2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

2001 Annual Report - Unibail-Rodamco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSOLIDATED FINANCIAL STATEMENTS<br />

Counter-party risks<br />

Because it uses derivatives to minimize its interest rate risk, the Group is exposed to potential counter-party defaults, which could heighten<br />

its earnings sensitivity to an upturn in interest rates. To reduce its counter-party risk, <strong>Unibail</strong> only relies on major international banks for its<br />

hedging operations.<br />

Note 9 - Sundry transactions<br />

Investment-related debt in the Office Portfolio amounted to € 57m and mainly covered work completed at Cœur Défense (€ 21m), at 108 rue<br />

de Richelieu (€ 1.4m) and at Cité du Retiro (€ 6.6m). Investment-related debt in the Shopping Center Portfolio mainly comprised work on the<br />

two shopping centers Bordeaux Mériadeck (€ 7.2m) and Les Quatre Temps (€ 4.4m). Lastly, work carried out at Paris Expo-Porte de Versailles<br />

accounts for all the investment-related debt incurred by the Convention-Exhibition division (€ 8.9m).<br />

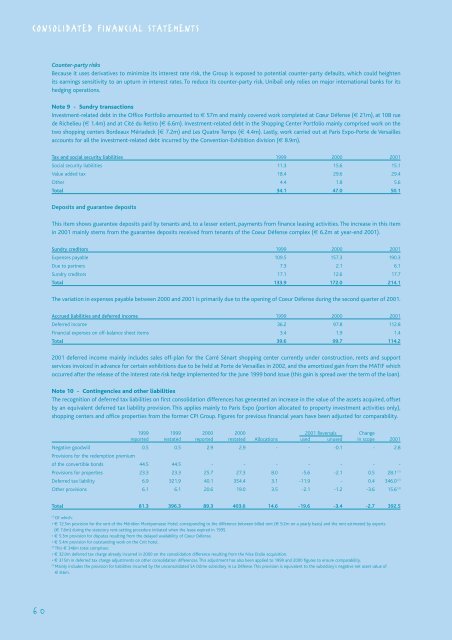

Tax and social security liabilities 1999 2000 <strong>2001</strong><br />

Social security liabilities 11.3 15.6 15.1<br />

Value added tax 18.4 29.6 29.4<br />

Other 4.4 1.8 5.6<br />

Total 34.1 47.0 50.1<br />

Deposits and guarantee deposits<br />

This item shows guarantee deposits paid by tenants and, to a lesser extent, payments from finance leasing activities. The increase in this item<br />

in <strong>2001</strong> mainly stems from the guarantee deposits received from tenants of the Coeur Défense complex (€ 6.2m at year-end <strong>2001</strong>).<br />

Sundry creditors 1999 2000 <strong>2001</strong><br />

Expenses payable 109.5 157.3 190.3<br />

Due to partners 7.3 2.1 6.1<br />

Sundry creditors 17.1 12.6 17.7<br />

Total 133.9 172.0 214.1<br />

The variation in expenses payable between 2000 and <strong>2001</strong> is primarily due to the opening of Coeur Défense during the second quarter of <strong>2001</strong>.<br />

Accrued liabilities and deferred income 1999 2000 <strong>2001</strong><br />

Deferred income 36.2 97.8 112.8<br />

Financial expenses on off-balance sheet items 3.4 1.9 1.4<br />

Total 39.6 99.7 114.2<br />

<strong>2001</strong> deferred income mainly includes sales off-plan for the Carré Sénart shopping center currently under construction, rents and support<br />

services invoiced in advance for certain exhibitions due to be held at Porte de Versailles in 2002, and the amortized gain from the MATIF which<br />

occurred after the release of the interest rate risk hedge implemented for the June 1999 bond issue (this gain is spread over the term of the loan).<br />

Note 10 - Contingencies and other liabilities<br />

The recognition of deferred tax liabilities on first consolidation differences has generated an increase in the value of the assets acquired, offset<br />

by an equivalent deferred tax liability provision. This applies mainly to Paris Expo (portion allocated to property investment activities only),<br />

shopping centers and office properties from the former CPI Group. Figures for previous financial years have been adjusted for comparability.<br />

1999 1999 2000 2000 <strong>2001</strong> Reversals Change<br />

reported restated reported restated Allocations used unused in scope <strong>2001</strong><br />

Negative goodwill 0.5 0.5 2.9 2.9 - - -0.1 - 2.8<br />

Provisions for the redemption premium<br />

of the convertible bonds 44.5 44.5 - - - - - - -<br />

Provisions for properties 23.3 23.3 25.7 27.3 8.0 -5.6 -2.1 0.5 28.1 (1)<br />

Deferred tax liability 6.9 321.9 40.1 354.4 3.1 -11.9 - 0.4 346.0 (2)<br />

Other provisions 6.1 6.1 20.6 19.0 3.5 -2.1 -1.2 -3.6 15.6 (3)<br />

Total 81.3 396.3 89.3 403.6 14.6 -19.6 -3.4 -2.7 392.5<br />

(1)<br />

Of which:<br />

• € 12.5m provision for the rent of the Méridien Montparnasse Hotel, corresponding to the difference between billed rent (€ 9.2m on a yearly basis) and the rent estimated by experts<br />

(€ 7.6m) during the statutory rent-setting procedure initiated when the lease expired in 1995.<br />

• € 5.3m provision for disputes resulting from the delayed availability of Coeur Défense.<br />

• € 5.4m provision for outstanding work on the Cnit hotel.<br />

(2)<br />

This € 346m total comprises:<br />

• € 32.0m deferred tax charge already incurred in 2000 on the consolidation difference resulting from the Nice Etoile acquisition.<br />

• € 315m in deferred tax charge adjustments on other consolidation differences. This adjustment has also been applied to 1999 and 2000 figures to ensure comparability.<br />

(3)<br />

Mainly includes the provision for liabilities incurred by the unconsolidated SA Dôme subsidiary in La Défense. This provision is equivalent to the subsidiary’s negative net asset value of<br />

€ 8.6m.<br />

60