2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PROFIT AND RECURRING CASH FLOW<br />

PROFIT AND RECURRING CASH FLOW<br />

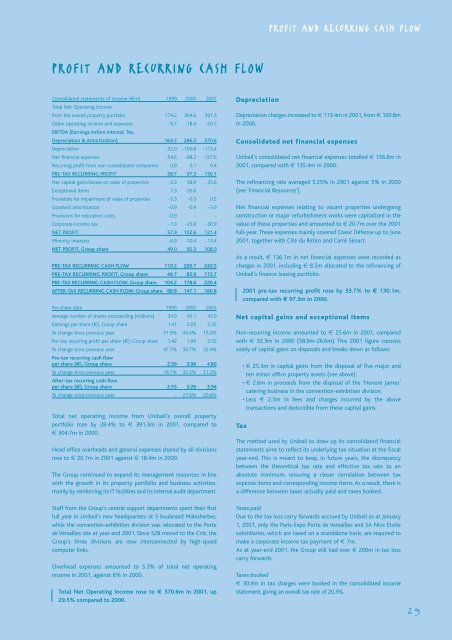

Consolidated statements of income (€m) 1999 2000 <strong>2001</strong><br />

Total Net Operating Income<br />

from the overall property portfolio 174.2 304.6 391.3<br />

Other operating income and expenses -9.7 -18.4 -20.7<br />

EBITDA (Earnings before Interest, Tax,<br />

Depreciation & Amortization) 164.5 286.2 370.6<br />

Depreciation -52.0 -100.8 -113.4<br />

Net financial expenses -54.6 -88.2 -127.6<br />

Recurring profit from non-consolidated companies 0.8 0.1 0.4<br />

PRE-TAX RECURRING PROFIT 58.7 97.3 130.1<br />

Net capital gains/losses on sales of properties 0.3 58.9 25.6<br />

Exceptional items 7.3 -26.6 -<br />

Provisions for impairment of value of properties -5.3 -0.3 0.5<br />

Goodwill amortization -0.9 -0.9 -3.9<br />

Provisions for relocation costs -0,9 - -<br />

Corporate income tax -1.3 -25.8 -30.9<br />

NET PROFIT 57.9 102.6 121.4<br />

Minority interests -8.9 -10.4 -13.4<br />

NET PROFIT, Group share 49.0 92.3 108.0<br />

PRE-TAX RECURRING CASH FLOW 119.2 200.7 243.5<br />

PRE-TAX RECURRING PROFIT, Group share 49.7 85.9 115.7<br />

PRE-TAX RECURRING CASH FLOW, Group share 104.2 178.6 220.4<br />

AFTER-TAX RECURRING CASH FLOW, Group share 88.8 147.1 180.8<br />

Per-share data 1999 2000 <strong>2001</strong><br />

Average number of shares outstanding (millions) 34.9 45.1 45.9<br />

Earnings per share (€), Group share 1.41 2.05 2.35<br />

% change since previous year 31.9% 45.6% 15.0%<br />

Pre-tax recurring profit per share (€), Group share 1.42 1.90 2.52<br />

% change since previous year 47.7% 33.7% 32.4%<br />

Pre-tax recurring cash flow<br />

per share (€), Group share 2.99 3.96 4.80<br />

% change since previous year 18.7% 32.5% 21.2%<br />

After-tax recurring cash flow<br />

per share (€), Group share 2.55 3.26 3.94<br />

% change since previous year - 27.8% 20.8%<br />

Total net operating income from <strong>Unibail</strong>’s overall property<br />

portfolio rose by 28.4% to € 391.3m in <strong>2001</strong>, compared to<br />

€ 304.7m in 2000.<br />

Head office overheads and general expenses shared by all divisions<br />

rose to € 20.7m in <strong>2001</strong> against € 18.4m in 2000.<br />

The Group continued to expand its management resources in line<br />

with the growth in its property portfolio and business activities,<br />

mainly by reinforcing its IT facilities and its internal audit department.<br />

Depreciation<br />

Depreciation charges increased to € 113.4m in <strong>2001</strong>, from € 100.8m<br />

in 2000.<br />

Consolidated net financial expenses<br />

<strong>Unibail</strong>’s consolidated net financial expenses totalled € 156.8m in<br />

<strong>2001</strong>, compared with € 135.4m in 2000.<br />

The refinancing rate averaged 5.25% in <strong>2001</strong> against 5% in 2000<br />

(see ‘Financial Resources').<br />

Net financial expenses relating to vacant properties undergoing<br />

construction or major refurbishment works were capitalized in the<br />

value of these properties and amounted to € 20.7m over the <strong>2001</strong><br />

full-year. These expenses mainly covered Coeur Défense up to June<br />

<strong>2001</strong>, together with Cité du Retiro and Carré Sénart.<br />

As a result, € 136.1m in net financial expenses were recorded as<br />

charges in <strong>2001</strong>, including € 8.5m allocated to the refinancing of<br />

<strong>Unibail</strong>’s finance leasing portfolio.<br />

<strong>2001</strong> pre-tax recurring profit rose by 33.7% to € 130.1m,<br />

compared with € 97.3m in 2000.<br />

Net capital gains and exceptional items<br />

Non-recurring income amounted to € 25.6m in <strong>2001</strong>, compared<br />

with € 32.3m in 2000 (58.9m-26.6m). This <strong>2001</strong> figure consists<br />

solely of capital gains on disposals and breaks down as follows:<br />

• € 25.3m in capital gains from the disposal of five major and<br />

ten minor office property assets (see above).<br />

• € 2.6m in proceeds from the disposal of the 'Honoré James'<br />

catering business in the convention-exhibition division.<br />

• Less € 2.3m in fees and charges incurred by the above<br />

transactions and deductible from these capital gains.<br />

Tax<br />

The method used by <strong>Unibail</strong> to draw up its consolidated financial<br />

statements aims to reflect its underlying tax situation at the fiscal<br />

year-end. This is meant to keep, in future years, the discrepancy<br />

between the theoretical tax rate and effective tax rate to an<br />

absolute minimum, ensuring a closer correlation between tax<br />

expense items and corresponding income items. As a result, there is<br />

a difference between taxes actually paid and taxes booked.<br />

Staff from the Group’s central support departments spent their first<br />

full year in <strong>Unibail</strong>’s new headquarters at 5 boulevard Malesherbes,<br />

while the convention-exhibition division was relocated to the Porte<br />

de Versailles site at year-end <strong>2001</strong>. Since S2B moved to the Cnit, the<br />

Group’s three divisions are now interconnected by high-speed<br />

computer links.<br />

Overhead expenses amounted to 5.3% of total net operating<br />

income in <strong>2001</strong>, against 6% in 2000.<br />

Total Net Operating Income rose to € 370.6m in <strong>2001</strong>, up<br />

29.5% compared to 2000.<br />

Taxes paid<br />

Due to the tax loss carry forwards accrued by <strong>Unibail</strong> as at January<br />

1, <strong>2001</strong>, only the Paris-Expo Porte de Versailles and SA Nice Etoile<br />

subsidiaries, which are taxed on a standalone basis, are required to<br />

make a corporate income tax payment of € 7m.<br />

As at year-end <strong>2001</strong>, the Group still had over € 200m in tax loss<br />

carry forwards.<br />

Taxes booked<br />

€ 30.9m in tax charges were booked in the consolidated income<br />

statement, giving an overall tax rate of 20.3%.<br />

29