May 2013 - I-Micronews

May 2013 - I-Micronews

May 2013 - I-Micronews

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

M A Y 2 0 1 3 I S S U E N ° 2 7<br />

ANALYST CORNER<br />

Mainstream flip chip bumping starts<br />

to move to copper pillars<br />

Copper pillars and micro bumps will soon re-shape the flip chip market and supply<br />

chain, as mobile processors, memory, and non-mainstream CMOS devices start<br />

to require smaller geometries, higher I/O counts, higher bandwidth, and better<br />

thermal management. That will propel 9% growth for the flip chip packaging<br />

market through 2018, with most of that growth driven by the emerging copper<br />

technologies.<br />

Lionel Cadix,<br />

Market & Technology<br />

Analyst, Advanced<br />

Packaging,<br />

Yole Développement<br />

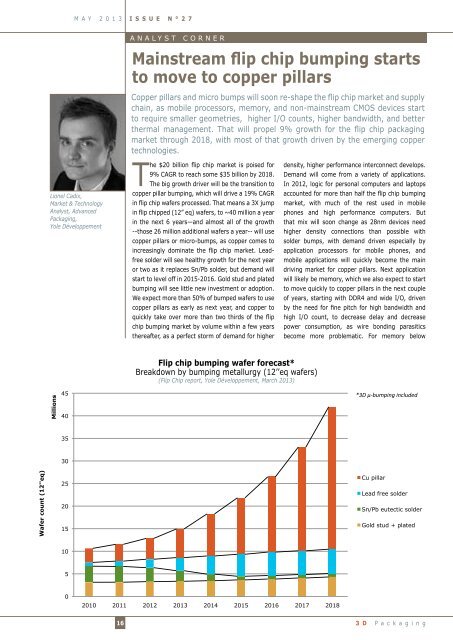

The $20 billion flip chip market is poised for<br />

9% CAGR to reach some $35 billion by 2018.<br />

The big growth driver will be the transition to<br />

copper pillar bumping, which will drive a 19% CAGR<br />

in flip chip wafers processed. That means a 3X jump<br />

in flip chipped (12” eq) wafers, to ~40 million a year<br />

in the next 6 years—and almost all of the growth<br />

--those 26 million additional wafers a year-- will use<br />

copper pillars or micro-bumps, as copper comes to<br />

increasingly dominate the flip chip market. Leadfree<br />

solder will see healthy growth for the next year<br />

or two as it replaces Sn/Pb solder, but demand will<br />

start to level off in 2015-2016. Gold stud and plated<br />

bumping will see little new investment or adoption.<br />

We expect more than 50% of bumped wafers to use<br />

copper pillars as early as next year, and copper to<br />

quickly take over more than two thirds of the flip<br />

chip bumping market by volume within a few years<br />

thereafter, as a perfect storm of demand for higher<br />

density, higher performance interconnect develops.<br />

Demand will come from a variety of applications.<br />

In 2012, logic for personal computers and laptops<br />

accounted for more than half the flip chip bumping<br />

market, with much of the rest used in mobile<br />

phones and high performance computers. But<br />

that mix will soon change as 28nm devices need<br />

higher density connections than possible with<br />

solder bumps, with demand driven especially by<br />

application processors for mobile phones, and<br />

mobile applications will quickly become the main<br />

driving market for copper pillars. Next application<br />

will likely be memory, which we also expect to start<br />

to move quickly to copper pillars in the next couple<br />

of years, starting with DDR4 and wide I/O, driven<br />

by the need for fine pitch for high bandwidth and<br />

high I/O count, to decrease delay and decrease<br />

power consumption, as wire bonding parasitics<br />

become more problematic. For memory below<br />

Flip chip bumping wafer forecast*<br />

Breakdown by bumping metallurgy (12’’eq wafers)<br />

(Flip Chip report, Yole Développement, March <strong>2013</strong>)<br />

Millions<br />

45<br />

40<br />

*3D µ-bumping included<br />

35<br />

30<br />

Wafer count (12''eq)<br />

25<br />

20<br />

15<br />

Cu pillar<br />

Lead free solder<br />

Sn/Pb eutectic solder<br />

Gold stud + plated<br />

10<br />

5<br />

0<br />

2010 2011 2012 <strong>2013</strong> 2014 2015 2016 2017 2018<br />

16<br />

3 D P a c k a g i n g