2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

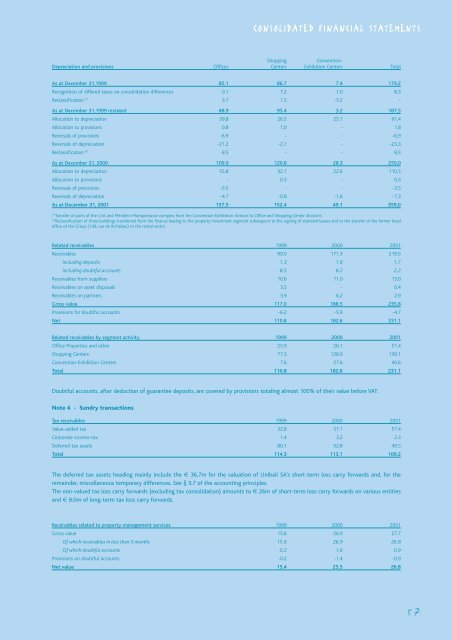

CONSOLIDATED FINANCIAL STATEMENTS<br />

Shopping<br />

Convention-<br />

Depreciation and provisions Offices Centers Exhibition Centers Total<br />

As at December 31,1999 85.1 86.7 7.4 179,2<br />

Recognition of differed taxes on consolidation differences 0.1 7.2 1.0 8,3<br />

Reclassification (1) 3.7 1.5 -5.2 -<br />

As at December 31,1999 restated 88.9 95.4 3.2 187,5<br />

Allocation to depreciation 39.8 26.5 25.1 91,4<br />

Allocation to provisions 0.8 1.0 - 1,8<br />

Reversals of provisions -6.9 - - -6,9<br />

Reversals of depreciation -21.2 -2.1 - -23,3<br />

Reclassification (2) 8.5 - - 8,5<br />

As at December 31, 2000 109.9 120.8 28.3 259,0<br />

Allocation to depreciation 55.8 32.1 22.6 110,5<br />

Allocation to provisions - 0.3 - 0,3<br />

Reversals of provisions -3.5 - - -3,5<br />

Reversals of depreciation -4.7 -0.8 -1.8 -7,3<br />

As at December 31, <strong>2001</strong> 157.5 152.4 49.1 359,0<br />

(1)<br />

Transfer of parts of the Cnit and Méridien-Montparnasse complex from the Convention-Exhibition division to Office and Shopping Center divisions.<br />

(2)<br />

Reclassification of three buildings transferred from the finance leasing to the property investment segment subsequent to the signing of standard leases and to the transfer of the former head<br />

office of the Group (108, rue de Richelieu) to the rental sector.<br />

Related receivables 1999 2000 <strong>2001</strong><br />

Receivables 99.0 171.3 219.5<br />

Including deposits 1.3 1.8 1.7<br />

Including doubtful accounts 8.5 8.2 2.2<br />

Receivables from suppliers 10.6 11.0 13.0<br />

Receivables on asset disposals 3,5 - 0.4<br />

Receivables on partners 3.9 6.2 2.9<br />

Gross value 117.0 188.5 235.8<br />

Provisions for doubtful accounts -6.2 -5.9 -4.7<br />

Net 110.8 182.6 231.1<br />

Related receivables by segment activity 1999 2000 <strong>2001</strong><br />

Office Properties and other 25.9 26.1 51.4<br />

Shopping Centers 77.3 128.9 139.1<br />

Convention-Exhibition Centers 7.6 27.6 40.6<br />

Total 110.8 182.6 231.1<br />

Doubtful accounts, after deduction of guarantee deposits, are covered by provisions totaling almost 100% of their value before VAT.<br />

Note 4 - Sundry transactions<br />

Tax receivables 1999 2000 <strong>2001</strong><br />

Value-added tax 32.8 57.1 57.4<br />

Corporate income tax 1.4 3.2 2.3<br />

Deferred tax assets 80.1 52.8 49.5<br />

Total 114.3 113.1 109.2<br />

The deferred tax assets heading mainly include the € 36.7m for the valuation of <strong>Unibail</strong> SA’s short-term loss carry forwards and, for the<br />

remainder, miscellaneous temporary differences. See § 3.7 of the accounting principles.<br />

The non-valued tax loss carry forwards (excluding tax consolidation) amounts to € 26m of short-term loss carry forwards on various entities<br />

and € 8.0m of long-term tax loss carry forwards.<br />

Receivables related to property management services 1999 2000 <strong>2001</strong><br />

Gross value 15.6 26.9 27.7<br />

Of which receivables in less than 3 months 15.6 26.9 26.8<br />

Of which doubtful accounts 0.2 1.6 0.9<br />

Provisions on doubtful accounts -0.2 -1.4 -0.9<br />

Net value 15.4 25.5 26.8<br />

57