2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NET ASSET VALUE<br />

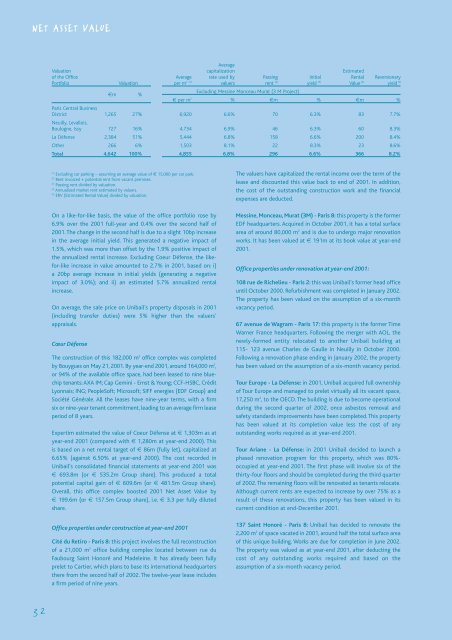

Average<br />

Valuation capitalization Estimated<br />

of the Office Average rate used by Passing Initial Rental Reversionary<br />

Portfolio Valuation per m 2 (1) valuers rent (2) yield (3) Value (4) yield (5)<br />

€m %<br />

Excluding Messine Monceau Murat (3 M Project)<br />

€ per m 2 % €m % €m %<br />

Paris Central Business<br />

District 1,265 27% 6,920 6.6% 70 6.3% 83 7.7%<br />

Neuilly, Levallois,<br />

Boulogne, Issy 727 16% 4,734 6.9% 46 6.3% 60 8.3%<br />

La Défense 2,384 51% 5,444 6.8% 158 6.6% 200 8.4%<br />

Other 266 6% 1,503 8.1% 22 8.3% 23 8.6%<br />

Total 4,642 100% 4,855 6.8% 296 6.6% 366 8.2%<br />

(1)<br />

Excluding car parking – assuming an average value of € 15,000 per car park.<br />

(2)<br />

Rent invoiced + potential rent from vacant premises.<br />

(3)<br />

Passing rent divided by valuation.<br />

(4)<br />

<strong>Annual</strong>ized market rent estimated by valuers.<br />

(5)<br />

ERV (Estimated Rental Value) divided by valuation.<br />

The valuers have capitalized the rental income over the term of the<br />

lease and discounted this value back to end of <strong>2001</strong>. In addition,<br />

the cost of the outstanding construction work and the financial<br />

expenses are deducted.<br />

On a like-for-like basis, the value of the office portfolio rose by<br />

6.9% over the <strong>2001</strong> full-year and 0.4% over the second half of<br />

<strong>2001</strong>. The change in the second half is due to a slight 10bp increase<br />

in the average initial yield. This generated a negative impact of<br />

1.5%, which was more than offset by the 1.9% positive impact of<br />

the annualized rental increase. Excluding Coeur Défense, the likefor-like<br />

increase in value amounted to 2.7% in <strong>2001</strong>, based on: i)<br />

a 20bp average increase in initial yields (generating a negative<br />

impact of 3.0%); and ii) an estimated 5.7% annualized rental<br />

increase.<br />

On average, the sale price on <strong>Unibail</strong>’s property disposals in <strong>2001</strong><br />

(including transfer duties) were 5% higher than the valuers’<br />

appraisals.<br />

Cœur Défense<br />

The construction of this 182,000 m 2 office complex was completed<br />

by Bouygues on May 21, <strong>2001</strong>. By year-end <strong>2001</strong>, around 164,000 m 2 ,<br />

or 94% of the available office space, had been leased to nine bluechip<br />

tenants:AXA IM; Cap Gemini - Ernst & Young; CCF-HSBC, Crédit<br />

Lyonnais; ING; PeopleSoft; Microsoft; SIFF energies (EDF Group) and<br />

Société Générale. All the leases have nine-year terms, with a firm<br />

six or nine-year tenant commitment, leading to an average firm lease<br />

period of 8 years.<br />

Expertim estimated the value of Coeur Défense at € 1,303m as at<br />

year-end <strong>2001</strong> (compared with € 1,280m at year-end 2000). This<br />

is based on a net rental target of € 86m (fully let), capitalized at<br />

6.65% (against 6.50% at year-end 2000). The cost recorded in<br />

<strong>Unibail</strong>’s consolidated financial statements at year-end <strong>2001</strong> was<br />

€ 693.8m (or € 535.2m Group share). This produced a total<br />

potential capital gain of € 609.6m (or € 481.5m Group share).<br />

Overall, this office complex boosted <strong>2001</strong> Net Asset Value by<br />

€ 199.6m (or € 157.5m Group share), i.e. € 3.3 per fully diluted<br />

share.<br />

Office properties under construction at year-end <strong>2001</strong><br />

Cité du Retiro - Paris 8: this project involves the full reconstruction<br />

of a 21,000 m 2 office building complex located between rue du<br />

Faubourg Saint Honoré and Madeleine. It has already been fully<br />

prelet to Cartier, which plans to base its international headquarters<br />

there from the second half of 2002. The twelve-year lease includes<br />

a firm period of nine years.<br />

Messine, Monceau, Murat (3M) - Paris 8: this property is the former<br />

EDF headquarters. Acquired in October <strong>2001</strong>, it has a total surface<br />

area of around 80,000 m 2 and is due to undergo major renovation<br />

works. It has been valued at € 191m at its book value at year-end<br />

<strong>2001</strong>.<br />

Office properties under renovation at year-end <strong>2001</strong>:<br />

108 rue de Richelieu - Paris 2: this was <strong>Unibail</strong>’s former head office<br />

until October 2000. Refurbishment was completed in January 2002.<br />

The property has been valued on the assumption of a six-month<br />

vacancy period.<br />

67 avenue de Wagram - Paris 17: this property is the former Time<br />

Warner France headquarters. Following the merger with AOL, the<br />

newly-formed entity relocated to another <strong>Unibail</strong> building at<br />

115- 123 avenue Charles de Gaulle in Neuilly in October 2000.<br />

Following a renovation phase ending in January 2002, the property<br />

has been valued on the assumption of a six-month vacancy period.<br />

Tour Europe - La Défense: in <strong>2001</strong>, <strong>Unibail</strong> acquired full ownership<br />

of Tour Europe and managed to prelet virtually all its vacant space,<br />

17,250 m 2 , to the OECD. The building is due to become operational<br />

during the second quarter of 2002, once asbestos removal and<br />

safety standards improvements have been completed. This property<br />

has been valued at its completion value less the cost of any<br />

outstanding works required as at year-end <strong>2001</strong>.<br />

Tour Ariane - La Défense: in <strong>2001</strong> <strong>Unibail</strong> decided to launch a<br />

phased renovation program for this property, which was 80%-<br />

occupied at year-end <strong>2001</strong>. The first phase will involve six of the<br />

thirty-four floors and should be completed during the third quarter<br />

of 2002. The remaining floors will be renovated as tenants relocate.<br />

Although current rents are expected to increase by over 75% as a<br />

result of these renovations, this property has been valued in its<br />

current condition at end-December <strong>2001</strong>.<br />

137 Saint Honoré - Paris 8: <strong>Unibail</strong> has decided to renovate the<br />

2,200 m 2 of space vacated in <strong>2001</strong>, around half the total surface area<br />

of this unique building. Works are due for completion in June 2002.<br />

The property was valued as at year-end <strong>2001</strong>, after deducting the<br />

cost of any outstanding works required and based on the<br />

assumption of a six-month vacancy period.<br />

32