Tourism Saskatchewan - IndustryMatters.com

Tourism Saskatchewan - IndustryMatters.com

Tourism Saskatchewan - IndustryMatters.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

YEAR ENDED SEPTEMBER 30, 2011<br />

50<br />

3. FINANCIAL INSTRUMENTS<br />

<strong>Tourism</strong> <strong>Saskatchewan</strong> as part of its operations carries<br />

a number of financial instruments which by their nature<br />

are subject to risks.<br />

a) Credit Risk<br />

The Authority is exposed to credit risk in respect to<br />

accounts receivable in the event that the customer<br />

cannot meet its obligations. The accounts receivable<br />

are presented on the balance sheet net of the<br />

allowance for bad debts. Credit risk is managed<br />

with regular credit assessments and an allowance<br />

is maintained and reviewed for potentially<br />

uncollectible accounts.<br />

b) Fair Value<br />

The carrying value of cash, accounts receivable and<br />

accounts payable and accrued liabilities<br />

approximates their fair value due to the short-term<br />

maturities of these items.<br />

c) Interest Rate Risk<br />

The Authority has cash balances and therefore is not<br />

exposed to significant interest rate risk.<br />

4. CASH<br />

The Authority has access to the following operating line<br />

of credit, repayable on demand with interest paid<br />

monthly at the TD Bank prime rate. As of<br />

September 30, 2011, the Authority has not drawn on<br />

the operating line.<br />

Base operating limit $500,000<br />

5. GST RECEIVABLE<br />

The Authority claims goods and services input tax<br />

credits based upon its level of staff time devoted to<br />

generating GST taxable supplies. For the year ended<br />

September 30, 2011, the applicable rate was 70%<br />

overall. Purchases of goods for resale are eligible for<br />

100% input tax credits.<br />

GST receivable is net of any GST payable.<br />

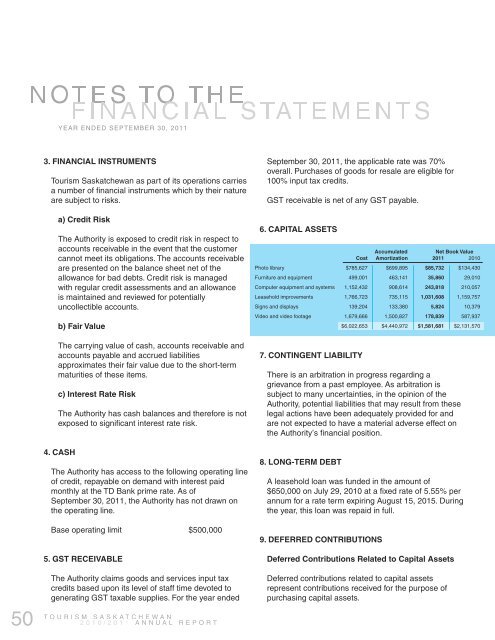

6. CAPITAL ASSETS<br />

Accumulated<br />

Net Book Value<br />

Cost Amortization 2011 2010<br />

Photo library $785,627 $699,895 $85,732 $134,430<br />

Furniture and equipment 499,001 463,141 35,860 29,010<br />

Computer equipment and systems 1,152,432 908,614 243,818 210,057<br />

Leasehold improvements 1,766,723 735,115 1,031,608 1,159,757<br />

Signs and displays 139,204 133,380 5,824 10,379<br />

Video and video footage 1,679,666 1,500,827 178,839 587,937<br />

$6,022,653 $4,440,972 $1,581,681 $2,131,570<br />

7. CONTINGENT LIABILITY<br />

There is an arbitration in progress regarding a<br />

grievance from a past employee. As arbitration is<br />

subject to many uncertainties, in the opinion of the<br />

Authority, potential liabilities that may result from these<br />

legal actions have been adequately provided for and<br />

are not expected to have a material adverse effect on<br />

the Authority’s financial position.<br />

8. LONG-TERM DEBT<br />

A leasehold loan was funded in the amount of<br />

$650,000 on July 29, 2010 at a fixed rate of 5.55% per<br />

annum for a rate term expiring August 15, 2015. During<br />

the year, this loan was repaid in full.<br />

9. DEFERRED CONTRIBUTIONS<br />

Deferred Contributions Related to Capital Assets<br />

Deferred contributions related to capital assets<br />

represent contributions received for the purpose of<br />

purchasing capital assets.