2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CONSOLIDATED FINANCIAL STATEMENTS<br />

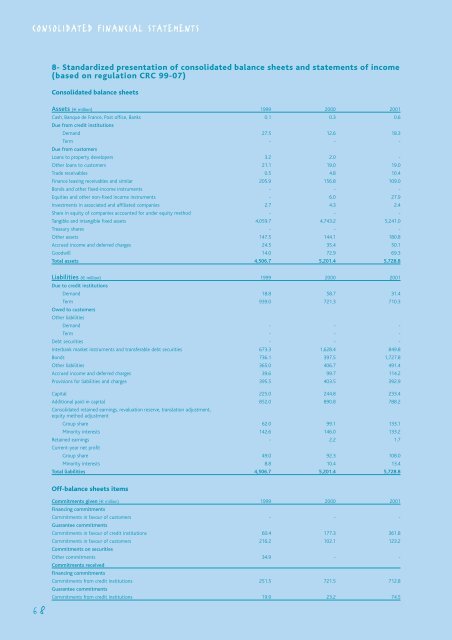

8- Standardized presentation of consolidated balance sheets and statements of income<br />

(based on regulation CRC 99-07)<br />

Consolidated balance sheets<br />

Assets (€ million) 1999 2000 <strong>2001</strong><br />

Cash, Banque de France, Post office, Banks 0.1 0.3 0.6<br />

Due from credit institutions<br />

Demand 27.5 12.6 18.3<br />

Term - - -<br />

Due from customers<br />

Loans to property developers 3.2 2.0 -<br />

Other loans to customers 21.1 19.0 19.0<br />

Trade receivables 0.5 4.8 10.4<br />

Finance leasing receivables and similar 205.9 156.8 109.0<br />

Bonds and other fixed-income instruments - - -<br />

Equities and other non-fixed income instruments - 6.0 27.9<br />

Investments in associated and affiliated companies 2.7 4.3 2.4<br />

Share in equity of companies accounted for under equity method - - -<br />

Tangible and intangible fixed assets 4,059.7 4,743.2 5,241.0<br />

Treasury shares - - -<br />

Other assets 147.5 144.1 180.8<br />

Accrued income and deferred charges 24.5 35.4 50.1<br />

Goodwill 14.0 72.9 69.3<br />

Total assets 4,506.7 5,201.4 5,728.8<br />

Liabilities (€ million) 1999 2000 <strong>2001</strong><br />

Due to credit institutions<br />

Demand 18.8 58.7 31.4<br />

Term 939.0 721.3 710.3<br />

Owed to customers<br />

Other liabilities<br />

Demand - - -<br />

Term - - -<br />

Debt securities - - -<br />

Interbank market instruments and transferable debt securities 673.3 1,628.4 849.8<br />

Bonds 736.1 397.5 1,727.8<br />

Other liabilities 365.0 406.7 491.4<br />

Accrued income and deferred charges 39.6 99.7 114.2<br />

Provisions for liabilities and charges 395.5 403.5 392.9<br />

Capital 225.0 244.8 233.4<br />

Additional paid-in capital 852.0 890.8 788.2<br />

Consolidated retained earnings, revaluation reserve, translation adjustment,<br />

equity method adjustment<br />

Group share 62.0 99.1 133.1<br />

Minority interests 142.6 146.0 133.2<br />

Retained earnings - 2.2 1.7<br />

Current-year net profit<br />

Group share 49.0 92.3 108.0<br />

Minority interests 8.8 10.4 13.4<br />

Total liabilities 4,506.7 5,201.4 5,728.8<br />

Off-balance sheets items<br />

68<br />

Commitments given (€ million) 1999 2000 <strong>2001</strong><br />

Financing commitments<br />

Commitments in favour of customers - - -<br />

Guarantee commitments<br />

Commitments in favour of credit institutions 60.4 177.3 361.8<br />

Commitments in favour of customers 216.2 102.1 123.2<br />

Commitments on securities<br />

Other commitments 34.9 - -<br />

Commitments received<br />

Financing commitments<br />

Commitments from credit institutions 251.5 721.5 712.8<br />

Guarantee commitments<br />

Commitments from credit institutions 19.9 23.2 74.5