Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

epresent and promote South African-designed content), for whom this agreement should<br />

be little short of life-saving. To date, the Cape Town Fashion Council has also remained<br />

silent.<br />

In a letter to the media written by this author (see Appendix 1) it was argued that the<br />

implementation of the quota restrictions could be beneficial to South African independent<br />

fashion designers if they, and the various bodies set up to support them, worked<br />

collectively to promote local content to South African consumers.<br />

4.6 The Retail Sector in South Africa<br />

The major retail companies dominating the South African apparel retail market are: Edcon;<br />

Mr Price; Foschini Group; Truworths and Woolworths (Wooltru). All of these retailers have<br />

taken advantage of globalisation and the changing face of production; retail buyers can<br />

now source their products from various foreign companies, or establish factories in<br />

favourable low labour-cost countries, which has resulted in the commodity chains being<br />

buyer-driven (Doel, 1996 as cited by Kenny, 2003:171; Gereffi, 1999). The development of<br />

such buyer-driven chains has a substantial link to the concept of fair trade, which submits<br />

that workers in the developing world are being exploited by the buyer-driven international<br />

corporations in a persistent search for cheaper production and labour costs in order to<br />

procure higher profit margins (Sengenberger and Campbell, 1994, cited in Barrientos,<br />

1999:8 and Starr, 2000:17).<br />

Surveying the value chain from manufacture to retailing, and exploring the growth of retail<br />

sales and profits reflected by Statistics South Africa, the indications are that sales in<br />

garments have grown significantly during the past years, while production volume has<br />

declined, compounded by employment losses within the industry (The Shop Steward,<br />

2005).<br />

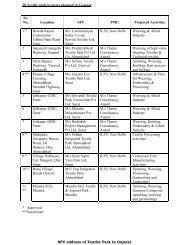

Analysis of these retailers’ Annual Reports for the years 2002 – 2004 and of the 2005 annual<br />

results for Edcon, Mr Price and Foschini Group (Figure Three) shows that these companies<br />

made a combined profit of R8.3 billion before tax (The Shop Steward, 2005). The following<br />

table reflects these companies’ rapid growth in profits:<br />

41