales revenues due to divestment of production units in<br />

compliance with requests made by antitrust authorities<br />

in North America and Europe following acquisition of the<br />

Case Group. Furthermore, the Sector faced a particularly<br />

unfavorable market in the construction equipment segment<br />

due to a steep decline in demand in Western Europe and<br />

North America.<br />

At the segment level, Sector revenues from agricultural<br />

equipment improved (+3%), mainly in North America and<br />

Brazil, while remaining weak in Europe. On the other hand,<br />

construction equipment revenues significantly decreased<br />

(-15%) due to the previously mentioned contraction in<br />

demand.<br />

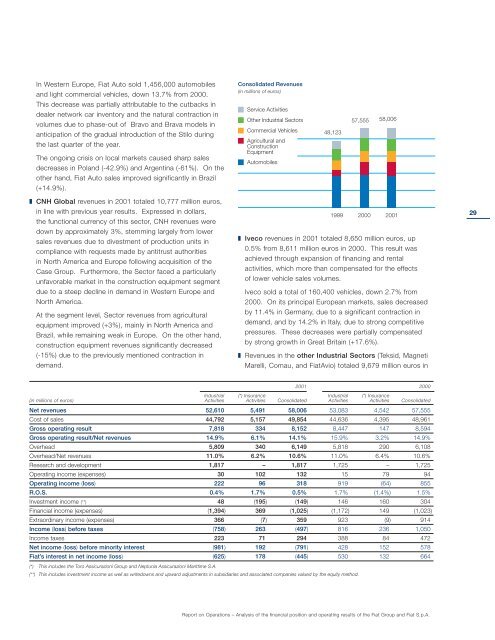

Consolidated Revenues<br />

(in millions of euros)<br />

Service Activities<br />

Other Industrial Sectors<br />

Commercial Vehicles<br />

Agricultural and<br />

Construction<br />

Equipment<br />

Automobiles<br />

48,123<br />

1999<br />

57,555<br />

2000<br />

58,006<br />

2001<br />

❚ Iveco revenues in 2001 totaled 8,650 million euros, up<br />

0.5% from 8,611 million euros in 2000. This result was<br />

achieved through expansion of financing and rental<br />

activities, which more than compensated for the effects<br />

of lower vehicle sales volumes.<br />

Iveco sold a total of 160,400 vehicles, down 2.7% from<br />

2000. On its principal European markets, sales decreased<br />

by 11.4% in Germany, due to a significant contraction in<br />

demand, and by 14.2% in Italy, due to strong competitive<br />

pressures. These decreases were partially compensated<br />

by strong growth in Great Britain (+17.6%).<br />

❚ Revenues in the other Industrial Sectors (Teksid, Magneti<br />

Marelli, Comau, and FiatAvio) totaled 9,679 million euros in<br />

2001 2000<br />

(in millions of euros)<br />

Industrial<br />

Activities<br />

(*) Insurance<br />

Activities Consolidated<br />

Industrial<br />

Activities<br />

(*) Insurance<br />

Activities Consolidated<br />

Net revenues 52,610 5,491 58,006 53,083 4,542 57,555<br />

Cost of sales 44,792 5,157 49,854 44,636 4,395 48,961<br />

Gross operating result 7,818 334 8,152 8,447 147 8,594<br />

Gross operating result/Net revenues 14.9% 6.1% 14.1% 15.9% 3.2% 14.9%<br />

Overhead 5,809 340 6,149 5,818 290 6,108<br />

Overhead/Net revenues 11.0% 6.2% 10.6% 11.0% 6.4% 10.6%<br />

Research and development 1,817 – 1,817 1,725 – 1,725<br />

Operating income (expenses) 30 102 132 15 79 94<br />

Operating income (loss) 222 96 318 919 (64) 855<br />

R.O.S. 0.4% 1.7% 0.5% 1.7% (1.4%) 1.5%<br />

Investment income (**) 48 (195) (149) 146 160 304<br />

Financial income (expenses) (1,394) 369 (1,025) (1,172) 149 (1,023)<br />

Extraordinary income (expenses) 366 (7) 359 923 (9) 914<br />

Income (loss) before taxes (758) 263 (497) 816 236 1,050<br />

Income taxes 223 71 294 388 84 472<br />

Net income (loss) before minority interest (981) 192 (791) 428 152 578<br />

Fiat’s interest in net income (loss) (625) 178 (445) 530 132 664<br />

(*) This includes the Toro Assicurazioni Group and Neptunia Assicurazioni Marittime S.A.<br />

(**) This includes investment income as well as writedowns and upward adjustments in subsidiaries and associated companies valued by the equity method.<br />

Report on Operations – Analysis of the financial position and operating results of the Fiat Group and Fiat S.p.A.<br />

29<br />

29