Tourism Saskatchewan - IndustryMatters.com

Tourism Saskatchewan - IndustryMatters.com

Tourism Saskatchewan - IndustryMatters.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

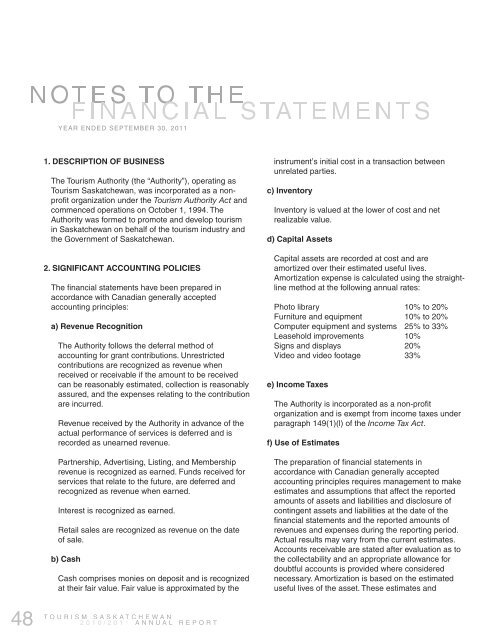

YEAR ENDED SEPTEMBER 30, 2011<br />

1. DESCRIPTION OF BUSINESS<br />

The <strong>Tourism</strong> Authority (the “Authority”), operating as<br />

<strong>Tourism</strong> <strong>Saskatchewan</strong>, was incorporated as a nonprofit<br />

organization under the <strong>Tourism</strong> Authority Act and<br />

<strong>com</strong>menced operations on October 1, 1994. The<br />

Authority was formed to promote and develop tourism<br />

in <strong>Saskatchewan</strong> on behalf of the tourism industry and<br />

the Government of <strong>Saskatchewan</strong>.<br />

2. SIGNIFICANT ACCOUNTING POLICIES<br />

The financial statements have been prepared in<br />

accordance with Canadian generally accepted<br />

accounting principles:<br />

a) Revenue Recognition<br />

The Authority follows the deferral method of<br />

accounting for grant contributions. Unrestricted<br />

contributions are recognized as revenue when<br />

received or receivable if the amount to be received<br />

can be reasonably estimated, collection is reasonably<br />

assured, and the expenses relating to the contribution<br />

are incurred.<br />

Revenue received by the Authority in advance of the<br />

actual performance of services is deferred and is<br />

recorded as unearned revenue.<br />

Partnership, Advertising, Listing, and Membership<br />

revenue is recognized as earned. Funds received for<br />

services that relate to the future, are deferred and<br />

recognized as revenue when earned.<br />

Interest is recognized as earned.<br />

Retail sales are recognized as revenue on the date<br />

of sale.<br />

b) Cash<br />

Cash <strong>com</strong>prises monies on deposit and is recognized<br />

at their fair value. Fair value is approximated by the<br />

instrument’s initial cost in a transaction between<br />

unrelated parties.<br />

c) Inventory<br />

Inventory is valued at the lower of cost and net<br />

realizable value.<br />

d) Capital Assets<br />

Capital assets are recorded at cost and are<br />

amortized over their estimated useful lives.<br />

Amortization expense is calculated using the straightline<br />

method at the following annual rates:<br />

Photo library 10% to 20%<br />

Furniture and equipment 10% to 20%<br />

Computer equipment and systems 25% to 33%<br />

Leasehold improvements 10%<br />

Signs and displays 20%<br />

Video and video footage 33%<br />

e) In<strong>com</strong>e Taxes<br />

The Authority is incorporated as a non-profit<br />

organization and is exempt from in<strong>com</strong>e taxes under<br />

paragraph 149(1)(l) of the In<strong>com</strong>e Tax Act.<br />

f) Use of Estimates<br />

The preparation of financial statements in<br />

accordance with Canadian generally accepted<br />

accounting principles requires management to make<br />

estimates and assumptions that affect the reported<br />

amounts of assets and liabilities and disclosure of<br />

contingent assets and liabilities at the date of the<br />

financial statements and the reported amounts of<br />

revenues and expenses during the reporting period.<br />

Actual results may vary from the current estimates.<br />

Accounts receivable are stated after evaluation as to<br />

the collectability and an appropriate allowance for<br />

doubtful accounts is provided where considered<br />

necessary. Amortization is based on the estimated<br />

useful lives of the asset. These estimates and<br />

48