May 2013 - I-Micronews

May 2013 - I-Micronews

May 2013 - I-Micronews

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I S S U E N ° 2 7 M A Y 2 0 1 3<br />

28nm, mass reflow will likely not be possible<br />

for reliability reasons, so we will have to move<br />

to copper pillar and thermal compression<br />

bonding directly. Then 3DIC/2.5D interposers<br />

will use copper pillar micro-bumping. Other<br />

more-than-Moore applications will also move<br />

to copper pillar for a variety of their own<br />

reasons, from image sensors needing higher<br />

density to power devices needing better<br />

thermal performance.<br />

Though the essential advantage of copper<br />

pillars is the tighter pitch possible with the<br />

straight-sided, high-aspect- ratio pillars and<br />

their smaller micro-bump cousins compared<br />

to the rounded form of solder bumps, the<br />

reduction of noise from the larger spacing<br />

between the pillars, and the better electrical<br />

conductivity compared to solder also improve<br />

performance. The downside, of course, is<br />

the higher cost and the immaturity of some<br />

of the processes, particularly probe and test.<br />

Progress will also be needed on finer precision<br />

in placement and bonding, and faster bonding<br />

with greater pressure. But we see few viable<br />

alternatives to copper pillar bumping going<br />

forward, especially for big ICs, and those with<br />

high numbers (~>800) of I/Os.<br />

Everybody adds capacity, looks at<br />

thermal compression bonding<br />

This growing demand is spurring investment<br />

across the value chain. Intel has long had<br />

the biggest copper bumping capacity, but<br />

foundries and OSATs are also both now<br />

investing aggressively, with recent investment<br />

by Samsung and TSMC on the foundry side,<br />

and Amkor and ASE on the OSAT side, driven<br />

primarily by 28nm CMOS. Most aggressive<br />

of all is PTI in Taiwan, who is investing some<br />

$300M over 2012-2014 to build and equip the<br />

world’s first fully dedicated fab for advanced<br />

bumping, to support its major customer<br />

Micron, but also to serving fabless customers<br />

like Qualcomm and non IC applications like<br />

MEMS from Toshiba. We see a 31% CAGR<br />

in additional copper pillar capacity brought<br />

online from 2010 to 2014, to bring it to 9<br />

million (12” eq) wafers a year. The industry’s<br />

copper bumping facilities have recently been<br />

running at ~88% capacity. This expanding<br />

cast of suppliers will expand availability of<br />

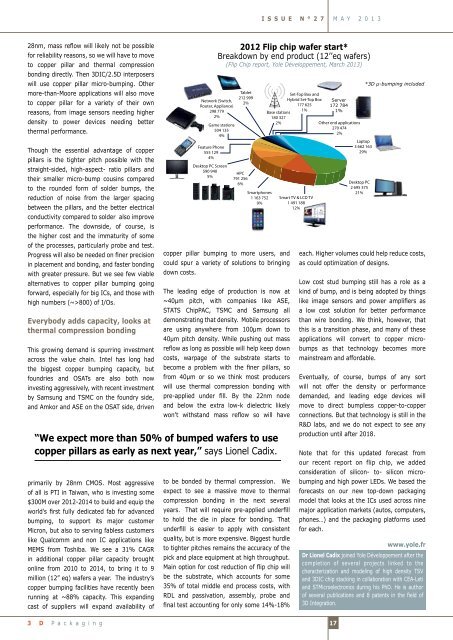

Network (Switch,<br />

Router, Appliance)<br />

298 779<br />

2%<br />

Game stations<br />

504 135<br />

4%<br />

Feature Phone<br />

555 129<br />

4%<br />

Desktop PC Screen<br />

590 940<br />

5%<br />

Tablet<br />

212 999<br />

2%<br />

HPC<br />

791 256<br />

6%<br />

Smartphones<br />

1 163 752<br />

9%<br />

copper pillar bumping to more users, and<br />

could spur a variety of solutions to bringing<br />

down costs.<br />

The leading edge of production is now at<br />

~40µm pitch, with companies like ASE,<br />

STATS ChipPAC, TSMC and Samsung all<br />

demonstrating that density. Mobile processors<br />

are using anywhere from 100µm down to<br />

40µm pitch density. While pushing out mass<br />

reflow as long as possible will help keep down<br />

costs, warpage of the substrate starts to<br />

become a problem with the finer pillars, so<br />

from 40µm or so we think most producers<br />

will use thermal compression bonding with<br />

pre-applied under fill. By the 22nm node<br />

and below the extra low-k dielectric likely<br />

won’t withstand mass reflow so will have<br />

“We expect more than 50% of bumped wafers to use<br />

copper pillars as early as next year,” says Lionel Cadix.<br />

2012 Flip chip wafer start*<br />

Breakdown by end product (12’’eq wafers)<br />

(Flip Chip report, Yole Développement, March <strong>2013</strong>)<br />

Base stations<br />

180 327<br />

2%<br />

to be bonded by thermal compression. We<br />

expect to see a massive move to thermal<br />

compression bonding in the next several<br />

years. That will require pre-applied underfill<br />

to hold the die in place for bonding. That<br />

underfill is easier to apply with consistent<br />

quality, but is more expensive. Biggest hurdle<br />

to tighter pitches remains the accuracy of the<br />

pick and place equipment at high throughput.<br />

Main option for cost reduction of flip chip will<br />

be the substrate, which accounts for some<br />

35% of total middle end process costs, with<br />

RDL and passivation, assembly, probe and<br />

final test accounting for only some 14%-18%<br />

Set-Top Box and<br />

Hybrid Set-Top Box<br />

177 625<br />

1%<br />

Smart TV & LCD TV<br />

1 491 188<br />

12%<br />

Server<br />

172 784<br />

1%<br />

Other end applications<br />

270 474<br />

2%<br />

Laptop<br />

3 662 163<br />

29%<br />

Desktop PC<br />

2 695 375<br />

21%<br />

*3D μ-bumping included<br />

each. Higher volumes could help reduce costs,<br />

as could optimization of designs.<br />

Low cost stud bumping still has a role as a<br />

kind of bump, and is being adopted by things<br />

like image sensors and power amplifiers as<br />

a low cost solution for better performance<br />

than wire bonding. We think, however, that<br />

this is a transition phase, and many of these<br />

applications will convert to copper microbumps<br />

as that technology becomes more<br />

mainstream and affordable.<br />

Eventually, of course, bumps of any sort<br />

will not offer the density or performance<br />

demanded, and leading edge devices will<br />

move to direct bumpless copper-to-copper<br />

connections. But that technology is still in the<br />

R&D labs, and we do not expect to see any<br />

production until after 2018.<br />

Note that for this updated forecast from<br />

our recent report on flip chip, we added<br />

consideration of silicon- to- silicon microbumping<br />

and high power LEDs. We based the<br />

forecasts on our new top-down packaging<br />

model that looks at the ICs used across nine<br />

major application markets (autos, computers,<br />

phones…) and the packaging platforms used<br />

for each.<br />

www.yole.fr<br />

Dr Lionel Cadix joined Yole Développement after the<br />

completion of several projects linked to the<br />

characterization and modeling of high density TSV<br />

and 3DIC chip stacking in collaboration with CEA-Leti<br />

and STMicroelectronics during his PhD. He is author<br />

of several publications and 8 patents in the field of<br />

3D Integration.<br />

3 D P a c k a g i n g<br />

17